The Delicate Path to Policy Normalization

The S&P 500 finished the third quarter with a whimper as the month of September was the worst performing month since the beginning of the pandemic, with the index falling -4.65%. Bond yields also reacted with the U.S. 10-Year Treasury moving swiftly from 1.31% to 1.49% in the last week of the quarter due to inflation fears, supply chain issues, higher oil prices, and fiscal disputes. China is suffering an energy crunch and pursuing a regulatory crackdown while Evergrande Group, the debt-laden real estate developer, is on the brink of failure thanks to a cooling real estate market in China, and fears of contagion have spread across global financial markets in recent weeks.

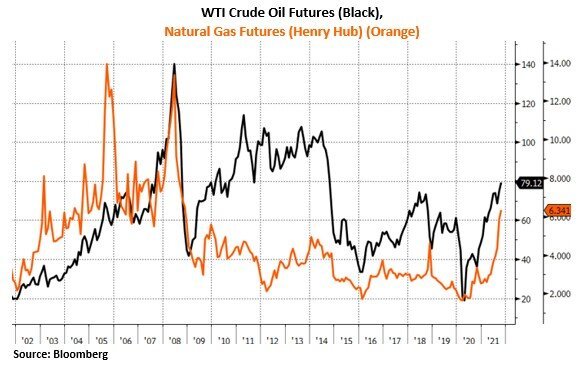

The price of oil closed in on $80 a barrel for the first time in seven years and natural gas is the most expensive it has been in thirteen. With Europe and China experiencing shortages in coal and natural gas, stronger demand for oil has pushed prices higher heading into winter.

Fuel and food costs are soaring worldwide, combining with congested ports and strained supply chains to elevate price pressures while labor shortages continue to plague some employers. The breakeven rate, the difference between yields on conventional U.S. Treasury securities and Treasury Inflation-Protected Securities, or TIPs, shows that market participants expect relatively higher inflations rates with the highest readings since 2013. Although the expansion seems intact, such a backdrop is fanning fears of a mix of weaker growth and faster inflation to come, threatening to complicate budding efforts by central banks to dial back stimulus without rattling markets.

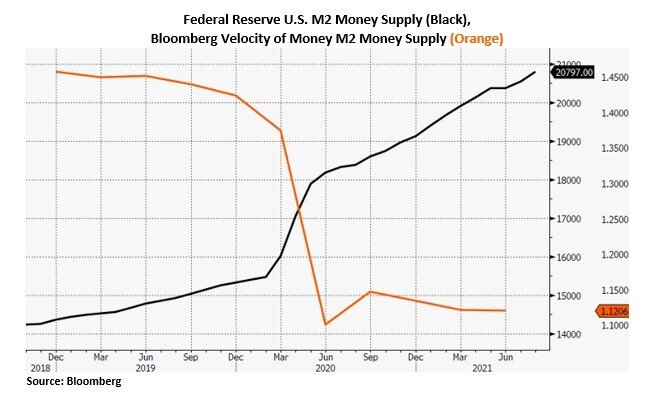

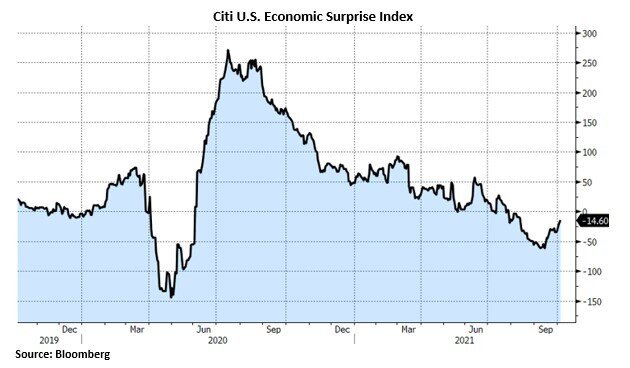

According to the Citi U.S. Economic Surprise Index, the incoming economic data has been falling below estimates at a degree not seen since early 2020. In addition to that, the Fed’s attempts to spur borrowing and spending have been unproductive. Since the end of 2019, the Fed has increased the money supply as measured by M2 by 34%, but that money is not moving through the system as velocity sits near record lows. The September FOMC meeting suggested that the Fed announcing its asset taper plan in November is a forgone conclusion, and with Friday’s employment report being the only nonfarm payrolls release before the November FOMC meeting, the data would need to be a massive disappointment for the Fed to alter its current blueprint.

It’s likely the Fed will remain cautious under its new framework and won’t begin hiking rates until mid-2023. The Fed risks tightening to the point that it triggers financial problems. Additionally, a big rate hike could precipitate bankruptcies in a number of highly levered sectors. They are keenly aware of these risks which is why they will inch towards contractionary policy. Investors will be wary of a policy misstep in both timing and magnitude and expect elevated market volatility once those conditions arise.

Headwinds continue to be Covid, tax and regulatory risks from legislative plans, supply chain issues, and corporate earnings warnings. While a disruptive shutdown of the federal government has been averted through a stopgap funding bill, fractured talks continue on President Biden’s $4 trillion economic agenda with deep divisions among legislators on the way forward. An accommodative Fed, strong capital expenditures, and low inventory levels should help extend the current economic cycle leaving us to continue to be constructive heading into 2022. We view the larger secular deflationary forces, such as technology, aging demographics, and the debt burden, outweighing cyclical, inflationary forces longer term.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request