Omicron and a Fed Pivot Bring Pause

Over the past two weeks, markets have suffered risk-off bouts as the Omicron variant spread and Fed Chair Jerome Powell pivoted to a faster taper of asset purchases. Powell is reversing the Fed’s transitory view on inflation and admitted the Fed erred to the Senate banking panel last week when he stated that “it’s probably a good time to retire the word transitory.” Fears of widespread lockdowns threatening the recovery and potential policy error from the Fed were enough to send the VIX (the expected volatility of the S&P 500 index) above 30 for the first time since February.

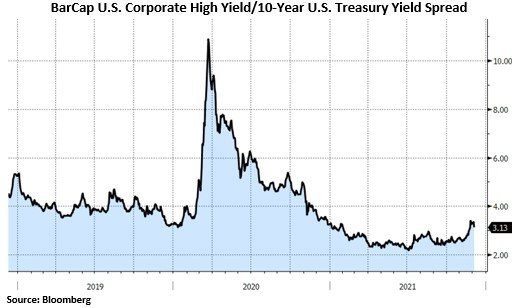

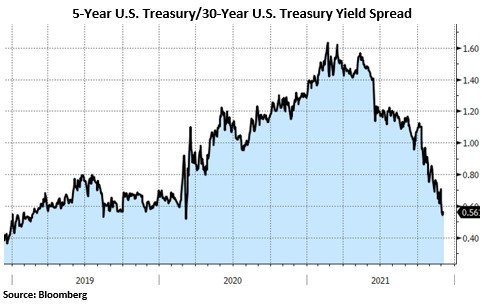

In corporate credit, junk bonds endured their worst November in ten years, and the biggest monthly jump in yields since the pandemic first shook markets in March 2020. In investment-grade, the market volatility caused issuers to delay their offerings, with December now poised to break the $57 billion record set in 2014. With the abrupt shift in Fed policy, market participants are likely front-running Fed action as evidenced by the move in the yield curve. The spread between the yield on the 5-year U.S. Treasury and 30-year narrowed to 51.5 basis points, the flattest since the pandemic meltdown in March 2020. A flatter yield curve is expected given the Fed’s more hawkish tone. The assumption is that the Fed will begin raising rates earlier than previously anticipated, pushing up yields on shorter-dated Treasuries, while the reduction in future inflation and growth will encourage investors to buy longer-dated bonds, therefore lowering their yields. We saw the impact of the prospect of monetary tightening play out in the high growth/high multiple stocks being sold as higher rates disproportionately effect their valuations.

The U.S. Dollar remains strong from supportive Fed policy and solid U.S. economic data. Friday’s CPI data release will be meaningful as a stronger than expected print (6.8%) could fuel further upside. With expectations for the taper to now end in March 2022 instead of June 2022, and that 2 rate hikes may form the Fed’s baseline assumption (up from 1 previously), participants will be keyed in to the upcoming FOMC meeting on December 15th.

Regarding Omicron, initial indication from South Africa is that although it spreads quickly, it has yet to cause serious illness. If this continues to hold true, this may be welcome news in the fight against COVID. Investors who have “bought the dip” in 2021 have been rewarded, so it’s little surprise to see markets bounce back strongly from the recent volatility. With real rates remaining firmly negative, there are few alternatives aside from being long risk assets. We still expect inflation to moderate in the 2nd half of 2022 as growth moderates and supply chains stabilize. What remains to be seen, however, is whether the Fed’s pace of tightening sacrifices market stability.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request