Pre emptive policies are needed to support growth

Financial markets are reconciling medium-term and secular growth dynamics as the global economy is in transition. The outlook for developed market growth is largely dependent on the pace of fiscal and structural adjustments in the U.S. and Europe. In addition, orderly sovereign and banking deleveraging remains critical for the distressed economies of peripheral Europe. On the emerging market front, developing countries are likely to contribute >80% of 2012 global GDP growth. Easing inflation will allow additional monetary accommodation which will put in place the conditions for the next cyclical leg in the EM secular growth path. Despite all the political hurdles, we remain cautiously optimistic that localized crises will act as agents of change on the road to sustainable growth. Therefore, our investment positioning is likely to adapt according to strategic, tactical and valuation considerations.

Our current view is for moderate U.S. and global growth. The outlook is contingent on policy execution and we believe that healthy secular fundamentals in Emerging Markets will continue to drive global growth. The European economy is leveraged to EM growth and easing global inflation is key for Europe’s export markets. From a U.S. perspective, U.S. blue chip companies are likely to continue to benefit as EM economies seek to close the wealth and income gap with developed economies. These secular trends bode especially well for the U.S. technology, energy and industrial sectors.

One of the medium-term issues in the U.S. economy is insufficient investment spending. By and large, corporations have been accumulating cash with the intent to reward investors with share buybacks and dividend increases. As we highlighted in past articles, one of our current concerns is whether corporations will postpone investment and hiring decisions due to the 2013 fiscal uncertainty. As we can see below, current capital expenditure expectations appear guarded. Thus, lack of visibility during the election period may lead to subdued jobs growth. Therefore, we look forward to upcoming labor hiring data in order to assess the pace of the U.S. growth outlook for the second half of the year and into 2013. Lastly, we continue to monitor the health of state budgets; especially in California whereby tax revenue shortfalls have led to a jump in the state’s budget deficit from $9.2bn to ~ $16bn.

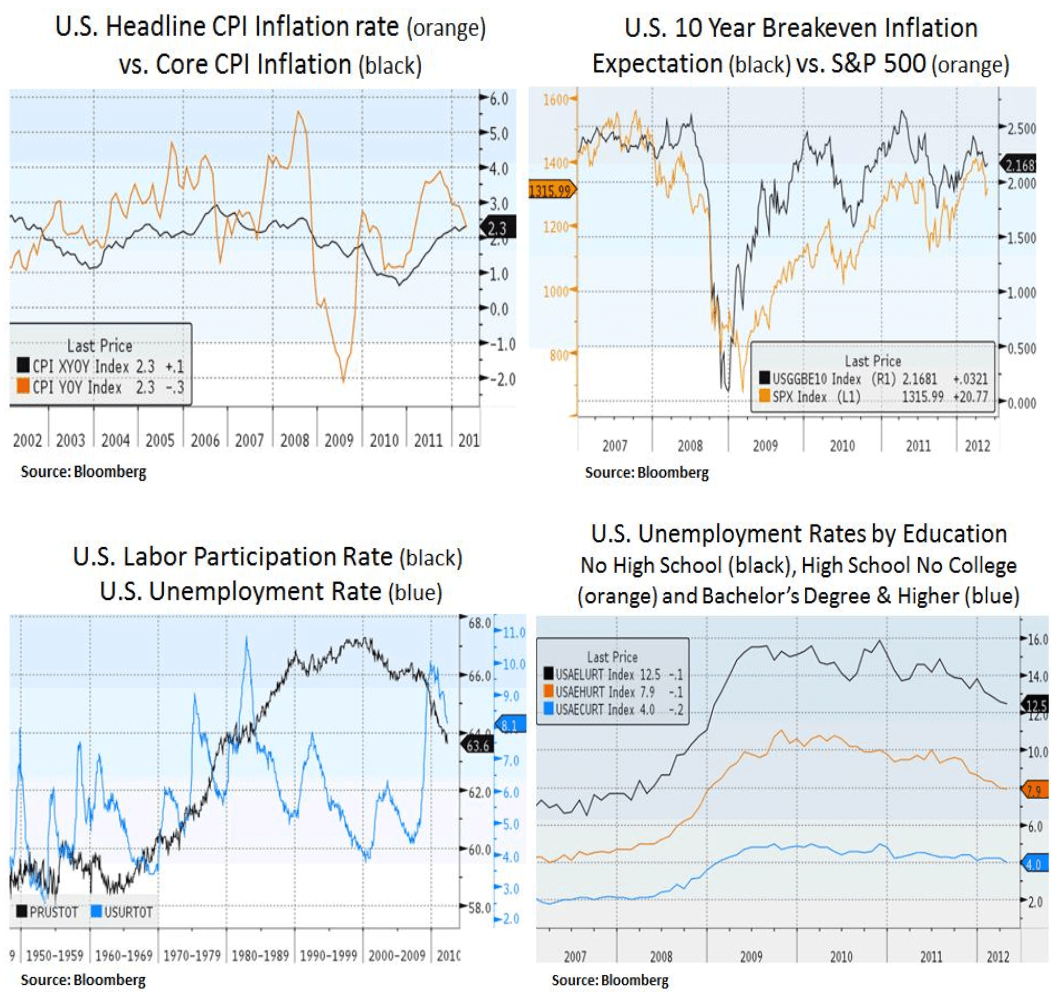

On the monetary front, easing headline inflation pressures will likely allow the Federal Reserve to continue its overall accommodative stance. We note though that recent Fed minutes indicated some uncertainty over the Fed’s assessment of core inflation (e.g. rent and labor cost inflation) and the overall amount of slack in the economy. U.S. corporations are seeking highly skilled labor and a skills mis-match is likely the underlying reason for the slow pace of improvement in the labor market; at a time where job openings continue their upward trend. Therefore, monetary accommodation is very supportive for economic growth and the housing recovery but not a panacea.

In Asia, recent commentary from China is indicating a renewed focus for growth stability. As residential and infrastructure investment is adjusting to more sustainable levels, the PBOC is set to resume its monetary accommodation in an attempt to stem a credit induced hard landing. This will be an incremental positive for U.S. industrial corporations with exposure to China.

In Europe, we are cautiously optimistic that a conservative government will eventually be formed in Greece as voters assess the very high costs of an exit from the Eurozone. Clearly, the political landscape in Europe is complex and given the high systemic stakes we expect at a minimum for European leaders to enact measures to stem the deposit flight out of the periphery. We also anticipate further bank recapitalizations for Spain where the declining housing market is weighing on its banking system. Moreover, despite recent suggestions for the issue of euro bonds, we believe the path of least resistance is for Germany to tolerate further Euro devaluation and somewhat higher inflation levels. We note that current 10 Year Bund breakeven inflation expectations are subdued. Thus, consequent medium-term dollar strength leaves us cautious with regards to the U.S. energy and materials sectors.

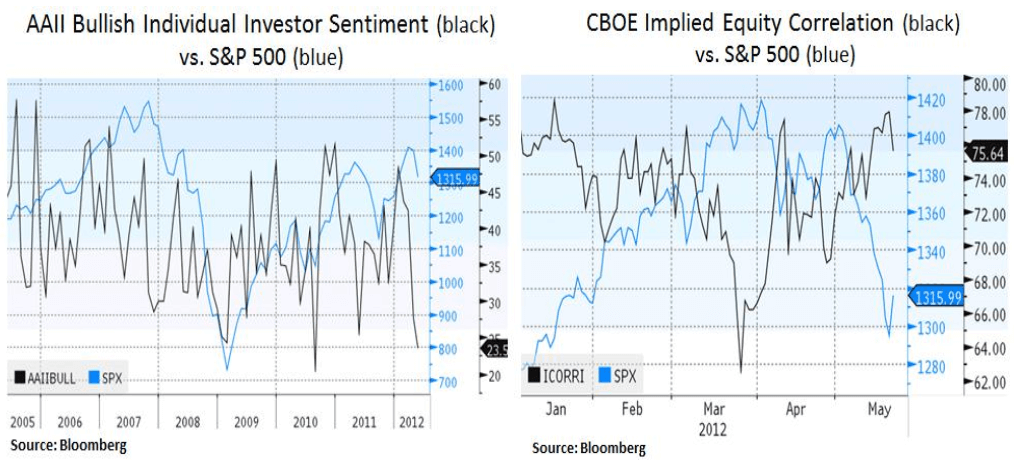

From an equity perspective, we note that the AAII (The American Association of Individual Investors) bullish investor sentiment is currently restrained and the implied correlation amongst equities is currently elevated after the recent correction. As we discussed above, policy execution is likely to act as a catalyst for a reversal in risk sentiment and a more conducive environment for stock-picking as correlation subsides.

In conclusion, we continue to assess the market’s ensemble of risks and opportunities. Our portfolio positioning remains tilted towards income oriented instruments (MBS, preferred shares) and dividend growing equity securities in defensive sectors such as healthcare, consumer staples, telecoms and utilities. Lastly, from a bottom-up perspective, we continue to look for favorable risk-reward opportunities that offer a margin of safety.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.