A View on U.S. Health Care and Sector Dynamics

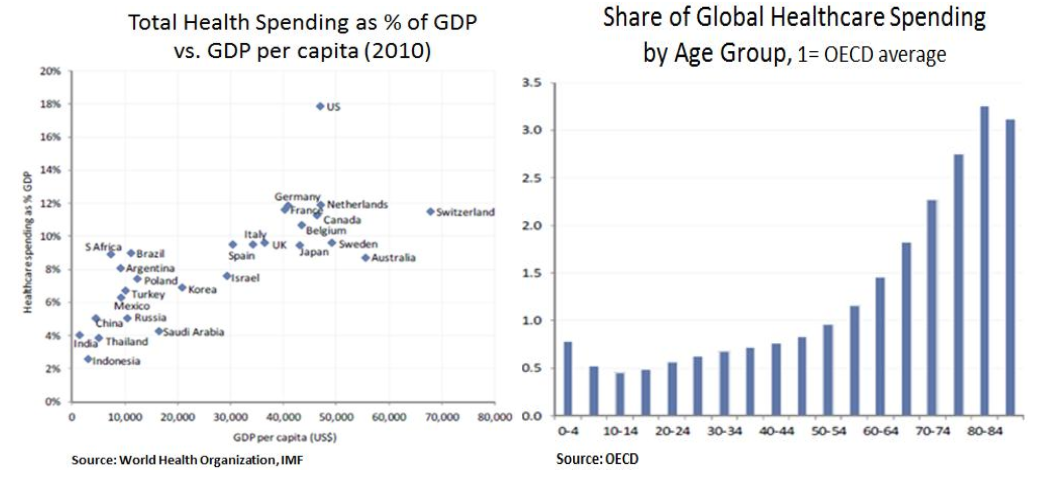

The Health Care sector is typically viewed as a defensive sector due to the non-cyclical nature of its earnings stream. In a zero-rate environment, investors can benefit from healthy dividend yields (3-4%) and stable dividend growth. From a secular perspective, the sector benefits from two main mega-trends i.e. emerging market demand as incomes expand and demographics change in developed markets as populations become older. At a global level, growth in healthcare spending has been ~4% in recent decades and developed markets account for 80% of total spending. Whilst emerging market demand is heating up, the main challenge for the sector is budgetary pressures in developed economies as most of healthcare is government funded and related spending is over 12% of GDP.

The UN expects the world population to grow by 2 billion over the next 30 years and the aging of the global population will result in faster demand for healthcare goods and services. Over 65s and over 80s typically cost 2.5x and 3x as much respectively as the average of OECD populations. Emerging markets offer attractive growth due to lower healthcare penetration and fewer budgetary constraints. Moreover, as growth economies develop, the pressure to provide a social safety net increases. In China for instance, the government laid out ambitious targets as part of its 12th Five Year Plan which include medical insurance coverage for the entire population, an essential drugs list and investment in healthcare infrastructure in both urban and rural areas.

As wealth and income levels increase, so do lifestyle and diet related illnesses. The World Health Statistics 2012 report showed that 33% of adults have high blood pressure, a condition that causes around half of all deaths from stroke and heart disease. The report also indicated that 10% have diabetes and 12% of the world’s population is considered obese. Obesity has doubled from 1980 to 2008 in all 194 member states, reaching the highest prevalence (26%) in the Americas. Non-communicable diseases currently cause almost 2/3 of all deaths worldwide and cardiovascular diseases are the most common cause of death, followed by cancers. Therefore, demand for healthcare is on a secular growth path and U.S. pharmaceutical companies in particular are likely to continue benefiting - especially due to their R&D competitive advantage.

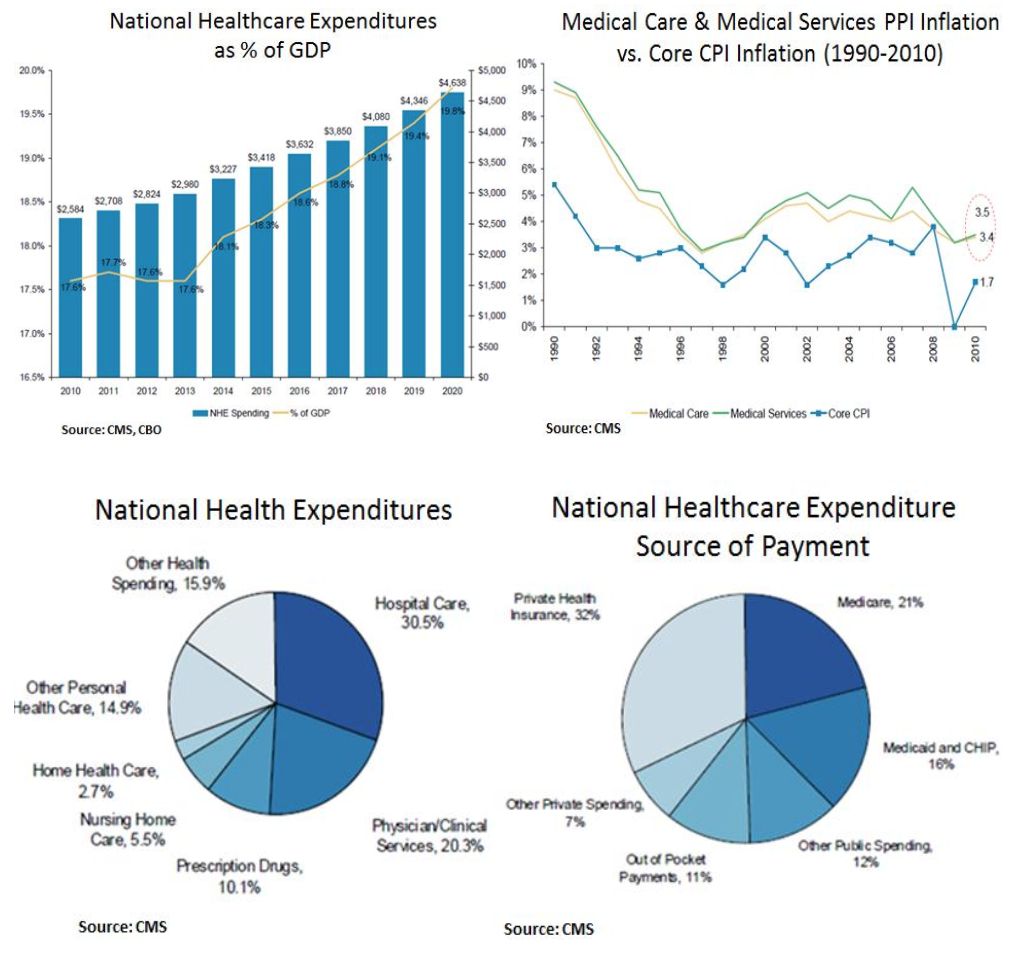

Within the U.S. healthcare sector, we are cautious on companies that are exposed to excessive expenditures due to the inefficient nature of the U.S. healthcare system. Total U.S. healthcare spending is projected to be approximately $2.8 trillion in 2012 (~18% of GDP), with the majority of this spend (31%) going towards hospitals and physicians (20%). According to CMS (Center of Medicare and Medicaid) projections, healthcare spending will grow at an average rate of 6.5% from now through 2020, increasing from $2.8 trillion in total spending in 2012 to $4.6 trillion in 2020. The largest payer is private health insurance, representing 32%. Government payers, however, also make up a large source of the funds - Medicare comprises 21% and Medicaid comprises 16%.

The incremental national health expenditure growth rate represents a cumulative $2.6 trillion of healthcare spending over the 2011-19 period. As of 2011, government health programs (federal and state/local) will finance the majority of health care spending (approximately 51%). Looking out to 2019, government spending will continue to crowd out private spending. An aging population, coverage expansion via Medicaid and incremental subsidization of portions of the private market will drive the government financed portion of national health expenditures up towards 54%. This rate of growth and the associated level of spending are not sustainable given budgetary constraints facing the federal government, state/local governments and private market consumers i.e. individuals and employers.

Slowing the growth rate of healthcare spending from the expected 6.8% eight-year CAGR (compound average growth rate) to a more manageable 4.8% CAGR (in line with Congressional Budget Office (CBO) forecasts for nominal GDP growth) requires removing nearly $2.6 trillion in aggregate expected healthcare spending over the next eight years. During the last debt ceiling congressional debate, the Budget Control Act in August 2011 mandated automatic budget cuts ($123bn over 10 years) for Medicare and Medicaid was exempted. Therefore, as the U.S. is scheduled to hit the debt ceiling in late 2012/early 2013 we expect that the next debt ceiling discussion will contain more meaningful cuts to Medicare and Medicaid spending.

Paradoxically, even as the healthcare share of U.S. GDP stands at 18% (the highest in the world) a seemingly high 50% share of Americans consume little or no healthcare. More critically, just 5% of patients account for 50% of expenditures. Government programs underpay for services and the private market actually subsidizes the mounting pressures on government healthcare spending. For decades, local market providers faced with inadequate reimbursement for healthcare costs from the government have looked to the commercial market to “cross-subsidize” these less profitable (and often unprofitable) government patients. Providers and suppliers offset pressures from inadequate government reimbursement by charging higher prices in the private market. This cost shift pressures commercial premium increases upward, challenging the affordability of health insurance for employers and individuals.

Over the last decade, premiums paid for employer-sponsored health insurance have increased at compound average growth rates of 7.4% for single plans and 7.9% for family plans. As employers have sought to control overall compensation costs, this acceleration in health benefit spending has directly weighed on growth in employees’ wages. In addition, in further attempting to offset this inflationary pressure on compensation costs, employers have shifted a greater burden of healthcare spending onto employees, with employees’ premium contributions increasing at a compound average growth rate of 10.7% for single plans and 9.5% for family plans, from 2000-10. Therefore, these cost pressures are an obstacle to labor market recovery and consumer spending.

The fundamental flaw of the U.S. healthcare system is that it is not a truly consumer centered system. According to the Centers for Medicare and Medicaid Services, roughly half of all health care spending in the U.S. is financed with government transfer payments. Counting private health insurance and other transfer schemes, only 12% of health care outlays are directly paid for by consumers. Therefore, radical structural reforms are needed in order to achieve proper allocation of resources and effective price discovery.

Investment Positioning:

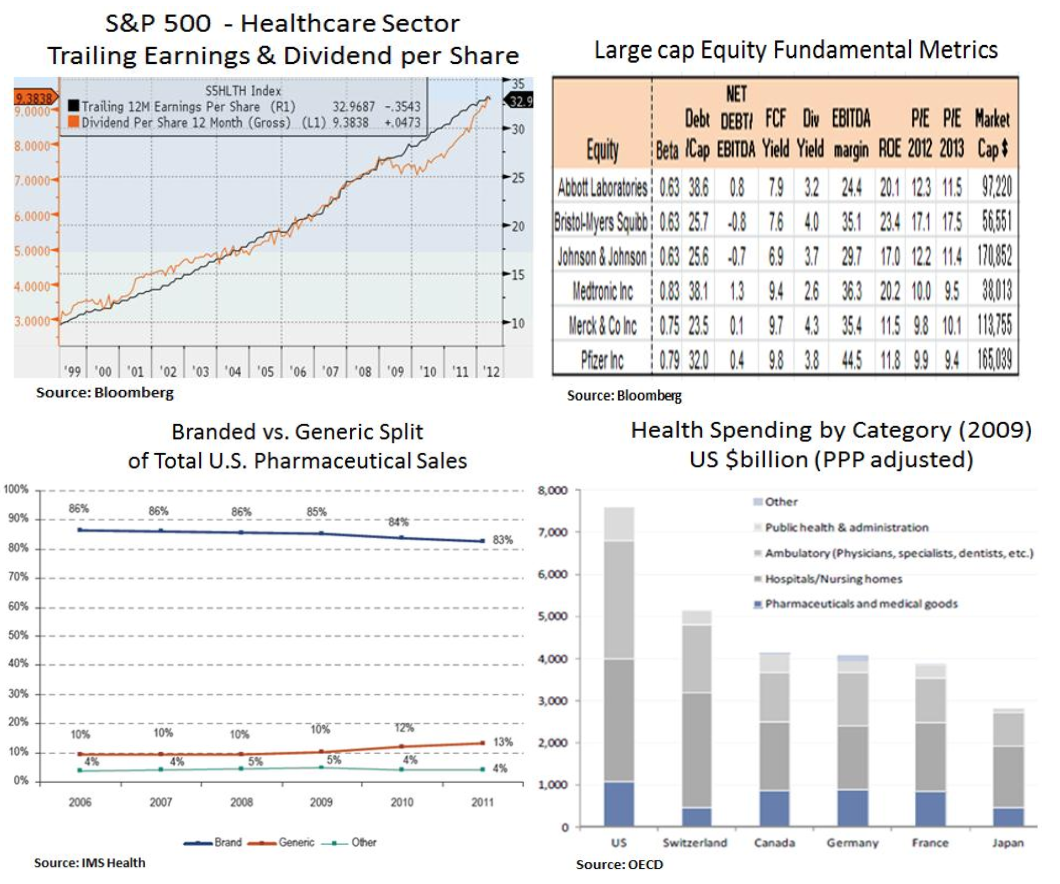

Given the above risks and opportunities, we focus on companies with strong free cash flow and balance sheets. Such features enable them to substantially fund management’s growth strategies internally and position them well to weather fluctuations in the operating environment or to pursue external growth opportunities. Within the U.S. healthcare sector we have a preference for large cap pharmaceuticals and other consistent dividend growers. Despite increasing generic competition, big pharmaceuticals still dominate drug sales and from a global big picture perspective drug expenditures do not strike us as excessive in relation to other healthcare expenditures.

We like the defensive attributes of the pharmaceuticals group and the differential growth in the pharmaceutical sector which is unusually predictable given long product cycles, known patent expiries and a general absence of economic cyclicality. Via M&A, companies such as Merck and Pfizer have substantially diversified their business portfolios into longer-tailed assets. Moreover, aggressive restructuring has kept EPS alive in the face of major patent expirations, while high yields, dividend hikes and share repurchases are supportive. Lastly, our view is for a gradual recovery in drug pipelines and incremental growth in emerging markets which will improve long-term EPS visibility. Therefore, from historically low valuations, P/E multiples have further room to expand e.g. as in the case of Bristol-Myers due to its premium new drug portfolio.

In conclusion, we look to the healthcare sector for its defensive attributes and as a source for consistent income generation. We like the sector’s secular growth trends and we are careful to avoid areas that may suffer from budget cuts as a result of inefficient and excessive government spending.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.