Gearing Up for a Solid Finale

The broad market turned in a strong performance for November, with the S&P 500 gaining 3.6%, putting it on course for its best calendar year performance since 2013. December has historically been one of the strongest months for stocks. Since 1980, stocks rise in December 72% of the time, compared to an average of 64% for all other months. Earnings season has essentially come to a close, with S&P 500 companies reporting broadly flat earnings relative to the third quarter of last year. Overall, around 80% of companies beat earnings estimates for the quarter, albeit estimates that had been lowered throughout the year.

Technically, the market appears set up to continue its strength into year-end. The NYSE Advance/Decline line, an indicator of market sentiment, posted several new highs last week confirming broad participation. Also, seven of the eleven S&P sectors are up more than 20%, while another two are up in the high teens. Furthermore, the number of new 52-week highs has expanded for both the NYSE and NASDAQ showing more stocks leading the market rally. In addition, after lagging for most of 2019, the Russell 2000 index is beginning to break out, and although it’s still 7% off its all-time highs, it’s a step in the right direction.

Bloomberg Cumulative Advance-Decline Line for NYSE Stocks - Source: Bloomberg

Russell 2000 Index - Source: Bloomberg

Investors who believe there will be a trade resolution before year end are buying the dips and that could buoy stocks into the new year. However, new tariffs on Chinese goods are still scheduled to go into effect on December 15th, and President Trump has intimated that he is willing to wait another year before striking an agreement. Market participants should pay close attention as that date approaches with more volatility expected towards the middle of the month. The changing picture of domestic politics in both the U.S. and China, including the situation in Hong Kong, could significantly impede the conclusion of a deal.

Central banks have eased policy with the aim of offsetting the trade shock and sustaining the economic expansion despite the late stage of the business cycle given low interest rates, subdued inflation, and a strong consumer. Market pricing seems to be reflecting optimism that growth will reaccelerate, and should that occur next year, we can see a continuation of the gains thanks in part to loose financial conditions and a manufacturing recovery. This should take the reins from monetary policy in supporting risk assets. We are monitoring for more signs that global manufacturing has bottomed after the J.P.Morgan Global Manufacturing PMI just posted a seven-month high of 50.3 in November, moving back above the 50.0 line dividing expansion from contraction.

Geopolitical risk will linger with the trade conflict unlikely to be fully resolved. Companies have been hesitant, and are likely to remain reluctant to invest, which could limit the extent to which manufacturing bounces back. Corporate earnings growth may stall given the tight labor market driving up costs and maintaining pressure on margins.

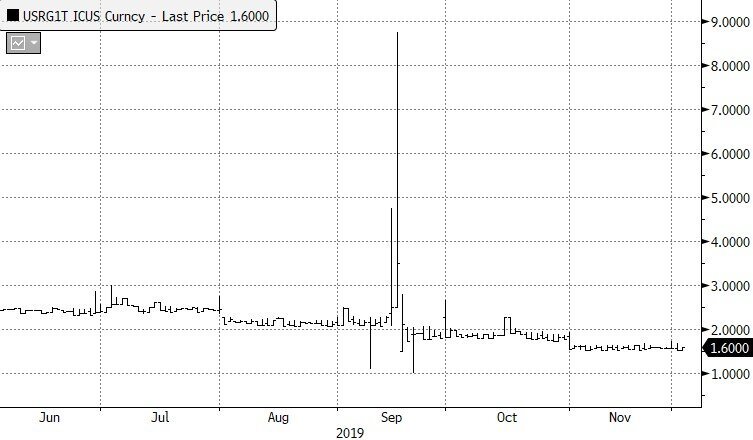

Another area worth watching is the repo market. If we see another disruption similar to the events in September it could cause worries across the global banking system. Mid-December will see a return of the same circumstances that led to the disorder. These include quarterly corporate tax payments that drained cash from the banking system, along with Treasury settlements that prompted a rush for scarce reserves. While the Fed has taken steps to bring normalcy back to repo (such as adding liquidity by buying Treasury bills and conducting overnight repo operations), many worry that won’t be enough to keep rates under control.

USD Overnight General Collateral Government Repo Rate - Source: Bloomberg

It’s proving more difficult to navigate markets today based on an assessment of the business cycle with the traditional roadmap being murky at best. Unemployment rates are near record lows in most of the developed world, suggesting the economy is late cycle. However, there are very few other signs of classic late-cycle economic exuberance. Neither business nor consumer spending looks overheated, the savings rate remains firm, and inflation is low. The Fed will be meeting in the middle of the month and is expected to keep rates steady. We look for December to build on the November gains despite a backdrop of anticipated increased volatility. Generally, bullish market fundamentals appear intact with the economy growing (granted at a slower pace), corporate profits projected to expand, and low interest rates. We remain poised to prudently deploy any excess cash as opportunities present themselves.

We’d like to wish you all a happy holiday.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request