Entering a New Phase

Economic data continues to bounce back from historically low levels; with this morning’s employment data showing encouraging signs on a standalone basis. As we saw last week however, markets are beginning to question the sustainability of the recovery following the initial rebound as COVID-19 cases reaccelerate. This pick-up in new infections has prompted a growing number of states to either stop or reverse their reopenings and some companies, such as Apple, to reclose some stores in certain locations.

Initial Jobless Claims (in thousands), Continuing Claims (in thousands) - Source: Bloomberg

ISM Manufacturing PMI, ISM New Orders - Source: Bloomberg

Meanwhile, several key relief measures are set to expire soon including the supplementary unemployment benefits and the Paycheck Protection Program. The absence of these provisions, coupled with a renewed fear amongst households prompting them to disengage from the economy again could threaten the magnitude and breadth of the recovery. Fed Chair Jerome Powell reiterated as much in his testimony Tuesday in front of the House Financial Services Committee. He acknowledged the significant improvement in economic data, but highlighted ongoing policy support that “is making a critical difference not just in helping families and businesses in a time of need, but also in limiting long-lasting damage to our economy.” He commented further that the outlook will depend on actions taken “at all levels of government” to support recovery “for as long as needed.”

Conference Board Consumer Confidence - Source: Bloomberg

U.S. Business Roundtable CEO Survey Econ Outlook Index - Source: Bloomberg

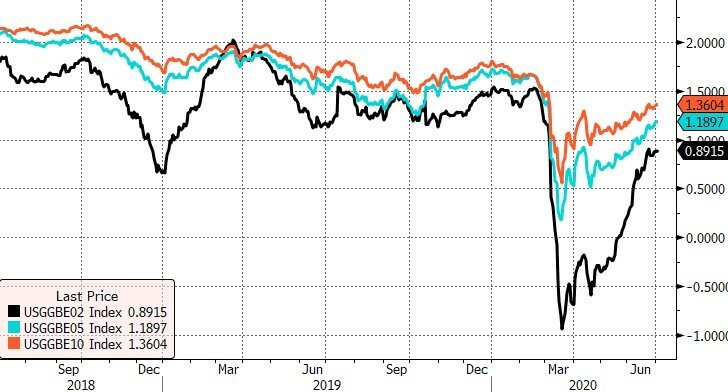

As we have previously noted, the Fed’s intervention in the corporate bond market has triggered a borrowing spree that has been met by an insatiable demand from investors. Narrowing credit spreads have come despite increased leverage ratios, loosening covenants, and defaults already on pace to surpass 2009 levels according to S&P Global. A key part of the distortion is due to Fed intervention which recently initiated their facility to buy corporate bonds directly from the companies themselves, and they are already the largest holders of many corporate bond ETFs. This is an area we will continue to focus on as it has considerable implications on the broader economy. In addition, inflation expectations have rebounded from their lows but remain muted even though there has been a sharp increase in the budget deficit.

Nonfinancial business debt outstanding - Source: Federal Reserve

U.S. BBB Rated Corp Bond Index/U.S. 10 yr Treasury Yield Spread - Source: Bloomberg

U.S. Breakeven 2 Year, U.S. Breakeven 5 Year, U.S. Breakeven 10 Year - Source: Bloomberg

Markets will continue to be challenged in 2020 amidst COVID uncertainty. Second quarter EPS expectations at -44% may prove overly pessimistic and could lead to a better-than-expected bounce. Fed officials now expect a 6.5% contraction in GDP this year, followed by a 5% recovery in 2021 and a further 3.5% expansion in 2022. Their forward guidance implies no rate hikes through 2022. The strength and continuation of the recovery will ultimately depend on job growth in the coming months, which in turn is dependent on progress on the public health front. The longer it takes for the unemployed to get back to work, the slower the economic rebound to the pre-crisis trend will be. Accelerating coronavirus outbreaks will elevate concerns not only about the economy’s prospects this summer, but also in fall and winter. We remain alert to opportunities as they present themselves with an expectation for increased volatility heading into the election. We wish you all a Happy 4th of July.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request