Diverging monetary policies causing currency frictions

Financial markets are witnessing an ongoing divergence between regional growth outlooks and monetary policies. The past week saw ongoing commitments and pledges for further monetary interventions (Japan and ECB respectively); in an attempt to stave off deflationary trends. In the U.S., incoming labor data suggested gradually improving labor markets conditions. In addition, easing global energy prices alleviated some of the global growth concerns. Asset prices such as U.S. equities have continued to make new highs (e.g. S&P 500 at 2040; +12.15% YTD – Dow Jones at 17,615; +8.3% YTD). Treasury yields have been trickling higher with the 10 Year yield at 2.36%. On the back of the above growth/policy outlooks, the USD DXY Index made a four year high (88). On the flip side, USD denominated precious metals such as gold made a four year low at $1140/oz. From an inflation perspective, we are approaching a cyclical and structural point in the U.S. labor market whereby wage inflation should gradually pick up. At the same time however, the aforementioned competitive currency devaluations and USD strength may keep global inflationary pressures in check i.e. due to low energy prices and a cheaper supply of global products. From a portfolio perspective, we remain selectively positioned in securities that offer a healthy mix of income generation and capital appreciation potential.

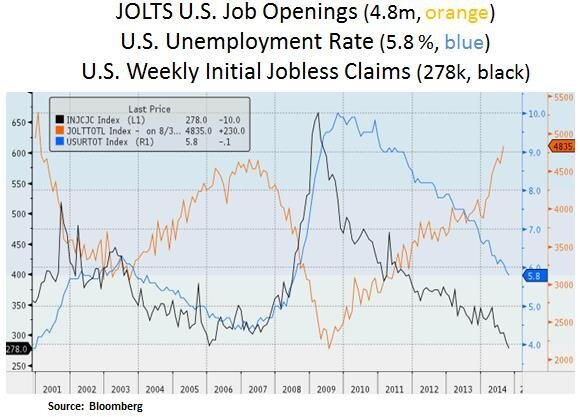

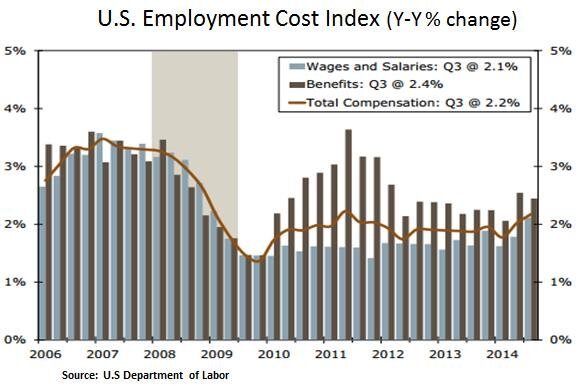

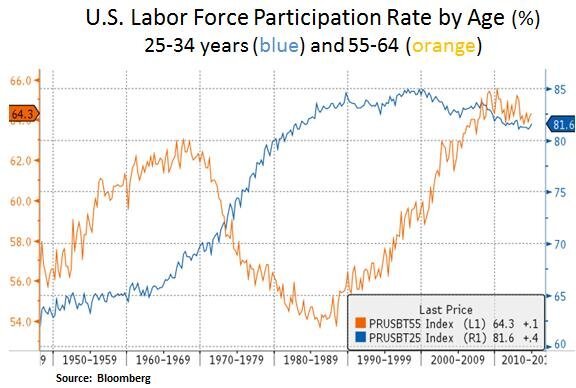

As we can see below, the U.S. unemployment rate (5.8%) has recently hit a level last seen in July 2008. Initial weekly jobless claims (278k) are reaching a level last seen in early 2000. Thus, cyclically, the U.S. labor market is at an advanced stage of its recovery. Demand for labor remains firm as indicated by the 4.8m job openings. Supply of skilled labor however is becoming an issue; met thus far by an increased supply of older skilled workers. Therefore, the Fed is likely to pay particular attention in 2015 to wage inflation data as it attempts to normalize its interest rate policy.

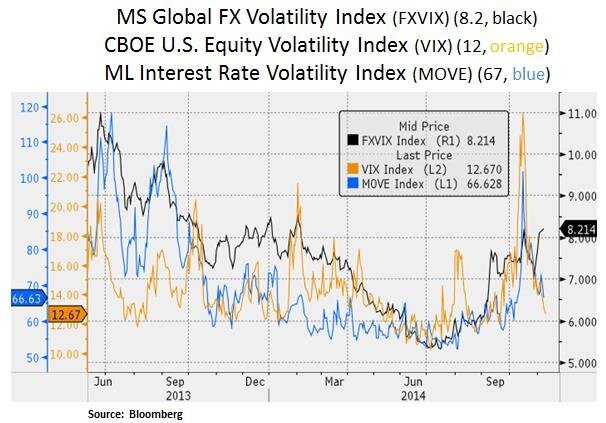

The question for global market participants is whether these competitive currency devaluations are promoting inflationary or deflationary price trends. For industries such as autos, due the ongoing yen depreciation, we are already seeing increasing pricing concerns for U.S. automakers such as Ford and GM – especially as they approach the later part in the current auto cycle. Moreover, export driven economies such as Germany and South Korea are likely to feel some competitive pressures or beggar-thy-neighbor policies i.e. strategies through which one country attempts to remedy its economic problems by means that tend to worsen the economic problems of other countries. We note below that FX volatility has been on the rise since the beginning of 2014.

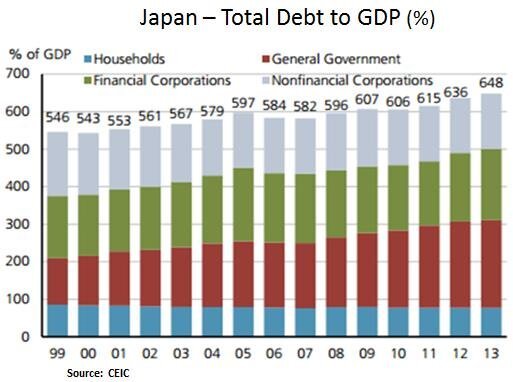

On Oct 31st ,the Bank of Japan (BoJ) unveiled its plan to increase its purchases of government debt from 50 trillion yen to 80 trillion yen per year, as well as extend the average duration of its JGB holdings to around 10 years. The BoJ currently holds 20% of the JGB market. At the same time, the Government Public Pension Fund (GPIF), the largest public pension fund in the world, announced that it will cut allocations of government debt in its portfolio (from 60% to 35%) and increase its holdings of domestic equities and foreign assets. In our view, these repetitive quantitative easing programs have a mixed impact on underlying GDP growth. Unfavorable demographics and an over-sized debt load are likely to continue weighing on the Yen; and thus be a source of global FX frictions.

Therefore, it’s plausible that foreign currency volatility may persist until a new and more sustainable global FX equilibrium is achieved. From a portfolio point of view, the above deflationary trends support demand for income generating securities. From an equity selection perspective, we prefer large-cap companies that have strong competitive advantages and sustainable pricing power.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.