The Fed Talks Tough

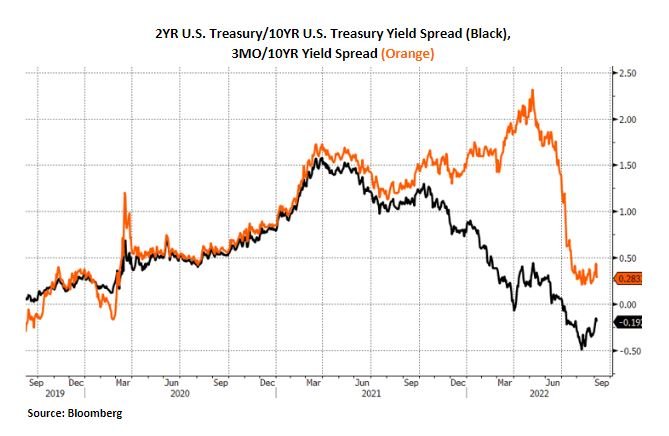

Equity markets have struggled as participants reposition following Fed Chair Jerome Powell’s hawkish comments at Jackson Hole where he reiterated the Fed’s “unconditional” objective to bring inflation back down to its 2% target, and that this goal will ultimately translate into economic pain. Powell also underscored that the Fed is going to maintain higher rates stating that “restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against premature loosening policy,” invoking lessons learned from the mistakes of the 1970’s. The yield curve inverted further after his speech as traders received the higher-for-longer message. Inflation remains significantly higher than the Fed wants, and last week’s employment report could embolden further aggressive tightening (non-farm payrolls were up 528k in July, unemployment fell to 3.5% and wage gains accelerated amid a persistent mismatch between labor demand and supply). The markets agree, with Fed Fund futures pointing to an 80% chance of a 75-basis point hike in September, extending the steepest interest-rate hiking cycle in a generation.

The Fed’s quantitative tightening program will ramp up this month, increasing from $47.5 billion to $95 billion per month. Some market participants are concerned this additional monetary tightening will have negative consequences on risk assets and the economy. The risks to the economic cycle are elevated. Cycles tend to end with policy tightening and inverted yield curves. Growth has been slowing across major economies, financial conditions have tightened meaningfully, and many believe the peak in inflation is behind us. The market is repricing for continued rate hikes from the Fed and other central banks, and the Fed continues to sound hawkish, talking down the potential for a pause or “pivot” to a more dovish stance. This amplifies the risk of a policy mistake if central banks overtighten. The Fed and other global central banks appear to be under tremendous political pressure to do whatever it takes to bring inflation down.

Robust labor income in the July personal income report is another reason for the Fed to stay committed to further rate hikes. Growth in wages and salaries was revised up in June, and the July report showed the fastest growth since February. Coupled with demand for labor showing no signs of slowing, the Fed will stay vigilant about the risk of a wage-price spiral. The Biden administration’s new student-loan forgiveness program could help further boost inflation in 2023. At a time that the Fed is trying to cool demand to bring down price gains, this new fiscal stimulus works in the opposing direction, and the benefits will be concentrated among households in the 40th-80th income percentiles.

On the currency front, the renewed move higher in Fed futures projections is supporting the USD. The Euro reached parity with the dollar for the first time in almost 20 years due to the divergence in energy costs after another disruption to the European gas market as Russia extended the shutdown of the Nord Stream pipeline. Diminished growth prospects in both Europe and China are likely to further reduce commodity prices and strengthen the dollar, helping to expedite the Fed’s disinflation process. This prolonged dollar strength has the potential to cause debt problems in the developing world and could weigh on risk assets more broadly.

The gap between breakevens and yields has narrowed notably, this will likely keep bond yields rangebound in the near term and could offer support to equity market valuations. The recent market jitters are reflective of concerns of an economic downturn in conjunction with restrictive monetary policy. This Fed aggression looks set to continue and many are looking for profit disappointments to be the next shoe to drop. How much of this is already reflected in asset prices remains the key question.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request