Markets Expect Ongoing Global Policy Action

Market confidence is currently relying on expectations for further global policy action (Eurozone, China, Japan); in order to safeguard a sufficient level of economic growth and inflation. The OECD expects 3.3% global GDP growth in 2014 and 3.7% in 2015. In Europe, expectations are rising for a more aggressive monetary response by the ECB in the form of a sovereign bond purchase program. In Asia, China recently cut its 1 year lending (6% to 5.4%) and deposit (3% to 2.75%) interest rates; for the first time in two years. In the U.S., despite the Fed’s October exit from its quantitative easing program, Treasury yields have remained relatively range bound; with the 10 Year yield at 2.3%. In U.S. equities, major indices hit all-time highs e.g. S&P 500 (2,072, total return of 14% YTD), Dow Jones (17,827, total return of 9.7% YTD) and NASDAQ (4,760, total return of 15.3% YTD). From our perspective, we continue to allocate capital selectively and opportunistically in income generating instruments and in industries with favorable fundamentals.

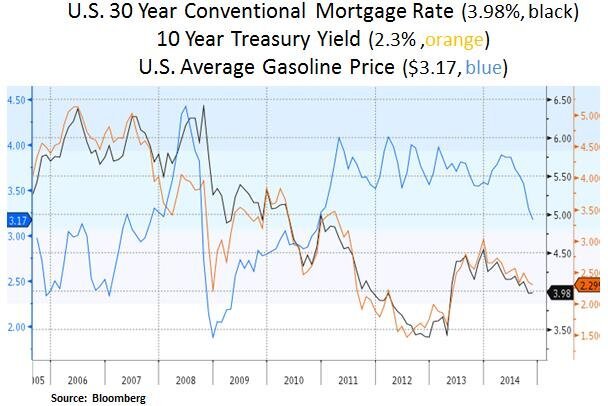

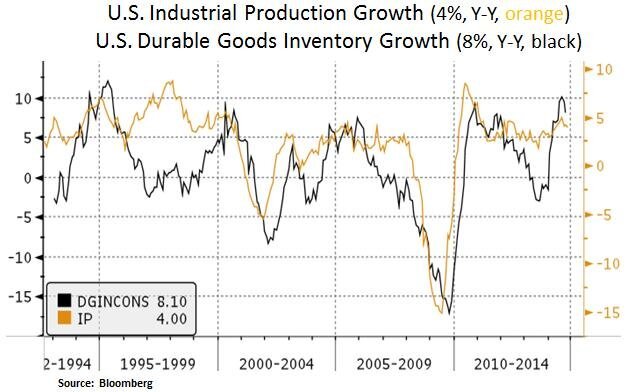

In the U.S., Q3 GDP growth (3.9%, Q-Q, annualized) has been on a better footing as a result of firm consumer spending and fixed asset investments. Along with rising asset prices and a steady labor market, the low mortgage rate and gasoline price backdrop remains supportive for households. On the cautious side, we are currently seeing a somewhat higher rate of durable goods inventory accumulation. An inventory drawdown may be a headwind for the coming quarters. From an investment point of view, we prefer industrial names with long product cycles and high order backlogs.

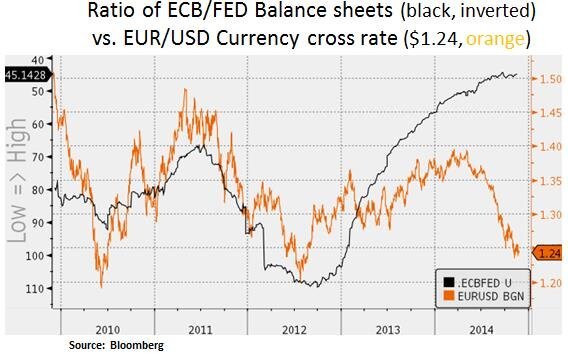

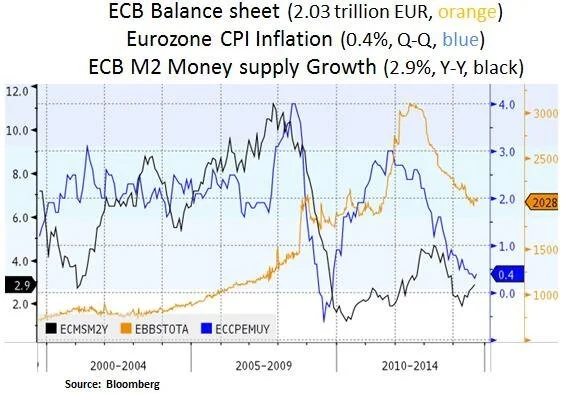

The Eurozone sovereign debt markets continue to anticipate an asset purchase program by the ECB; as underlying growth and inflation trends have been underwhelming. The OECD expects 0.8% Eurozone GDP growth for 2014 and 1.1% in 2015. Inflation is expected at 0.6% vs. 1.2% in the U.S. in 2015. Moreover, a 300 billion-euro ($373 billion) investment program is expected to be unveiled by the European Commission. In our view, bank balance sheet repair is key to unlocking pent-up demand; especially in Southern Europe. As we can see below, Eurozone M2 money supply is starting to pick up. The current EUR/USD cross rate seems to anticipate an expansion of the ECB’s balance sheet; after lagging the Federal Reserve. From an investment perspective, U.S. multinationals in the technology and industrials sectors are likely to be beneficiaries of a European growth recovery.

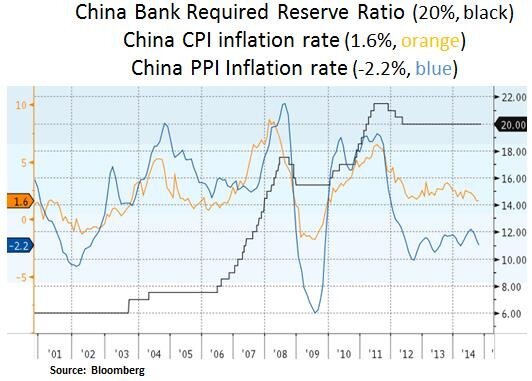

One of the current market debates is whether we are in the midst of competitive currency devaluations. For example, in the past two years, Bank of Japan has been aggressive in expanding its balance sheet (now at 44% of GDP). On a trade weighted basis, the yen has depreciated by ~50%. This may have prompted the recent cut in Chinese interest rates. As China has been shifting from investment to consumption driven growth, we may see attempts to cushion this transition by easing further some of the domestic lending costs or by reducing the required reserve ratio for banks.

The more relevant question for U.S. investors is whether USD strength will cause further deflationary effects in 2015; at a time whereby the Fed is attempting to normalize its interest rate policy. As other monetary policies diverge from the Fed’s, excessive USD strength may be an issue for U.S. exports and inflation expectations. This may be offset to a degree by capital inflows in U.S. asset markets. Hence, our view on interest rates and interest rate sensitive instruments is still constructive. We seek to be nimble as these policy divergences cause currency or asset price frictions.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.