U.S. Cyclical Inflation Expectations Peaking

2018 has been a year of policy divergence between the U.S. and other major economic areas. Rising U.S. interest rates drove U.S. Treasury yields and the trade weighted U.S. dollar higher. The latter has triggered weaker emerging market (EM) currencies, higher EM funding costs and a big gap in asset performance vs. U.S. equities. On the back of the U.S. tax reform, record share buybacks and robust earnings growth; U.S. equities have been the clear winner in 2018. As of late, the new trade deal (USMCA) between U.S., Canada and Mexico is helping to ease some of the trade war concerns. China remains the key trade uncertainty as the U.S. tariff rate is set to rise to 25% at the start of next year from 10%. To some degree, China is attempting to offset some of the tariff headwind by a combination of monetary and fiscal policy. As the U.S. mid-term elections are approaching (Nov 6th), we would not rule out a renewed negotiating framework between U.S. and China that would ease global trade tensions. On the European front, Italy came back into the spotlight last week as the Italian government unveiled its budget plan - it would be looking for a deficit at 2.4% of GDP each year until 2021. Italian 10-year yields have risen by 1.3% in the past year to 3.44%. The EU commission will start a review and a protracted negotiation of the Italian budget on Oct 15th.

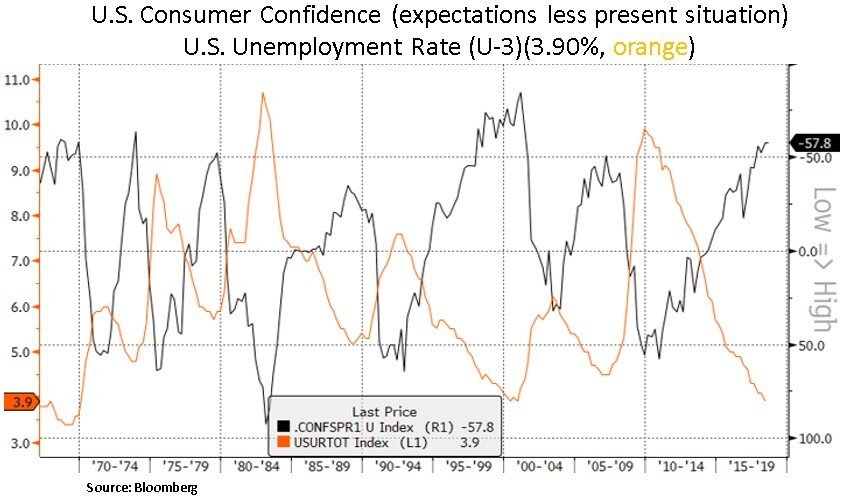

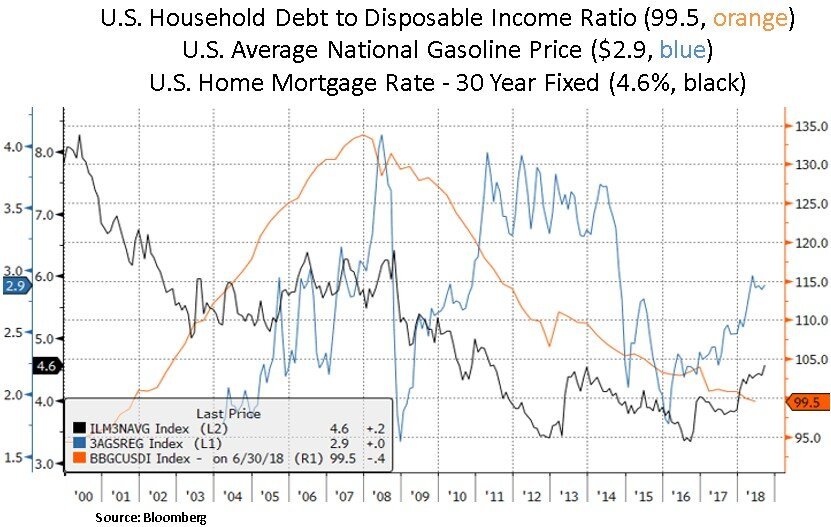

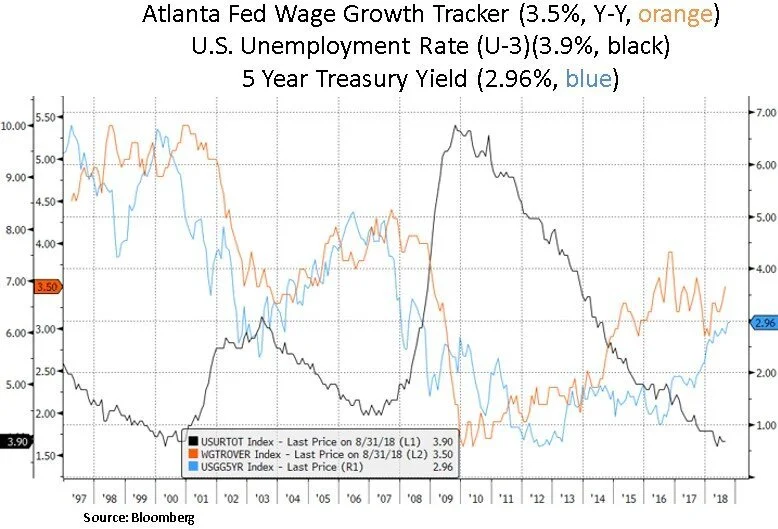

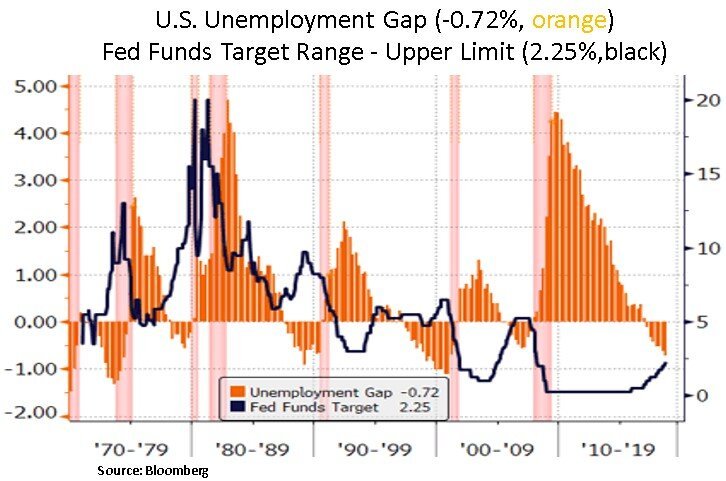

On the U.S. economic side, we are seeing some classic late cycle indications such as peaking consumer confidence, a surge in energy/gasoline prices, rising wages and an increase in borrowing costs as the Fed has stayed the course in its tightening path. The latter is likely the culprit behind recent deceleration in U.S. housing permits and other big-ticket purchases such as autos. There has also been an increase in banks reporting tightening credit card standards. On the manufacturing side, new orders and prices are easing. U.S. cyclical inflation is likely peaking as credit conditions lead economic growth and the latter leads inflation (which tends to be a lagging indicator).

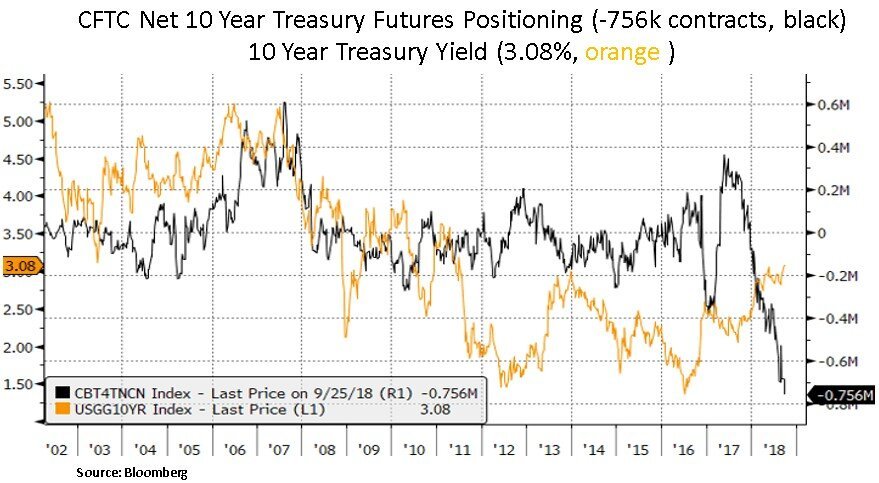

In terms of market positioning, speculative short Treasury futures positioning has increased further. Apart from a very tight U.S. labor market, rising oil prices have also been a major contributor to rising inflation expectations. The Trump administration set a deadline of Nov. 4th for oil buyers to stop purchasing Iranian crude. There is a market expectation that OPEC will struggle to cover a decline in exports from Iran. As we can see below, Iranian oil exports have already seen a dramatic decline. Due to OPEC’s constrained spare capacity, we cannot rule out an overshoot in oil prices. However, those overshoots do not tend to be sustainable as they curb demand; particularly in emerging markets, which at this juncture are dealing with weak currencies.

Additional reasons for the bearish bond positioning include the widening U.S. budget deficit (i.e. higher issuance of debt) and the ramping up of the Fed’s balance sheet contraction i.e. to 50 billion/month in Q4 2018. The balance of Treasuries and MBS will be reduced by up to $420 billion in 2018 and an additional $600 billion in 2019 (and every year going forward until the Fed decides that the balance sheet has been "normalized" enough). At some point however, the Fed’s tightening will likely cause a U.S. growth deceleration and a consequent paring back in long-term inflation expectations. Additional Fed interest rate hikes and a shrinking balance sheet are also likely to cause further weakness in Emerging markets. Through 2025, emerging market governments and companies face $2.7 trillion in USD-denominated bonds and loans that will come due and must be paid off or refinanced. Therefore, as global liquidity conditions continue to deteriorate, we expect inflation expectations to be gradually pared back. From our portfolio perspective, a rising Treasury yield backdrop is creating opportunities in income generating instruments; which will likely stay in high demand as Baby Boomers retire.

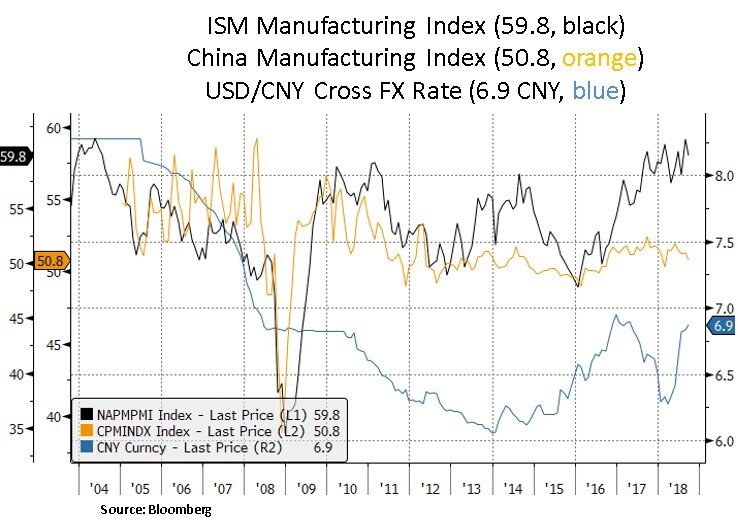

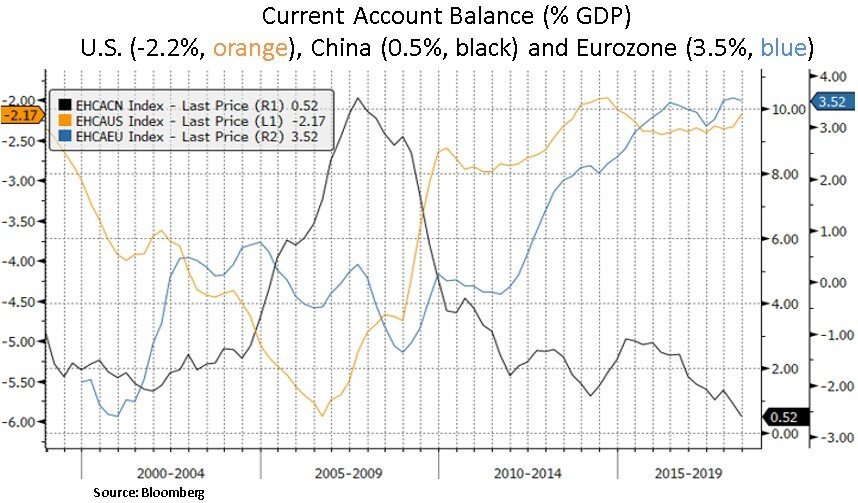

Lastly, we highlight below the growth divergence between U.S. and Chinese manufacturing. Most likely, if the global economy continues to decelerate, deflationary concerns may increase i.e. if China is forced to devalue its currency. We note below that China’s current account has been decelerating. In contrast, the U.S. and Eurozone current accounts have improved in recent years. Therefore, as we look into 2019 and beyond, we see more risk to the U.S. growth and long-term inflation outlook. As such, we see uncertainty to the Fed’s interest rate path in 2019.

In conclusion, we are navigating a backdrop of rising global borrowing costs and maturing cyclical inflation. As global labor markets tighten, and Central Banks are forced to withdraw monetary accommodation, we see more risks for global growth and inflation expectations. From a capital allocation perspective, we seek to be opportunistic as potential policy errors cause asset price volatility in both equity and fixed income spectrums. We continue to focus on quality companies with strong balance sheets and strong competitive advantages.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.