Markets Look Past Shutdown in Washington

The month of October was a noteworthy one for investors. The month began with the U.S. government shutting down for the first time since January 2019. Equities navigated a choppy landscape but remained resilient, reflecting a mix of optimism from continued strength from corporate earnings reports, and caution due to softening economic data. The divergence in the year-to-date performance between the market cap weighted S&P 500 and the equal-weighted S&P 500 index grew markedly due to the unrelenting exuberance into all things Artificial Intelligence. Bond yields mostly declined across the curve in October, signaling some potential concerns about growth.

While the release of much of the U.S. government economic data was impacted by the shutdown, some of the private indicators released painted a picture of decelerating momentum. For example, Challenger Job Cuts for October far exceeded forecasts; and ADP private payrolls added fell short of expectations, suggesting a softening labor market. Also, the preliminary Michigan Consumer Sentiment Index for November sank to 50.3, well below the 53.2 consensus.

The Federal Reserve implemented its second consecutive rate cut on October 29th, lowering the policy rate range by 0.25% to 3.75%-4.00%. They also announced they will stop shrinking the size of their $6.6 trillion balance sheet (Quantitative Tightening) on December 1st by reinvesting coupon payments or maturities from existing holdings, aiming to maintain liquidity and stability in short-term markets. The markets widely expected the move, but Fed Chair Jerome Powell did not commit to another cut in December stating that “a further reduction in the policy rate at the December meeting is not a foregone conclusion- far from it. Policy is not on a preset course.” Notably, there were opposing dissents on the Federal Reserve Board for the first time since 2019, with Governor Miran wanting a half-point rate cut while Kansas City Fed President Schmid voted to hold rates steady. The ongoing government shutdown (now the longest in history) may force the Fed to pause due to a lack of reliable data. In his press conference Chair Powell asked “what do you do if you’re driving in a fog? You slow down.” From here, investors will be watching any available income labor and inflation data closely, as the Fed has made clear that future policy decisions will depend on whether recent signs of softer employment persist. With the Treasury set to auction a combined $67 billion in 10-year and 30-year notes and bonds this week, it will be telling of overall bond market sentiment.

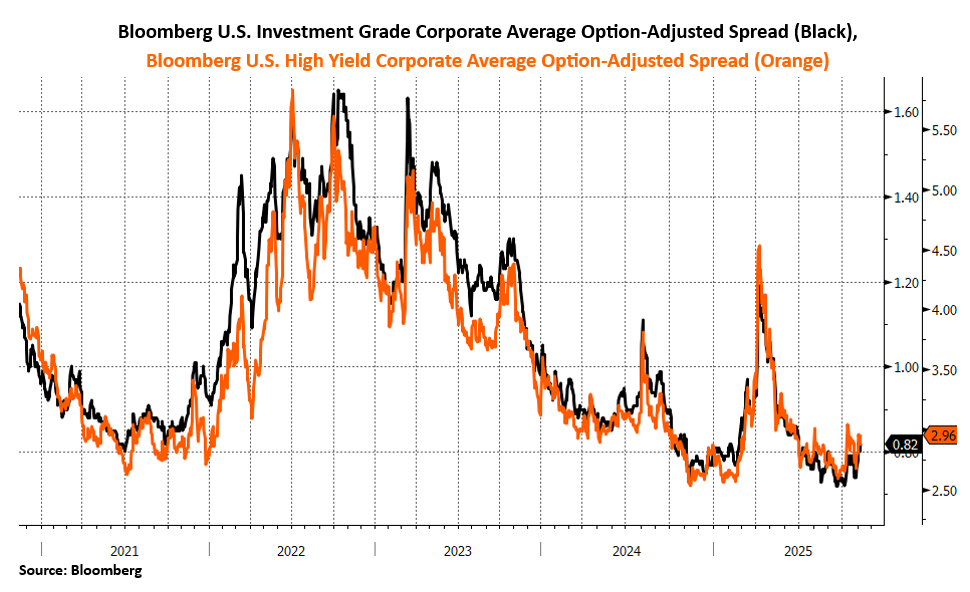

We have witnessed early signs of stress in the private credit market, where an immense amount of capital has flowed in recent years to chase higher yields. Private credit refers to lending by non-bank institutions, such as hedge funds, private equity firms, and asset managers, to companies that might otherwise borrow from traditional banks. In recent years, the U.S. private credit market has experienced explosive growth, driven in large part by banks’ retreat from riskier lending due to post-2008 regulations, and investor demand for higher yields in a low-rate environment. Notably, the bankruptcy filings and subsequent fraud allegations of sub-prime auto lender Tricolor Holdings and auto parts supplier First Brands sent shockwaves through the market, ultimately forcing several banks to write down loans as a result. Interestingly, this has not had a material impact on public debt markets as we are not seeing a meaningful widening of credit spreads. Credit spreads are the difference in yield between corporate bonds and Treasury bonds of comparable maturities. Despite the cracks that have emerged within private credit, it is surprising that public debt market spreads remain near multi-year lows. While it is highly likely that these events are idiosyncratic rather than systemic, it is our view that investors are not being adequately compensated for the risk. In light of this, we have sold our preferred stock holdings firm-wide as a way of reducing credit and duration exposure. With markets lingering a couple percentage points from their all-time high, we remain cautious heading into year-end.

Ryan Babeuf, CFA

Market Strategist

Ryan.Babeuf@EdgeWealth.com

Past performance does not guarantee future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product directly or indirectly referenced will be profitable, equal any corresponding indicated historical performance level, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. This content does not serve as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. If you have any questions about the applicability of any content to your individual situation, we encourage you to consult with the professional advisor of your choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request or by selecting “Part 2 Brochures” here.