Public policy visibility will be critical in 2013

Financial markets witnessed in 2012 a fundamental backdrop that featured uneven global economic growth and a meaningful systemic risk reduction as a result of global central bank support. In a negative real rate environment investors sought investment returns across the broad risk asset spectrum. With significant 2013 monetary accommodation in the U.S., Japan and most likely Europe, we expect demand for income generating assets to remain strong in 2013. Thus, we continue to favor instruments such as Non Agency MBS, preferred shares, MLPs and large cap dividend paying equities. In an uncertain growth environment, we seek favorable risk-reward opportunities with a secular growth/late cycle tilt e.g. global industrials and healthcare equities. Moreover, we seek to be opportunistic in increasing our exposure to the technology sector which features excellent balance sheets, high free cash flow capacity and undemanding valuations. Lastly, from a macro point of view, we expect U.S. housing, the U.S. energy sector and easing global inflation pressures to be catalysts for economic growth.

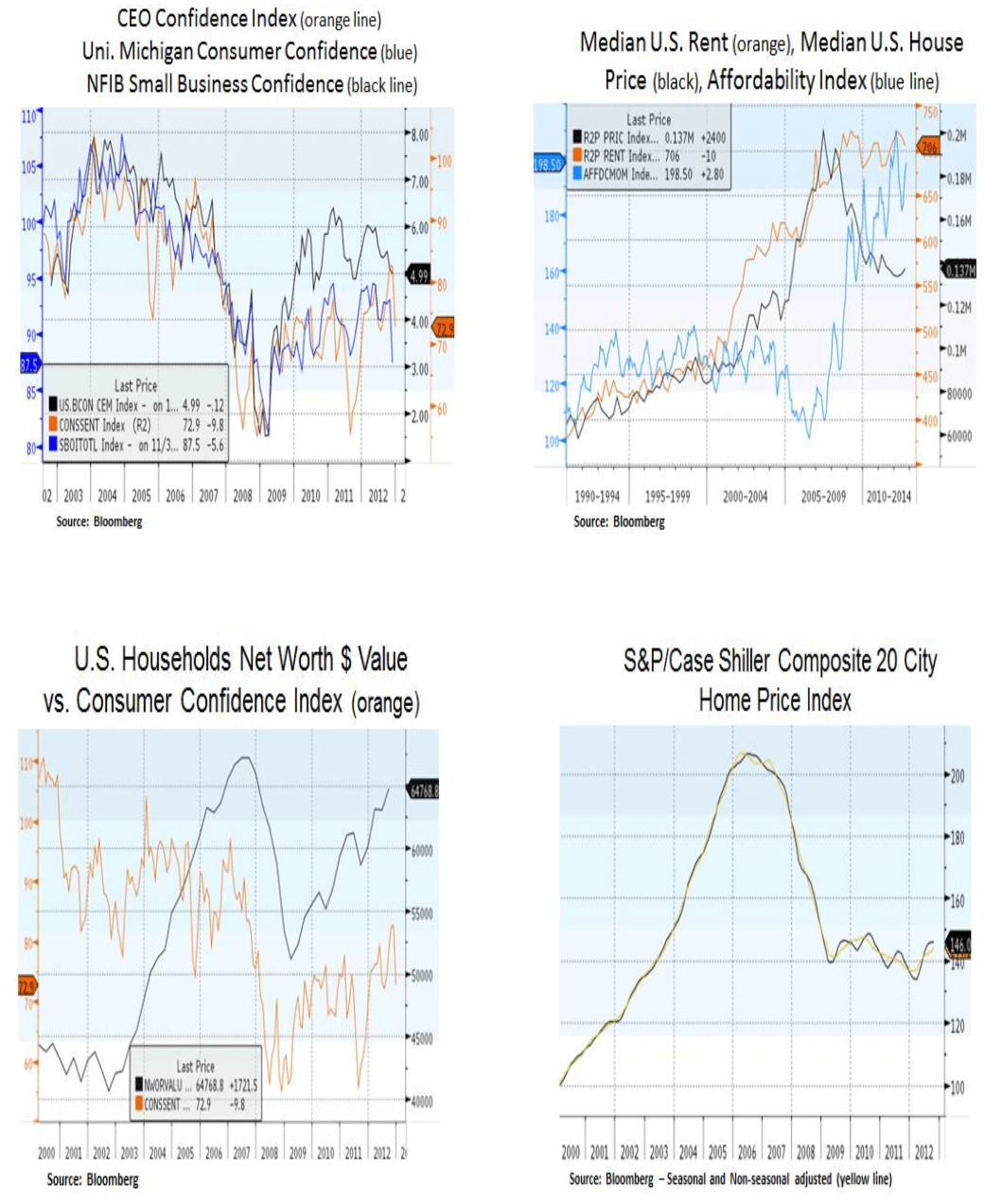

Political risk is the major risk factor to our broadly constructive world view. As the below confidence charts attest, public policy uncertainty has recently been weighing on both business and household animal spirits. In all likelihood, Congress will pass yet another short-term fiscal fix and there is a risk that a lack of sustainable fiscal solutions will keep an air of uncertainty in the business community. Thus far this year, household confidence has benefited from a wealth recovery as a result of housing price stabilization and an increase in the value of investment portfolios. An ongoing housing recovery in 2013 has the potential for a positive feedback loop. Increased housing prices can further help bank balance sheets, credit conditions and they can enable labor mobility i.e. as households with decreasing negative equity will be able to relocate.

Household balance sheet deleveraging continued in 2012 and as a result of mortgage defaults and lower interest rates, the monthly household debt burden has been materially reduced. Yet, the labor market remains anemic and income growth remains subdued. As we can see below, consumers have been drawing down on their savings and they have been increasing their credit card debt. A stronger labor market will likely promote a more sustainable household formation backdrop.

The recent trends in the labor market have been declining layoffs and steady growth in job openings. An improving housing market and increased labor mobility will likely help in filling these job vacancies. From a structural perspective, we highlight the declining labor participation rate since the early 2000s and the upcoming demographic challenge of retiring Baby Boomers. Moreover, it is important for global developed market leaders to find the right mix of entitlement spending and growth promoting measures that will deal with these demographic and fiscal challenges.

On a more positive note, we are encouraged by the recent stabilization in global growth and credit metrics. Improvement in European credit conditions in conjunction with a growth pick-up in China will likely benefit U.S. multi-nationals in the industrial and technology sectors. The missing piece to this constructive 2013 scenario is fiscal policy visibility in the U.S. The degree of fiscal consolidation and its subsequent impact on growth will likely dictate the pace of U.S. capital spending recovery.

With healthy trade and manufacturing inventory levels, we don’t expect a ‘surge’ in capital spending but at a minimum we expect some pick-up in durable good replacement as a result of an aging capital stock. In addition, we see scope for increased I.T. expenditures. Corporations such as IBM and EMC have shown notable order weakness in Q3 of this year. Yet, we see scope for a capital spending recovery as cash-rich companies seek to protect profit margins via investments in technology i.e. in order to achieve cost efficiencies and to improve their productivity. Moreover, as we discussed in recent articles, we see ample room for growth in the U.S. energy sector as the shale oil and gas revolution continues. Thus, we expect energy infrastructure demand to continue as U.S. oil production in particular is set to reach a new record in 2013. Therefore, we expect MLPs to benefit from incremental demand for pipelines and other mid-stream energy infrastructure.

In a negative real rate environment in most developed economies, we expect ongoing demand for income generating financial instruments in 2013. We maintain our balanced portfolio approach that favors visible income and cash flow generation via a set of fixed income and equity instruments. Moreover, we seek thematic exposure to late-cycle/secular growth investment opportunities. From a big picture perspective, we expect global fiscal constraints to be offset to a certain degree by further global monetary accommodation in 2013. Therefore, we look forward to a year whereby global growth finds some pillars of policy support which in turn offer renewed confidence to a cash-rich corporate sector.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.