Insurance Cuts and Low Rates Extending the Business Cycle

Federal Reserve chairman Jerome Powell has indicated the recent cuts in the federal funds rate are “insurance” for an economy that was struggling to digest trade uncertainty, tariffs, and weak global growth. With U.S. equities at record highs amid continued optimism on U.S.-China trade, sufficiently strong economic data, and eased concerns about Q3 earnings season, it appears in the near-term that Powell has successfully navigated a soft landing.

The core components of the most recent economic data were strong enough to allow the Fed to declare a rate-cutting pause in December with Powell stating that a “material reassessment of our outlook” would be needed for another rate cut, and that “we’re not thinking about raising rates right now.” With earnings reported for companies accounting for more than 80% of the S&P 500’s market cap, Q3 is surpassing lowered expectations as consumers continue to drive economic growth close to potential.

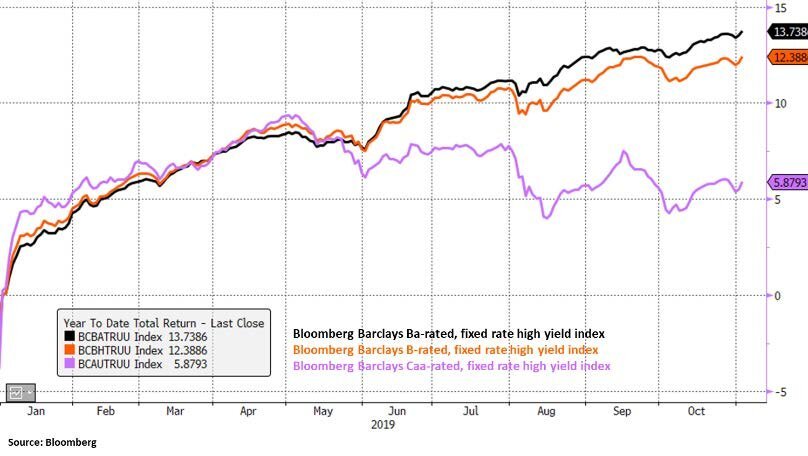

Despite the seemingly rosier outlook from both the Federal Reserve and U.S. equity markets, the bond market’s view is unquestionably more pessimistic. Slowing global growth, particularly in the manufacturing sector, declining inflation expectations, and questionable efficacy of monetary intervention all suggest a near-recessionary outlook. In addition, there is currently more than $14 trillion in negative-yielding bonds across the globe, at least five major central banks have reduced policy rates to zero or below zero, and the European Central Bank (ECB) has fired its last substantial bullets in September with the return to quantitative easing and extension of negative rates. What’s more, signs of this diminished outlook have begun to creep into credit markets, with the performance of the lowest-rated corporate bonds diverging from higher-rated bonds. This is reflective of investors’ concerns that a weakening economy could lead to an increase in defaults.

European Sovereign Yields

YTD Performance of Ba, B, Caa Rated High Yield Bond Indices

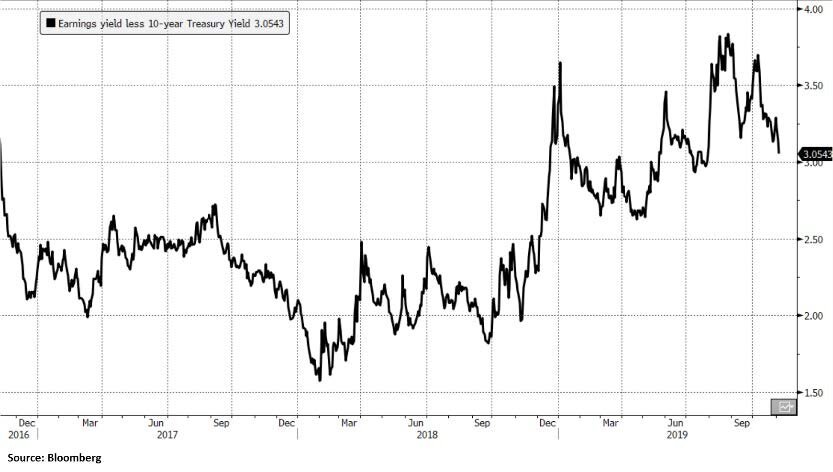

Markets are impatiently waiting for a “phase one” trade deal with China and bouts of volatility will remain with meaningful turmoil expected if the deal lacks any real substance. In the face of an impeachment inquiry, President Trump has incentive to limit the trade-war damage to the U.S. economy ahead of next year’s election. President Xi’s motivation is a bit more complex, however, China’s economy is struggling from the combined impact of the 2017/2018 deleveraging campaign and the tariff escalation. China’s pain threshold is higher, but job losses and the threat of social instability provide an incentive to de-escalate the trade tensions. The confluence of coordinated global central bank easing, potential trade-war retreat, and improving U.S. economic data bodes well for a continuation of the equity bull market. Despite a strong performance in equities in 2019, there is not the investor euphoria that generally presages a downturn; and although valuations appear stretched in certain spaces, there is room to run in others.

S&P 500 Earnings Yield Less the 10 Year Treasury Yield

S&P 500 Fwd P/E & AAII Investor Bullish Sentiment Index

Given the unpredictability on both sides of the U.S./China trade talks and limited global central bank ammunition to fight future downturns, to ignore the uncertainties would be misguided. However, we welcome the volatility that the negotiations are sure to bring as an opportunity to strategically deploy cash.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request