Jobs Data at the Forefront

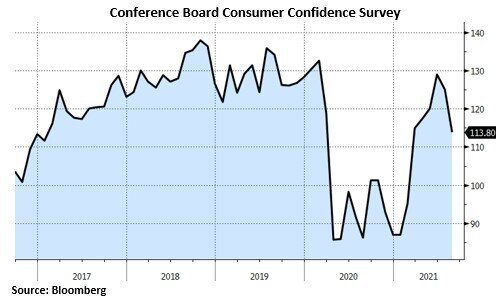

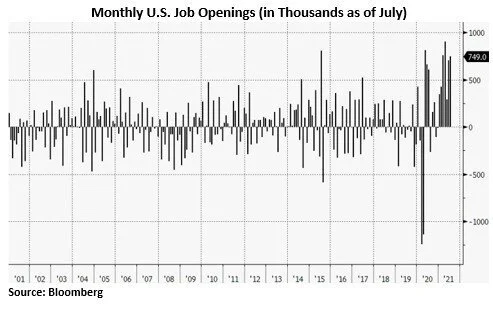

With August having come to a close, U.S. equity markets continued to grind higher with very little volatility. The S&P 500 ended the month with its strongest performance over the first eight months of a calendar year since 1997, and has posted 53 record highs in 2021. Further, the index has not experienced a pullback of 5% or more since October of 2020. The markets were keenly focused on jobs last week with Friday’s nonfarm payrolls number significantly missing the 740k consensus forecast with a gain of just 235k new payroll jobs for August, breaking the series of robust job gains from the past two months. Unemployment fell to 5.2% from 5.4% however and hourly workers benefited from a 4.3% annual gain in hourly wages. Consumer confidence is beginning to wane as seen in the Conference Board Consumer Confidence Survey dropping over 11 points in August to the lowest level since February. This is a trend worth watching as we head into fall and the holiday season. The job openings data released today showed a rise of 749k job openings in July versus an expectation of a slight decline. The total number of available jobs is now just under 11 million, and job openings now exceed the number of unemployed by a record amount. While this data is fairly dated, it will be notable to see how it changes over the coming months as emergency benefits end, vaccination rates rise, and children return to school.

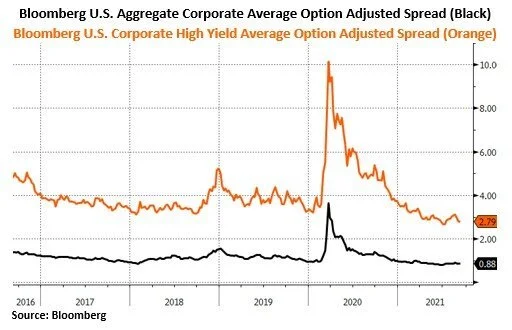

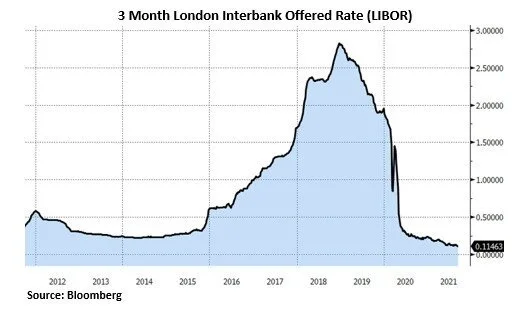

In the corporate credit markets September is shaping up to be very busy with high-grade borrowing setting a two-day record yesterday and today with 38 deals. The frenzy of activity is making up for a slow August and companies may see September as the last window to issue at such favorable rates. Yesterday’s deals were absorbed well by investors with order books 2.2 times covered according to Bloomberg, further illustrating the insatiable appetite for fixed income assets. The three-month London Interbank Offered Rate for dollars dropped to a record low on Monday as the flood of excess cash in short-end markets continues to put downward pressure on rates; and the Markit CDX North America Investment Grade Index, which is composed of credit default swaps on investment grade entities and broadly used as a gauge of credit risk, has fallen to a level not seen since before the pandemic. The move down in the CDX came in the wake of Fed Chair Jerome Powell’s comments at Jackson Hole that he isn’t rushing to raise rates. The Federal Reserve will find the disappointing August jobs report noteworthy, but it is doubtful that it will ultimately alter their timeline for tapering asset purchases. Further details on the taper at the September FOMC meeting, and a start to the process at the end of the year remains the base case scenario.

Expect a busy September in Washington as lawmakers continue to craft what could be the largest spending package in U.S. history. The $3.5 trillion reconciliation bill that contains the bulk of President Biden’s economic agenda faces a litany of roadblocks as there is a fundamental lack of agreement on both the size of the package and how to pay for it. Compound this with the potential government shutdown and the need to raise the debt ceiling and you get a recipe for a lot of finger-pointing and theatrics.

While potential headwinds including but not limited to COVID, policy error, inflation, taxes, and “peak growth” are all meaningful, our view for the remainder of 2022 remains constructive. We see a continuation of the recovery that has been driven by earnings growth, consumer spending, and inventory rebuilding carrying us forward through the end of the year, however bouts of volatility and meaningful pullbacks are likely as the market has gone an exceptionally long time without them.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request