On Hold For More Stimulus

U.S. equity markets have resumed their recovery theme as growth stocks continue to outperform blue chips; and although there has been a plethora of economic data, last week that was eclipsed by big-tech earnings reports. The current focus has now turned to Washington as Democrats and Republicans continue negotiations on a new virus relief package, but remain far apart on some of the key issues, most notably the extension of the supplemental unemployment benefits which have expired.

Meanwhile, after hitting multi-year highs back in March and subsequently selling off more than 9% since, the U.S. dollar is signaling caution amidst a backdrop of exploding deficits, zero-interest-rate policy from the Federal Reserve, rising geopolitical tensions, and an uncertain economic recovery. Given the deluge of liquidity provided by the Fed, the odds of a rush back into the dollar in a risk-off scenario are diminished. With a weakening growth outlook and rising inflation expectations, real U.S. interest rates (adjusted for inflation) are now negative, exacerbating the selloff in the dollar and helping propel gold to all-time highs. It is unlikely that this situation will change in the near term given that the Fed remains committed to continuing its asset purchases “at least at the current pace,” and has not ruled out implementing some form of yield-curve control. In addition, the Fed has discussed tying future rate increases explicitly to actual inflation reaching or exceeding a 2% target which would further support negative real yields going forward.

The U.S. Dollar Index - Source: Bloomberg

U.S. 10-Year Real Yield - Source: Bloomberg

Gold Spot Price $/Oz - Source: Bloomberg

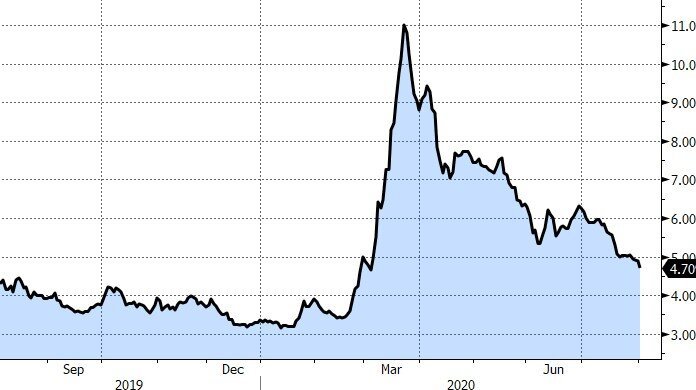

In debt markets, a combination of technical factors including a declining supply, Federal Reserve participation, and an abundance of investor cash have all caused spreads to tighten further. U.S. investment grade borrowing costs are at all-time lows, while high yield spreads have fallen below 500 basis points for the first time since early March. The amount of distressed debt in the U.S. has declined to about $341 billion as of July 24th, down from a $943 billion high on March 24th according to Bloomberg.

Bloomberg Barclays U.S. Corporate High Yield Option Adjusted Spread - Source: Bloomberg

Economic data continues to be mixed and any meaningful recovery cannot take hold until there is a restoration of confidence in both consumers and businesses. Despite $1.2 trillion of U.S. investment grade bond issuance so far this year, companies are playing it safe and either sitting on cash or refinancing debt. As we saw in the 2Q GDP report last week, the decline in consumer spending on services illustrates the caution from individuals in navigating the current landscape. We’re entering a new chapter of policy-driven financial repression, and the most compelling investment from our standpoint continues to be well-capitalized, innovative companies with stellar balance sheets.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request