Central Bank execution entering a higher level of complexity

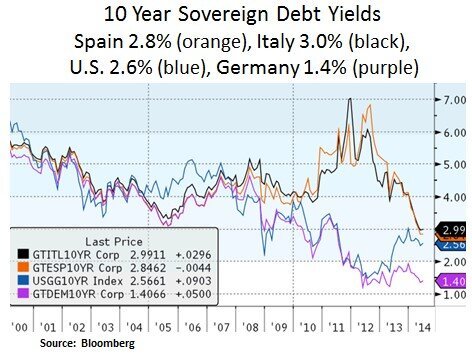

Financial markets are anticipating ECB easing measures on Thursday, in an attempt to boost Eurozone GDP growth and stem deflation concerns. European equity and debt markets have been beneficiaries of substantial capital flows in anticipation of an eventual economic recovery. However, in contrast to rising asset prices, GDP growth and inflation readings remain anemic. After promising action in recent meetings, the ECB is now under pressure to take a variety of traditional and unconventional measures; in order to boost credit creation across the Eurozone. In our view, the year-to-date rally in European and U.S. sovereign debt markets has been the combination of fundamental concerns (low growth & inflation) and technical factors such as reduced issuance of sovereign debt. Market positioning has been equally important, as certain participants were expecting a rising yield backdrop. From our investment perspective, we continue to favor a healthy balance of income generation and capital allocation in sectors/securities that offer value and cash flow visibility. In U.S. equities, with the S&P 500 at its all-time highs (1922), we continue to be selective with a preference for defensive/secular growth themes.

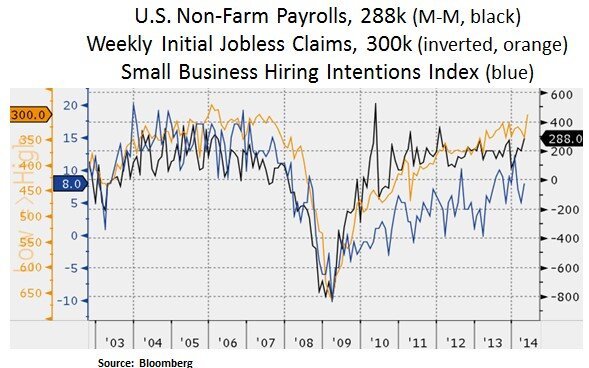

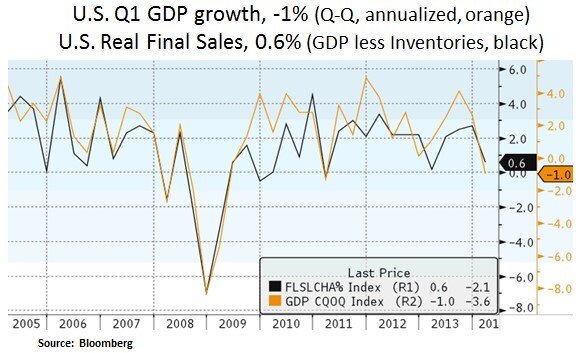

After a weak start for U.S. GDP growth in 2014 (-1%), the market is focused on incoming cyclical data. The monthly employment report on Friday is in focus this week. It will give investors further readings on the health of the economy and the labor market. One leading labor indicator is the weekly initial jobless claims which continue to show cyclical improvement. Thus, the Fed is likely to continue on the tapering path for its asset purchase program.

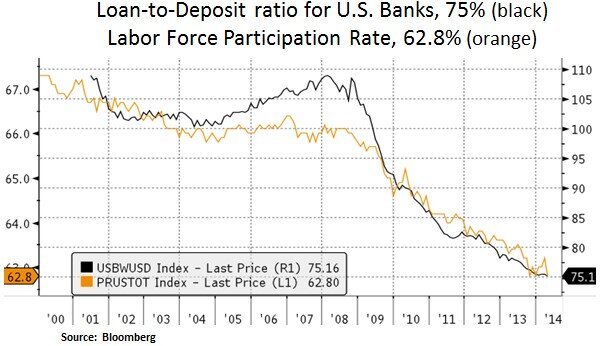

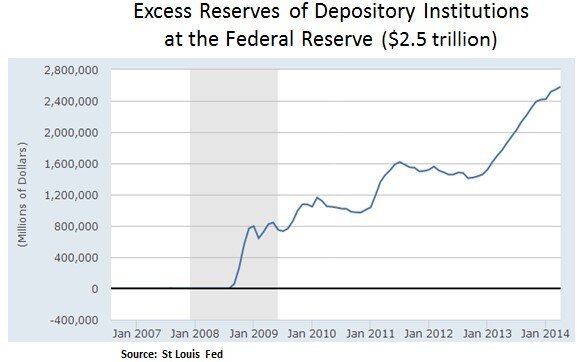

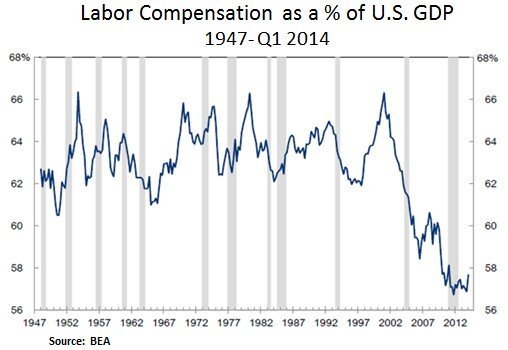

In our view, the Fed is approaching an important milestone in its monetary policy. Apart from normalizing the size of its own balance sheet, the Fed has to deal with a built-up of excess reserves in the banking system. As households repair their balance sheets and as the labor force continues to recover, one would expect a gradual improvement in credit demand. The Fed’s challenge is to prevent any inflationary pressures as demand for bank lending picks up; especially in the context of a fractional reserve system (e.g. as $10 of deposits can be converted to $100 of bank credit). Draining liquidity from the system can be achieved either by paying higher interest on these excess reserves (currently at 0.25%) or by using tools such as reverse repos (in which the Fed lends its securities to financial institutions). Therefore, normalization of Fed policy is not simply about a traditional interest rate hike cycle. The Fed has to manage liquidity and credit creation potential in the banking system, particularly as labor costs are still in check.

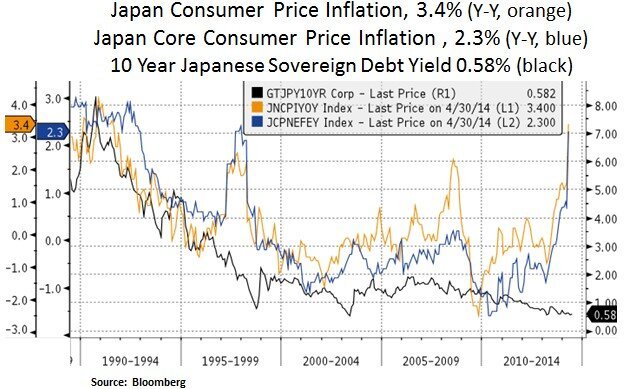

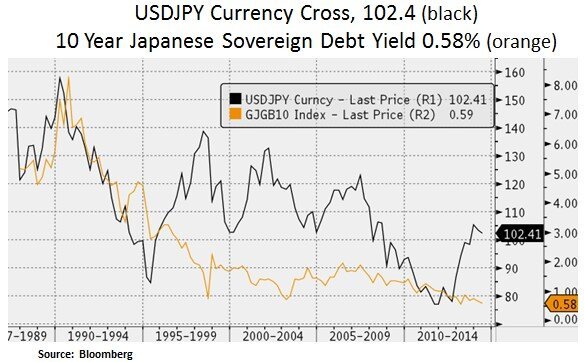

Lastly, the Bank of Japan has perhaps one of the most challenging tasks of all Central Banks. With a Japanese debt/GDP balance of 240%, the BoJ has the formidable challenge of suppressing sovereign debt costs. Currency devaluation has been beneficial to its corporate sector but elevated energy costs have led to a jump in inflation. Thus, the BOJ now finds itself in a catch 22 situation i.e. if it continues to expand its balance sheet, currency devaluation may weigh further on consumers. We see a risk of JGB yields gradually rising if the BOJ takes a pause in its balance sheet expansion. Thus, we see Japan (and China as discussed in past articles) as sources of growth instability in Asia.

In conclusion, global growth and pricing stability remain dependent on timely policy execution. From our investment perspective, we remain positioned in fixed income and equity instruments that offer steady income generation and visible cash flow. We remain opportunistic in deploying incremental capital as value opportunities arise.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.