U.S. Earnings Revision Cycle is Likely Not Complete

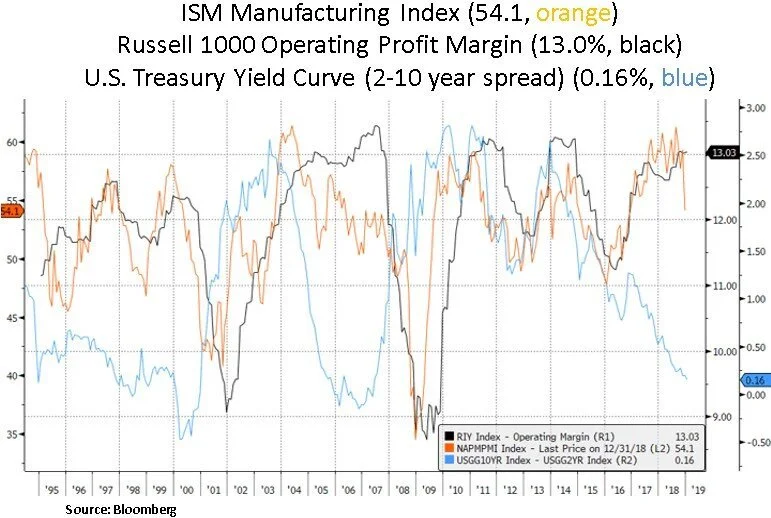

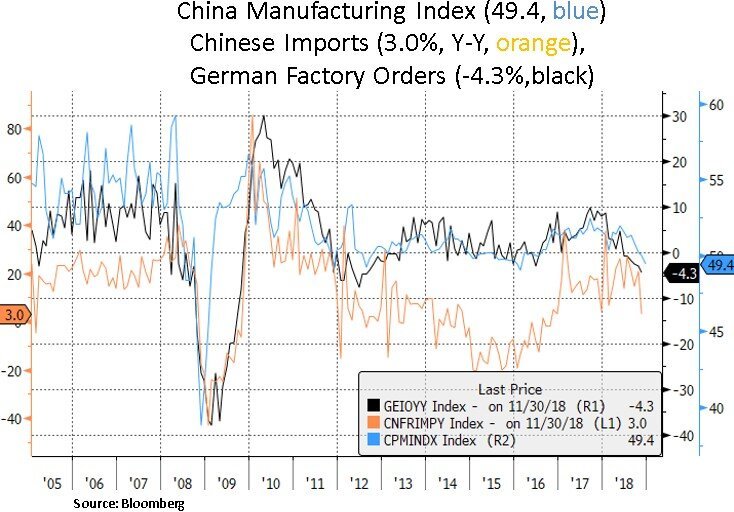

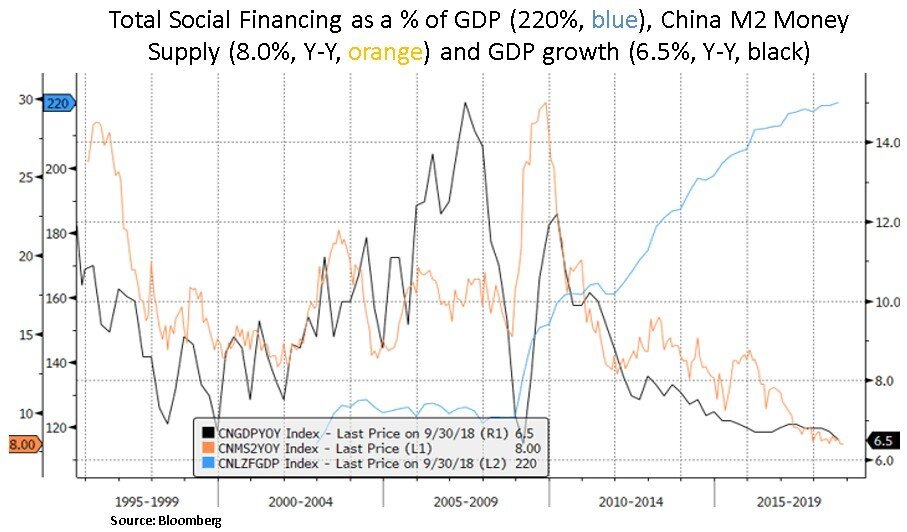

Happy New Year. After a turbulent 2018 in global equities (MSCI World -10%) investors are entering 2019 with ongoing global growth concerns. Leading indicators such as U.S/China/German manufacturing orders have deteriorated rather abruptly in the past week. To a large degree, these data are a confirmation of last year’s global slowdown concerns; with issues arising in global trade and Chinese domestic growth. The U.S. Treasury yield curve continues to be flattish (2-10 spread) and certain segments of the front-end of the curve are still narrowly inverted i.e. 12M-2Y, 2-5Y spreads. From a capital flow perspective, the month of December saw record outflows i.e. mutual funds invested in equity and bonds lost a record $152 billion, according to TrimTabs Investment Research. On the positive side, we are now starting to see a global policy shift e.g. the Federal Reserve’s tone has turned more dovish and monetary & fiscal easing measures are increasing in China. From our perspective, after de-risking portfolio moves in autumn of 2018, the volatility surge recently enabled us to start increasing our equity exposure in our favorite investment themes. We remain in a good position to deploy further capital selectively in 2019.

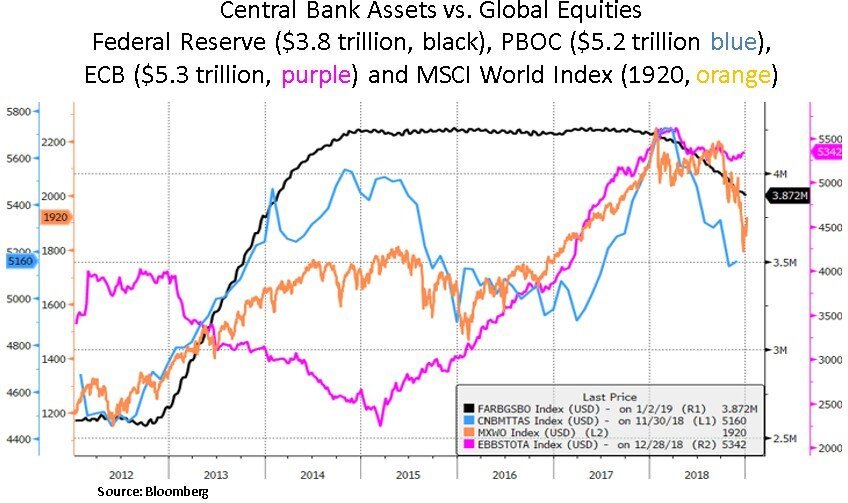

Given the current investor sentiment and positioning, there is some scope for growth expectations to recover; assuming a comprehensive U.S.-China trade deal and a meaningful reduction in policy error risk by Central Banks. In our view, a double-barreled tightening stance by the Federal Reserve (rate hikes and balance sheet reduction) took a toll on U.S. and global financial conditions. Last Friday, Federal Reserve Chairman Powell specifically addressed risks that may be emanating from the Fed’s balance sheet reduction and signaled a more dovish stance.

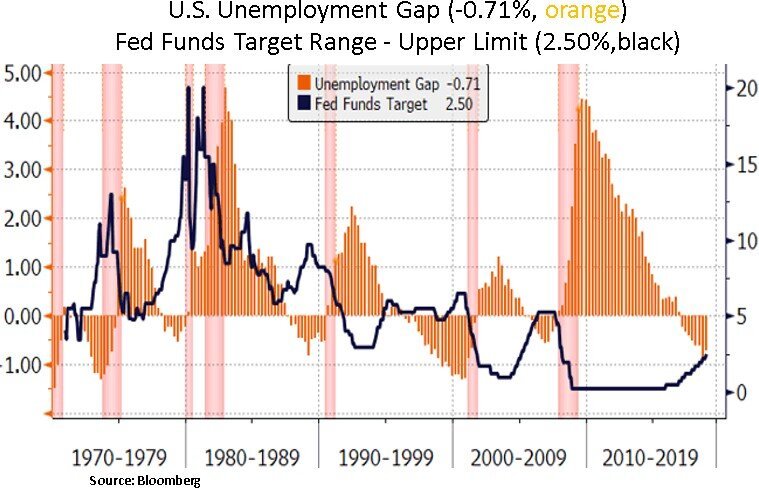

From a fundamental perspective, the question for us is whether consensus earnings estimates have recalibrated enough. Looking at the above charts, we see some more risk to U.S. earnings estimates. Certain corporations such as Apple and Delta have brought down their revenue/earnings expectations. We suspect the upcoming earnings season starting next week will see more management guidance changes. These will likely impact sell-side earnings/revenue expectations that are currently still on the high side for 2019 and beyond. Given cyclical cost pressures (e.g. wages and wider credit spreads) it’s unlikely that corporate margins can meet consensus high margin expectations over the next 12-24 months. Therefore, the U.S. earnings revision cycle is likely not complete. We look forward to more opportunities at the stock level as at some point earnings revisions will likely trough and thus set up good risk-reward opportunities in subsequent quarters.

In our view, the Fed and other policymakers will have to be very mindful of the global credit and liquidity backdrop. As we can see below, the global economy and financial markets have benefited from aggressive expansion in Central Bank balance sheets and a material credit growth in China. There is a strong case for pinning global interest rates at low levels, as excessive monetary tightening can undermine the current credit and profit cycles. U.S. corporate debt will likely continue to be a market focal point, as non-financial debt as a % of GDP is at historic highs and credit quality has been deteriorating. From our portfolio perspective at the equity and corporate debt level, as the credit cycle is maturing, we continue to focus on large-cap corporations that have ample balance sheet and cash flow capacity.

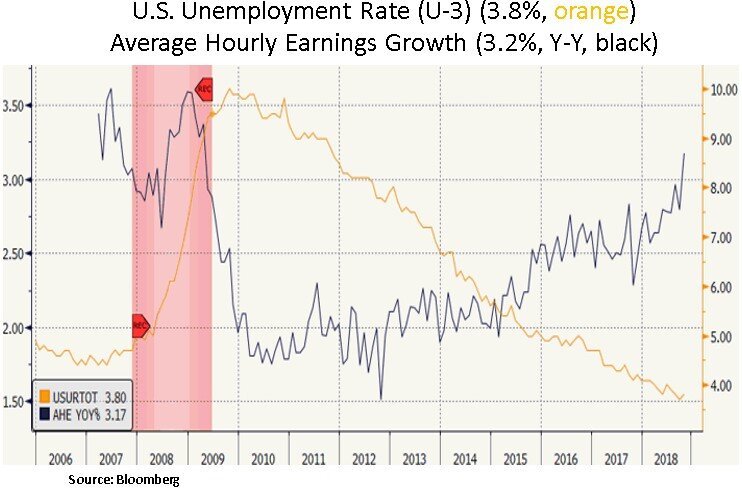

Lastly, we note that the U.S. labor market continues to mature, and wage inflation is firming higher. The recent non-farm payroll report surprised materially on the upside and labor force participation picked up. On the positive side, we suspect that a skills mis-match and higher wages are enticing people to enter the labor force but on the negative side we note that wage inflation can weigh on labor intensive industry margins. In terms of our portfolio exposure, we are leaning on higher margin industries e.g. tech and healthcare companies.

In conclusion, we are entering 2019 in a good portfolio position to deploy capital selectively. From a contrarian perspective, last year’s volatility surge and investor de-risking is unmasking security specific opportunities. We continue to prefer large-cap equities with strong credit quality and defensible earnings profiles. As the current earnings revision cycle is still in progress, we look forward to further stock picking and capital allocation opportunities throughout the year.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.