Growth Now Required to Drive Asset Returns in the New Year

U.S. equity markets have largely shrugged off the escalation of tensions in the Middle East following the killing of Iranian general Soleimani. Instead, markets seem focused on the continued optimism that saw stocks rally strongly into year-end. The early morning sell offs have been met with buying lead by mega caps.

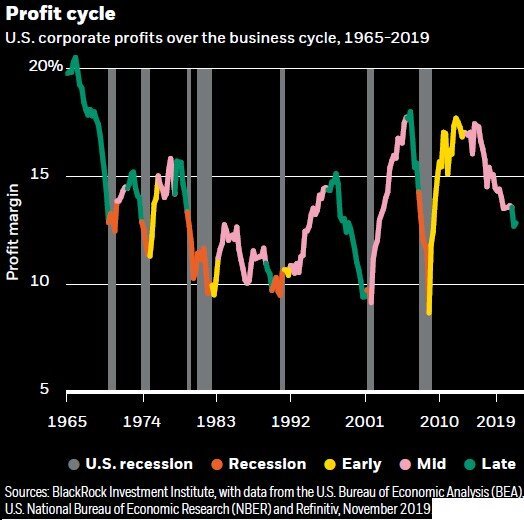

As we’ve noted, the significant performance stories of 2019 were price/earnings multiple expansion, China trade deal progress, and the dovish monetary policy pivot. For 2020, we do not see more room for further multiple expansion, however we see a mild pickup in growth as the key support for risk assets. Stocks may begin to factor in a greater risk premium for geopolitics, but we believe the macro environment remains sound given low bond yields, expected rebound in corporate profits, and strong jobs and wage growth that should continue to embolden the U.S. consumer.

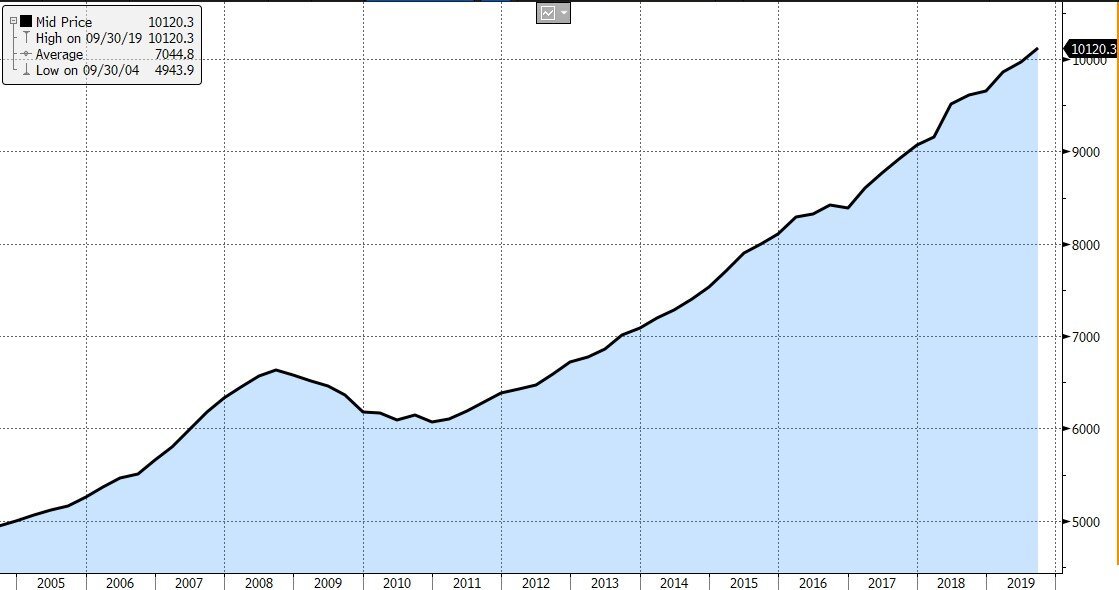

Risks to our current outlook include trade frictions and deglobalization weighing on growth, boosting inflation, and derailing the expected recovery in manufacturing and capital expenditures. This growth undershoot and persistent inflationary pressure, potentially caused by supply shocks as a result of deglobalization, could push the economy to stagflation. Given this scenario, U.S. corporations are particularly vulnerable given their high levels of debt. In addition, corporate profit margins appear to have peaked and are at risk of reversing amid trade conflicts, rising wages, and increased regulatory scrutiny.

(US Debt Outstanding Nonfinancial business; debt securities and loans (in billions)) - Source: Bloomberg

The bar for further easing by the Federal Reserve appears to be high with no policy action barring a slowdown or unwanted tightening in financial conditions. We expect to see the lagged effect of policy easing beginning to trickle through to economic activity. Income streams are essential in a slow-growth, low-rate world and we continue to favor income-generating assets. With the expansion of valuation multiples that powered equity markets higher in 2019 behind us, we see growth ticking up and trade tensions abating which should pave the way for modest returns to risk assets in 2020.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request