Rethinking 2020 in the Face of Global Market Convulsions

The theme of 2020 was to center around supportive monetary policy and stable growth. This was short-lived however as the rise of the COVID-19 outbreak and the ensuing quarantines have significantly hampered production, which will translate into a growth drawdown at an inconvenient time for the global economy. This exogenous shock roiled markets causing one of the swiftest stock market corrections on record dropping 12% in only six trading days.

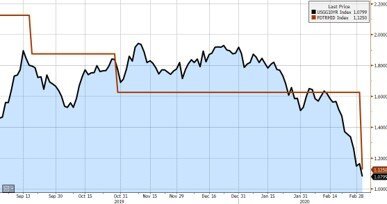

S&P 500 (Black), WTI Crude Oil (Orange), Gold (Blue) - Source: Bloomberg

Falling yields on long-term U.S. bonds indicate market participants anticipate a disinflationary negative demand shock, and last week, with the Federal Funds Rate above the 10-year U.S. Treasury yield, the Fed was forced to cut rates which they did earlier this morning delivering a half point cut in an emergency move (the first since October 2008). The Federal Reserve issued a statement Friday saying that it would “act as appropriate to sustain the expansion” and other global central bankers from Japan and Europe made similar pledges over the weekend to act as needed to stabilize financial markets. The Fed then followed that up with the emergency cut today stating “the coronavirus poses evolving risks to economic activity.” Many rightfully question the efficacy of rate cuts at this point in combating the sell-off. In the short term however, the fall in risk assets has meant a sharp tightening in financial conditions despite lower bond yields. Easier money should alleviate some stress on heavily leveraged companies and avert the cascading effect of forced selling, bankruptcies, and boost household confidence.

10-Yr U.S. Treasury Yield (Black), Federal Funds Target Rate Mid-Point of Range (Orange) - Source: Bloomberg

The U.S. investment-grade bond market slowed to a standstill last week with no new issuances for the first time since the summer of 2018. Companies have been kept on the sidelines by a jump in risk premiums amid fears that the spreading virus will disrupt global growth. If companies put bond deals on hold for a prolonged period, it would mean potential delays in acquisitions, expansions, and other investments, with a likely knock-on effect for growth. The U.S. high-yield debt market traded at the widest spread since August as investors pulled record amounts of cash from the two largest junk-bond ETFs.

BarCap US Corp High Yield/10-Yr US Treasury Spread - Source: Bloomberg

The market isn’t going to make a lasting recovery until it becomes clearer that we have avoided a recession. Dozens of companies have now announced that the coronavirus would hurt at least first-quarter profits from a combination of supply-chain problems and other impediments. An expected rebound to 10% growth in 2020 corporate profits from the very low single-digits in 2019 is looking increasingly unlikely as companies contend with the coronavirus impacts. This picture will become clearer as economic data continues to roll out and markets can begin to quantify the virus’ ramifications.

As we’ve stated before, we welcome bouts of volatility and market dislocation to opportunistically deploy excess cash. While we remain cognizant of the uncertainty surrounding coronavirus and its ultimate impact on growth, and recognize that a further market decline is likely, we have been selectively adding to client portfolios and will look to continue to do so on additional weakness.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request