Whatever It Takes

The adage that bull markets don’t die of old age has never seemed more prescient after witnessing global economies effectively shut down as countries battle to contain the COVID-19 pandemic, resulting in the worst quarter for stocks since the 2008 financial crisis. This economic destruction has prompted unprecedented monetary and fiscal intervention that includes open-ended asset purchase programs, emergency funding facilities to stabilize markets for investment grade corporate debt, money markets, and commercial paper, repo facilities for foreign central banks, and a $2.2 trillion fiscal spending plan to name a few. This “whatever it takes” mentality from the Federal Reserve has expanded their balance sheet $1.3 trillion in just two weeks.

Federal Reserve Balance Sheet (in Millions US$) - Source: Bloomberg

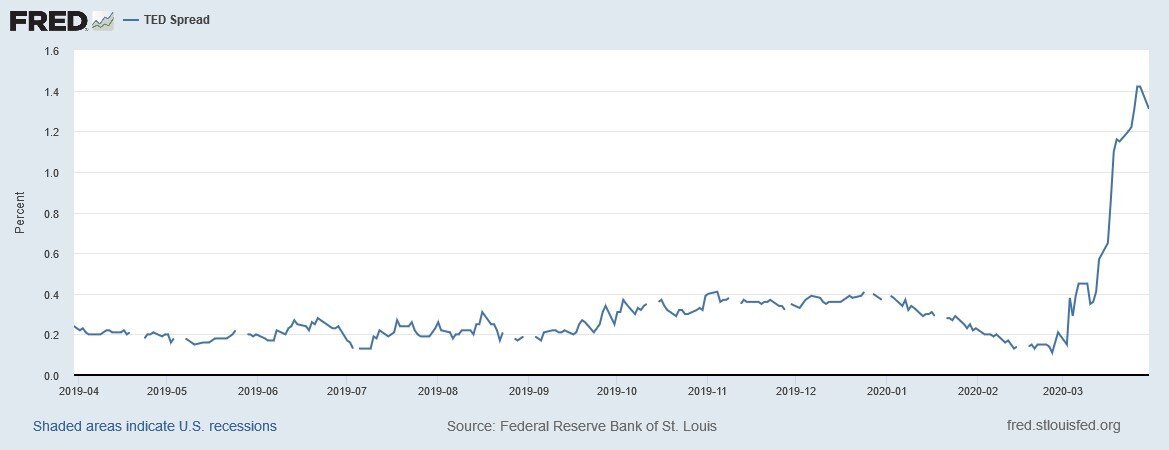

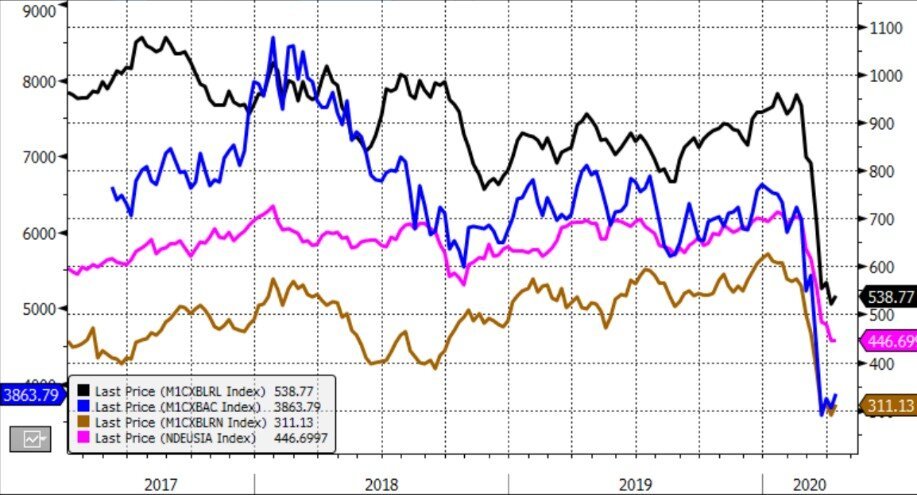

Crucially, the Fed’s immense liquidity and bond-buying efforts appear to have shored up the fixed income and mortgage securities markets for now. After significant turmoil in late March, most segments of the bond market are resuming normal functionality, and the price dislocations in usual safe havens of investment-grade municipal and corporate debt have started to ease. This can be evidenced by both the IG CDX (basket of credit default swaps on investment grade entities which represents the cost of “insuring” bondholders against default), and the TED Spread (indicator of perceived default risk on interbank loans derived as the difference between T-Bills and LIBOR) coming off their recent highs. Additionally, several new deals priced in the high yield bond market following a three-week issuance drought.

Markit CDX North America Investment Grade Index - Source: Bloomberg

TED Spread - Source: Bloomberg

For market participants, updates on employment data have become the focal point to determine the extent of the economic impact from the business shutdowns designed to slow the spread of the coronavirus. In the U.S., the data has been abysmal. Thursday’s weekly initial jobless claims doubled the prior week’s record 3.3 million reading to a new record of 6.6 million, for a two-week total of nearly 10 million. During the 2008 financial crisis it took 28 weeks to reach 10 million claims. The stock market response to efforts to contain the global coronavirus pandemic has been sharp and rapid. However, the severity of the economic impact of these efforts to contain the virus, through social distancing and business closures, is just starting to take shape. While dire jobless data was not a surprise, the magnitude was greater than analyst expectations because most of the data was collected before widespread efforts to contain the virus through social distancing were adopted by state and local governments, and sizable losses were also found in now-critical industries like health care, which saw 61,200 layoffs. Consequently, 2020 growth estimates have been revised down significantly from 2.3% to 0.1% on GDP and from 8.0% to -7.6% on S&P 500 EPS. Furthermore, there is the issue of emerging markets, where the virus has not yet had a significant impact. Many of these economies do not have the types of jobs that can easily be done from home, their cities are densely populated, and their health systems are already struggling. They could be faced with a disaster that the West avoids and their markets have reacted accordingly.

MSCI Mexico IMI Index (Black), MSCI South Africa Index (Blue),

MSCI India Index (Pink), MSCI Brazil Index (Brown) - Source: Bloomberg

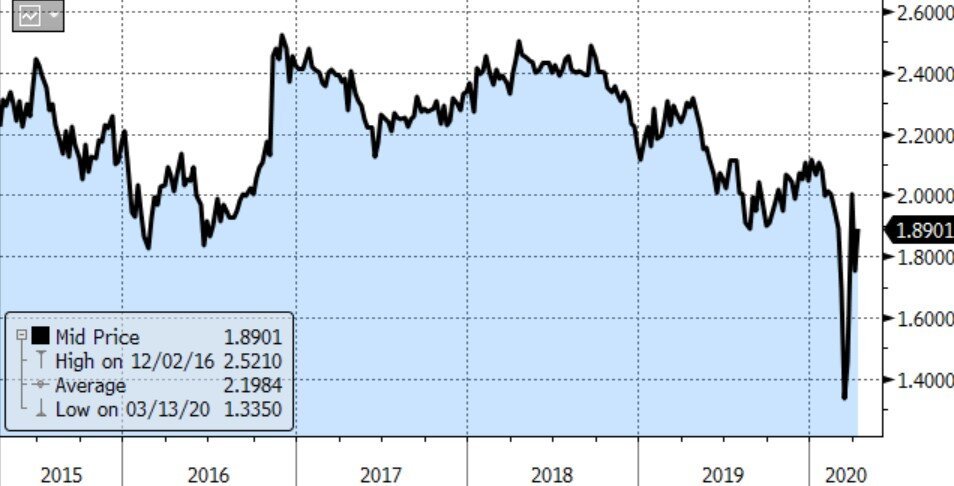

Through all the uncertainty and upheaval there are some bright spots. An immediate financial crisis has been averted, and the “worst-case scenario” from a public health perspective as it pertains to the virus in the U.S. has been avoided. Equities repriced on Monday to reflect the improving health data and have now retraced roughly 40% of the loss from peak to trough. While last week’s volatility may seem historically high with the S&P 500’s average daily move of 2.6%, this is less than half the average 5.4% daily move of the prior three weeks; which when coupled with the fact that stocks held in well at the end of last week’s employment data indicates that they are likely in stronger hands than several weeks ago. We are also seeing some modest reflation expectations creep into the market which can be observed through the 5-year, 5-year USD inflation swap rate. This rate is used by central banks and dealers to look at the market’s future inflation expectations and it measures the expected inflation rate (on average) over the five-year period that begins five years from today. The characteristics of this COVID-driven recession are also different. Prior to the pandemic emerging, the economy was on a fairly solid footing (with the exception of manufacturing), which would lend credence to the theory that the recovery may come sooner than in the past.

CBOE Volatility Index (VIX) - Source: Bloomberg

USD Inflation Swap Forward 5Y5Y - Source: Bloomberg

During this extraordinary time, we expect markets to continue to be turbulent as they attempt to quantify the ultimate economic impact surrounding the virus. We are still in the early stages with many decisions still to be made. It is highly likely that these events are reshaping our economy from how business is conducted (e.g. virtual meetings, telemedicine) to consumer behavior (>50% of U.S. households having no emergency savings may view this as a wake-up call). Being opportunistic long-term investors, we have used the fluctuations to add to and reposition our portfolio while being mindful that further downside is likely in the near-term.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request