Unyielding Rally Despite a Dystopian Landscape

Equity markets continue their relentless march higher on the heels of immense Fed intervention and continued optimism as the developed world gradually begins to reopen their shuttered economies. The S&P 500 rose 4.53% in the month of May, is up over 36% from the March 23rd low, and is now down only 5.12% year-to-date. This while U.S.-China tensions have reignited, there’s civil unrest gripping nearly every major city in the country, and global COVID-19 cases outside of the U.S. hit a new record.

China’s decision last week to impose new national security laws on Hong Kong prompted the U.S. determination that Hong Kong is no longer autonomous from mainland China. This could mark the beginning of a squeeze on China’s international financial operations from which Beijing lacks the equivalent capacity to retaliate. Thus far China has announced a pause in the purchase of U.S. soybeans and have cancelled an unspecified number of pork orders. This latest flare-up has the potential to put the phase-one trade deal in jeopardy as a “tough on China” stance currently has bipartisan support domestically, and the Chinese government will dig in to save face on their crown jewel.

A key characteristic of the equity market rally continues to be the lack of breadth, with mega-cap technology stocks driving much of the gains. The market value of the five largest companies in the S&P 500 now account for more than 20% of the index, the highest proportion since the tech bubble in 2000. The S&P 500 is currently trading at 24.4 times next twelve-month EPS projections as compared with 17.7x and 15.5x two months after the bear market bottoms of 2002 and 2009 respectively. While mathematically this makes sense as EPS projections (the denominator) have been meaningfully reduced, and a lower-for-longer interest rate environment increases the present value of estimated future cash flows making equities relatively more attractive; it signifies that with poor near-term earnings prospects any further equity market gains are dependent on even more multiple expansion.

S&P 500 Forward Price-to-Earnings Ratio - Source: Bloomberg

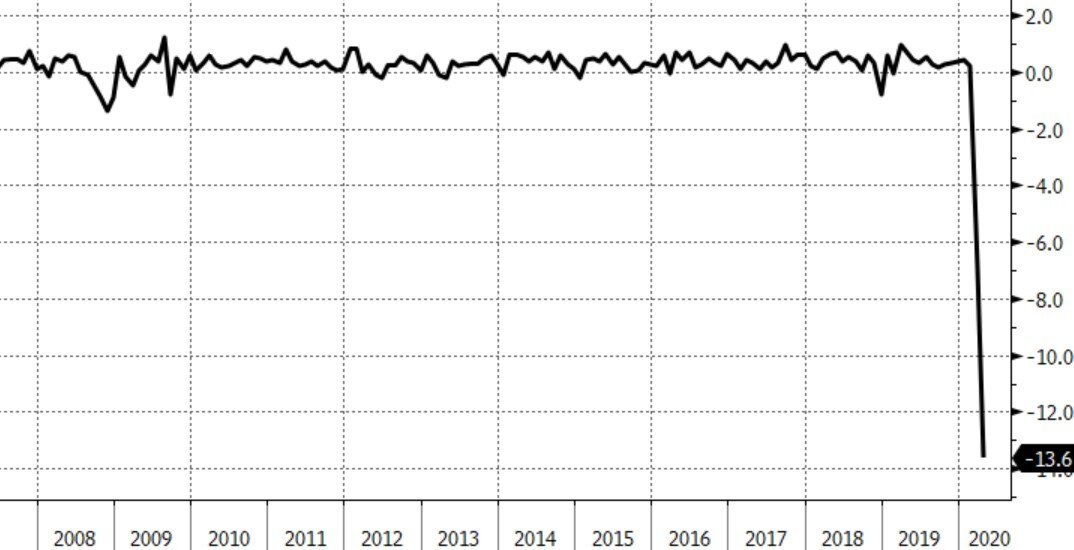

Easing quarantine measures will undoubtedly help economic activity rebound in the coming months, but the elevated savings rate, which is commensurate with low levels of consumer confidence amid heightened uncertainty in the labor market outlook, will limit the magnitude of a rebound in consumer spending. Economists expect that this week’s employment report will show that millions more people lost their jobs in May and that the unemployment rate will rise even further. That will result in many people being reluctant to spend, and that reluctance likely won’t go away until there are sure signs that the job market is improving. The Commerce Department on Friday reported that consumer spending fell a record 13.6% in April from a month earlier following a 6.9% drop in March, so we have a long way to go.

U.S. Personal Saving as a % of Disposable Personal Income - -Source: Bloomberg

U.S. Personal Consumption Expenditures, Nominal Dollars MoM - Source: Bloomberg

U.S. Initial Jobless Claims (in thousands), U.S. Continuing Jobless Claims (in thousands) - Source: Bloomberg

As declining tax revenues and increased government spending in response to the COVID-19 crisis substantially widens the federal budget deficit, the U.S. Treasury will auction a record $3 trillion in debt in the second quarter. The supply will be more heavily weighted to longer-term maturities than in the past, and the Treasury is even reintroducing a 20-year bond issue for the first time in over 30 years. This extraordinary amount of issuance is causing many to urge the Fed to implement some form of yield-curve control. Instead of announcing a set volume of purchases as it has done under quantitative easing programs, it would buy or sell whatever amount is needed in order to maintain the chosen yield. The idea behind it is that as short-term interest rates approach zero, capping longer term rates will benefit borrowers while capping debt costs for the government. Opponents argue that it further punishes savers and encourages companies to increase their already heavy debt loads. This type of intervention by the Fed has not been done since World War Two and is another example of the unconventional tools the Fed must consider deploying in order to help navigate the economy through uncharted waters.

In the corporate debt market, there has been a frenzy of issuance in which last week the year-to-date total sales of bonds surpassed the $1 trillion faster than any other year on record. In 2019 for example it took until November to reach that threshold. From the Fed’s perspective, the borrowing spree is exactly the reaction they were looking for when they announced two months ago that they would purchase $750 billion of corporate debt to prop up struggling companies devastated by the pandemic.

Year-to-Date U.S. Investment-Grade Corporate Bond Sales - Source: Bloomberg

The challenge of reopening America was already an exceedingly arduous task. This difficulty has now been compounded by the fact that cities across the nation are faced with considerable discontent. The critical component in an effective reboot of the economy will be getting small businesses, what Fed chair Jerome Powell refers to as “America’s job machine,” back up and running. Market upside ultimately depends on the path of the virus and the success of reopening with a fair amount of optimism currently being priced in. Our preference for quality companies poised to benefit from long-term structural growth trends remains.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request