Stocks Power Past Inflation and a Flattening Yield Curve

U.S. equity markets rallied to all-time highs in October on the back of robust corporate earnings. Companies representing more than half of the S&P 500 market value have reported third quarter earnings, with over 80% of them beating expectations on profit, and more than 75% exceeding revenue estimates. Short-term yields spiked after a surprisingly hawkish shift by the Bank of Canada last week prompted markets to pull forward their projections of when the Fed might lift U.S. policy rates next year. Investors are braced for a busy week as earnings season continues, the FOMC makes their key rate decision, and worries about growth persist.

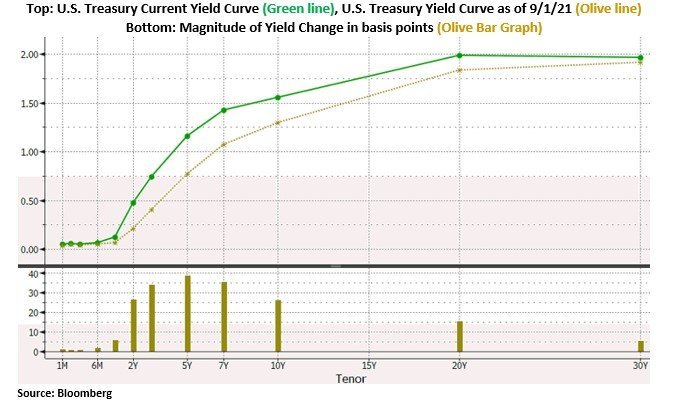

In the Treasury market, yields on short-dated notes have moved sharply higher in recent weeks, while those on longer-dated bonds have fallen moderately. This flattening of the yield curve has come in reaction to concerns about inflationary risks potentially being more persistent in the near term and lasting longer than previously anticipated. Flattening yield curves typically occur relatively later in an economic cycle as investors expect central banks to raise short-term policy rates, which pushes up short-dated yields relative to longer-term ones. The speed and magnitude of this most recent repricing suggests investors expect the Fed to start tightening monetary conditions sooner, and at a swifter pace than previously thought.

The concerns over inflationary pressures are not unfounded, as much of the data continues to support this narrative. Wage trends suggest that inflation may be more sustainable than many thought. The above-consensus 1.3% increase in the employment cost index, one of the Fed’s preferred wage gauges, suggests that the pace of wage growth has picked up vigorously. In addition to labor, much of the recent change in market thinking relates to questions about the persistence of supply chain disruptions and supply-demand mismatches in various sectors as the global economy recovers. With some inflation metrics remaining elevated, market participants are envisioning a more imminent reduction in quantitative easing, with interest rate hikes on the horizon. Like the markets, many central bank officials are beginning to pivot on their thoughts on inflation. For much of this year, they suggested the accelerating inflation showing up in economic data was transitory; now, central bankers are questioning this thesis.

While Fed meetings are always thoroughly dissected, this week’s will be especially so because it comes against a backdrop of elevated inflation, a surge in short-term rates, and central bankers around the world having a more hawkish tone. The FOMC is expected to announce the start of tapering, including key details on the pace, timing, and structure of its plan to reduce asset purchases. With price and wage inflation metrics both elevated, the FOMC will likely not introduce any calendar-based language on when rate hikes might follow taper. Instead, outcome-dependent language will remain. Though a well-calibrated withdrawal of monetary stimulus will be necessary, central banks are eager to continue supporting a recovery in labor markets, and thus will be cognizant of the threats of tightening too rapidly.

Persistent inflation and policy risks remain the market’s biggest concerns. A moderation of earnings growth into next year is to be expected as we move beyond the economic restart. Markets may overreact to earnings normalizing and supply chain disruptions, but companies should be able to preserve margins as they pass higher costs on to consumers. Seasonal strength and strong equity inflows from passive investors should bode well for stocks for the balance of 2021, and all eyes will be on the Fed as they try and wean markets off of extraordinary intervention.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request