Uncommon Resiliency in the Face of Global Turbulence

The first month of the new year has seen a resurgence of volatility as market participants have reacted to the emergence of the coronavirus, impeachment proceedings, and the long-anticipated departure of Great Britain from the European Union. The main focal point however has been the potential economic impact of the coronavirus with markets held hostage to the worsening news flow that now includes halted commercial flights, travel restrictions, and the World Health Organization declaring a public health emergency.

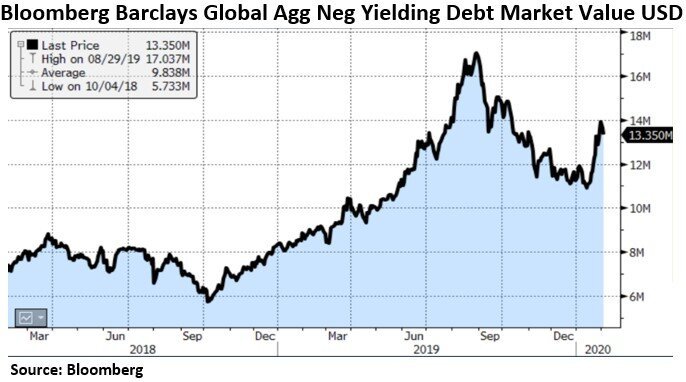

Traditionally the uncertainty surrounding an uncontained virus would lead investors to embrace a “sell-first” mentality as the ramifications of the global supply chain disruptions were quantified as evidenced by the (albeit brief) yield curve inversion on Thursday (where the yield on 3 Month Treasury Bills exceeded the yield on 10-Year Treasury Note which prognosticators argue is a signal of a coming recession). This was followed by steep market declines on Friday. These fears were quickly assuaged however when on Sunday China announced $174 billion liquidity injection into their markets which had been closed in observance of the Lunar New Year. Also, policy makers in the U.S. remain alert to international developments with Chairmen Powell noting potential downside risks in his press conference last week.

30 mo / 10 yr Treasury Spread

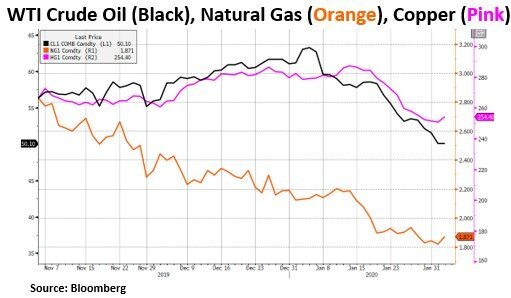

Instead, markets seem focused on respectable Q4 corporate earnings reports and strong headline economic data. Although the market is not entirely discounting the situation in Asia, it appears it is expressing this trepidation by selling economically sensitive commodities as opposed to stocks; with WTI Crude Oil, Natural Gas, and Copper down 16%, 15%, and 9% respectively year-to-date. The decline in oil could prompt an emergency meeting of OPEC+ to consider new production cuts.

We would urge caution by putting too much weight into some of the positive economic data because once you look under the hood the numbers are not as robust as they appear. Q4 GDP was temporarily boosted by a drop in imports, which is unlikely to be repeated. Also, the solid December durable goods orders were entirely attributable to defense spending, and Boeing’s production halt was not fully reflected in the latest ISM numbers. Earnings in Q4 are now expected to decline 1.1% year-over-year, worse than the 0.3% drop expected at the start of the quarter, and full-year 2019 profit growth is expected at a meager 1.5%. With all that being said, we still believe equities continue on their upward trajectory in the near-term. In the last 5 weeks markets have quickly digested the threat of war, impeachment proceedings, and a potential pandemic. With global central banks signaling a willingness to act if the virus undermines demand, inflation, and financial markets, the coordinated push into risk assets continues. Our objectives remain unchanged as we continue to deploy capital into income-generating assets of companies with solid balance sheets that exhibit consistent growth.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request