Lower for Longer

The events of this year and the response it has prompted, in both scope and scale, have led to countless records being broken (both good and bad). The one that captures the most attention however is that this was the fastest recovery in U.S. equities in history to a new high following a decline of at least 30%. The dominance of the five largest stocks in the S&P 500 has received much of the attention, with Apple, Amazon, Microsoft, Alphabet (Google), and Facebook now comprising almost 25% of the index. The move in Chinese markets has been even more exaggerated, with the top 3 stocks in the benchmark MSCI China Index, Alibaba Group, Tencent Holdings, and Meituan Dianping, now commanding 38% of its market cap. In fact, according to Bloomberg, there are roughly 9,000 companies in indexes that track the broad global stock market, but just 30 of them produced more than 70% of the total gain over the past 5 years. This lack of broader participation has many understandably worried about the sustainability of the new bull market going forward.

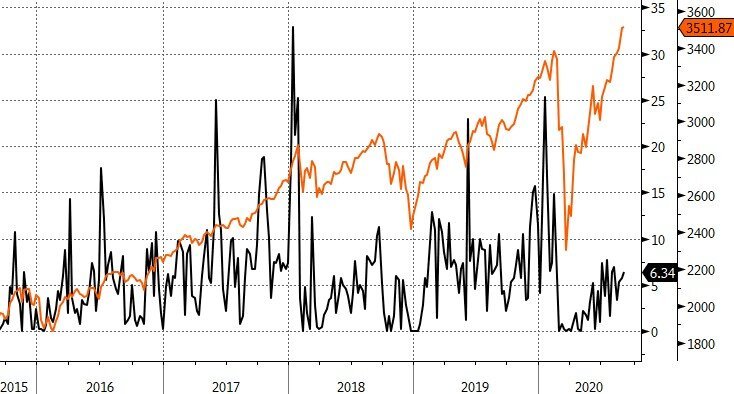

S&P 500, Percentage of S&P 500 Members with New 52 Week Highs - Source: Bloomberg

Last Thursday Federal Reserve Chair Jerome Powell made a significant announcement regarding a shift in their policy framework. The FOMC adjusted its strategy for achieving its longer-run inflation goal of 2%. In this flexible average inflation targeting, policymakers will shoot for an average inflation rate of 2% (as measured by the PCE Price Index) over time, but not in a mechanical or mathematical way. A period of inflation below 2%, would be followed by a period of letting inflation run above 2%, often referred to as letting inflation run “hot.” This will help to reaffirm 2% as a goal, rather than a ceiling. The Fed also altered its employment objective, they emphasized that this is a broad-based and inclusive goal and reports that its policy decision will be informed by its “assessments of the shortfalls of employment from its maximum level.” The key change is in regards to the word “shortfalls” where the original objective referred to deviations from its maximum level. The Fed has lost faith that there is much of a trade-off between low unemployment and inflation. The Phillips Curve (the economic theory that inflation and unemployment have an inverse relationship) is apparently flatter than in the past, making shortfalls in unemployment less inflationary. In addition, the Fed has learned that low unemployment has been especially beneficial to low- and middle- income communities, and considering we had historically low unemployment for several years before COVID-19 without leading to inflation, the Fed is willing to alter their approach. What was lacking from Powell’s statement was any mention of forward guidance, which many were expecting an outcome-based trigger for future rate increases in some form.

U.S. Personal Consumption Expenditure Core Price Index YoY - Source: Bloomberg

The key question going forward though is how the Fed hopes to achieve higher inflation when they and other central banks have had ongoing difficulty hitting inflation goals. The COVID-19 crisis will continue to put downward pressure on aggregate demand creating disinflationary pressures, and the Fed has already expanded monetary policy decidedly without lifting inflation. Many of their tools at this point are stretched, and many Fed officials have been urging Congress to act and pass more fiscal relief as that would be more impactful in the near term in boosting growth, employment, and inflation. Congress is set to resume talks on the next round of stimulus when the Senate returns from recess next week. The last reports were that Democrats and Republicans remain far apart on the details of the package. With Democrats proposing $3T-$3.5T while Republicans are only seeking $1T. The gridlock resulted in President Trump signing four executive orders including expanded unemployment benefits (an additional $400 per week scaled down from the previous $600), temporary payroll tax deferral, provision of eviction protection, and student relief. The longer the political bickering continues, the more onus is put on the Fed to support the recovery.

The U.S. 5-Year/5-Year Forward Inflation Swap Rate - Source: Bloomberg

Corporations continued to take advantage of the low rate environment as they sold $16B of notes last week, more than triple the normal volume for the last week in August. There was approximately $144B of U.S. dollar investment grade new issuance in August, a record for the month. That's the fifth time since March a record has been set for a given month, including April's $305B deluge. August also marked the worst month for investment grade credit since March. This weakness is primarily being blamed on rates. Duration has fallen from its record peak earlier in the month, but the trend is higher as issuers extend their debt maturities, locking in lower rates for longer, leaving them more susceptible to a further backup in rates.

Bloomberg Barclays U.S. Agg Corporate Modified Adjusted Duration - Source: Bloomberg

The U.S. dollar hit a 2-year low after Chinese manufacturing data indicated that exports are underpinning a recovery. It is expected to remain challenged in light of a combination of factors including that the Fed is likely to keep the policy rate lower for longer under the Average Inflation Targeting framework, significant deterioration of U.S. deficits, and an eroding U.S. rate advantage.

The U.S. Dollar Index - Source: Bloomberg

With accommodative monetary policy and massive fiscal stimulus propelling markets higher in record fashion, the biggest headwinds that could alter its trajectory continue to be COVID-19 infection rates, unfavorable vaccine headlines, increasing China tensions, and uncertainty around the U.S. election. With correlations across asset classes remaining relatively high and investors starved for yield, we still favor equities of well-capitalized, disciplined market leaders with strong track records of returning capital to shareholders as we patiently await our next market opportunity.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request