Increasing expectations for further global policy intervention

Financial markets are currently reconciling an environment that features soft global GDP growth (~3.5%), low developed market sovereign bond yields and fairly muted inflation expectations. Five years into the economic recovery, investors have witnessed material asset price gains (e.g. U.S equities and housing) and below trend GDP and inflation growth (especially in developed markets). In our view, global debt deleveraging and demographic headwinds are likely to weigh on global growth and the pressure remains on policymakers to continue supporting asset prices and broader price stability i.e. avoid a deflationary environment. From an investment perspective, we see robust secular demand for income generating instruments. A back-up in Treasury yields will likely present a further opportunity in quasi fixed income instruments (e.g. utilities, telecoms, preferred shares, MLPs, REITS). Moreover, industries and securities with secular growth dynamics such as healthcare and technology are also likely to stay in demand. At the right entry points, we also see opportunity in energy infrastructure themes with a focus on North America energy and global growth in unconventional oil & gas. Lastly, as we approach the mid-point of the current business cycle, we also favor selective late-cycle industrials with healthier end-markets such as commercial aerospace.

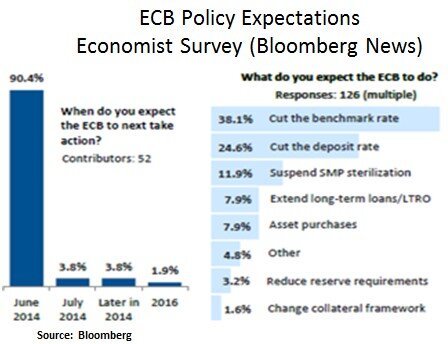

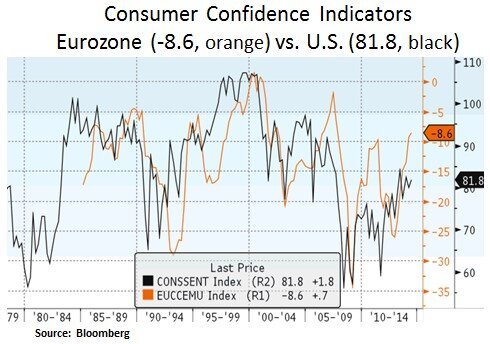

In terms of the next policy intervention episode, the market currently expects the ECB to reduce all of its key rates in June, including the rate it pays on overnight bank deposits at the ECB, which is currently zero. A negative deposit rate is likely to force banks to lend out excess reserves. Consumer prices in April grew at only 0.7% versus one year earlier. A long period of very low inflation is an issue, as it could dis-anchor long-term inflation expectations. The Eurozone GDP grew 0.8%, on an annualized basis, during the first quarter.

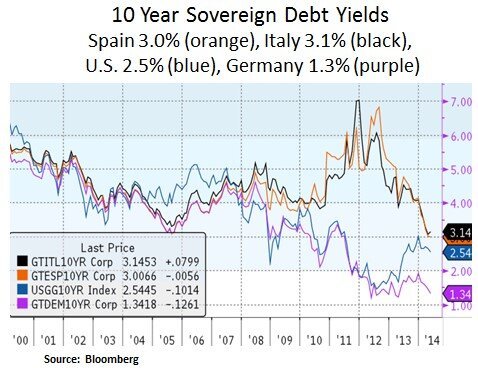

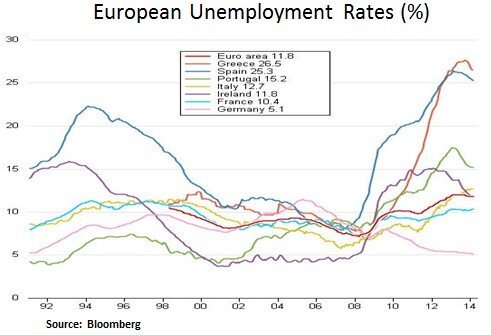

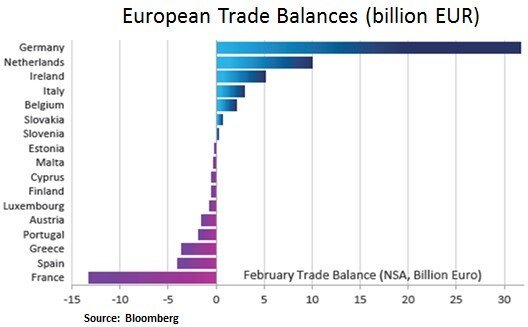

As we can see above, the European sovereign bond markets seem to have priced in the low growth/inflation backdrop and a potential asset purchase program. The ECB’s balance sheet has certainly lagged the Fed’s balance sheet expansion. It remains to be seen how aggressive the ECB will be in its signaled June action. In our view, the chance shouldn’t be missed in boosting consumer confidence further. Especially as Q1 GDP came in at a lackluster pace (0.8% annualized), led by Germany (3.3%). European unemployment rates may have peaked and as European banks continue their lengthy repairing process, we see pent-up demand potential. In addition, despite competitive divergences, a positive Eurozone current account balance is likely to continue to attract capital flows, as long as policy reform and execution stay on track.

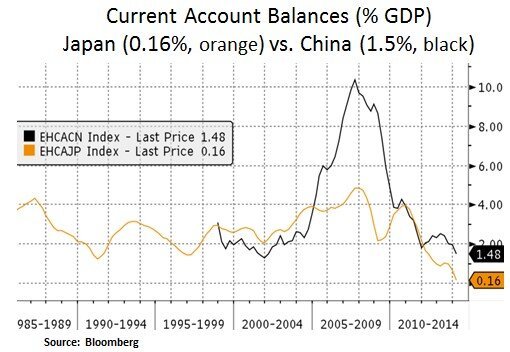

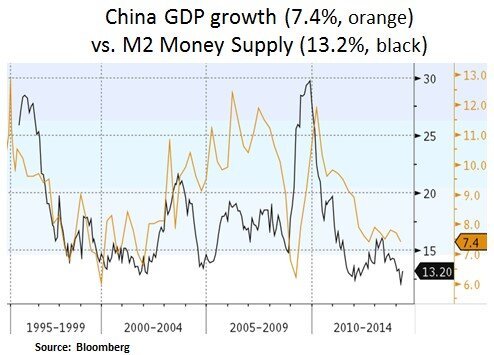

In Asia, we see scope and need for policy intervention. The improvement in Europe’s and the U.S.’s current account balance has largely been achieved via a decline in imports. The mirror image can be seen below in China’s and Japan’s current account balances, largely due to lower exports to the West. In China’s case, we see an ongoing transition from export/investment to consumer led growth. This is a structural transition from high to low multiplier economic growth. Thus, the long-term trend growth rate for China is likely to be in the ~5% vicinity vs. the 8-10% GDP growth rates enjoyed in the past decade. As China reforms and gradually liberalizes its economy and banking system, the question is how its trade and current account balances evolve. Moreover, its property sector is likely to be a key focus for foreign investors and thus foreign direct investment (FDI) flows. In our view, China’s policymakers need to utilize their fiscal and monetary capacity in order to facilitate the economy’s transition. From our investment perspective, we are keen to see how potential Chinese currency (Yuan) devaluation may lead to exports of cheap goods (deflation) to developed markets. This also applies to Japan’s ongoing efforts to devalue the JPY in order to boost its own exports. In equities, we continue to be cautious with regard to base metal and commodity exposures such as iron ore, steel, copper and coal. In 2013 for example, China accounted for 66% of global iron ore imports (up from 50% in 2008). Lastly, we note that G7 foreign exchange volatility has declined to levels last seen in 2007. Given the above factors, we are interested to see what will be the impact of future competitive currency devaluations.

In conclusion, in a low rate environment, we still see robust demand for income generating instruments. We favor a healthy mix of fixed income (non-agency MBS) and quasi fixed income instruments, along with large-cap equity opportunities in industries with favorable supply/demand dynamics such as healthcare and technology. We seek to be opportunistic in allocating capital, as asset prices respond to underlying fundamentals and global policy interventions.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.