U.S. Treasury yields starting to re-price interest rate expectations

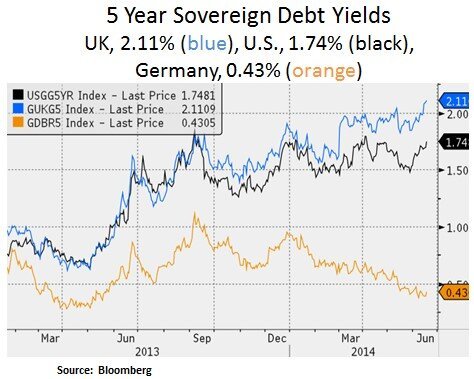

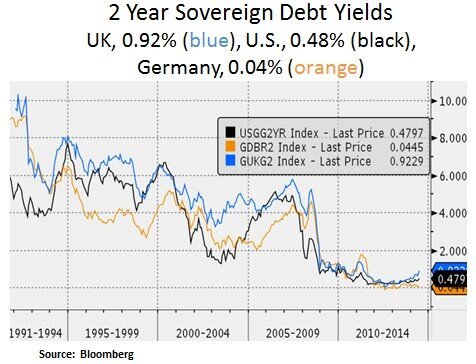

Financial markets are currently witnessing low volatility levels across most asset classes. Asset prices such as U.S. (1941, S&P 500, 5% YTD) and European (3275, Euro Stoxx 50, 5.3% YTD) equities continue to trade near their recent highs. At the corporate level, M&A activity in 2014 is approaching levels last seen in 2007 ($1.7 vs. $2.3 trillion YTD). On the geopolitical level, Iraq’s sectarian violence has kept oil prices firm (Brent, $113 – WTI, $107). In our view, the more interesting price action is taking place in the short-end sovereign debt market. After a long period of quantitative easing programs, the Bank of England (BOE) is starting to shift its language to a more hawkish tone as its housing and labor markets are heating up. Moreover, in the U.S., despite challenging GDP growth in the first half of the year (~0.5-1%), firmer inflation and macro data have led to higher yields; especially at the front end of the Treasury yield curve. As the Federal Reserve concludes its two day meeting this week, we expect the Treasury and equity markets to scrutinize the Fed’s communication with regard to short-term and long-term growth, inflation and Fed funds interest rate projections. From our perspective, we continue to patiently allocate capital in financial instruments that offer healthy income streams and favorable risk-reward profiles. In equities, we continue to seek defensive/secular growth themes.

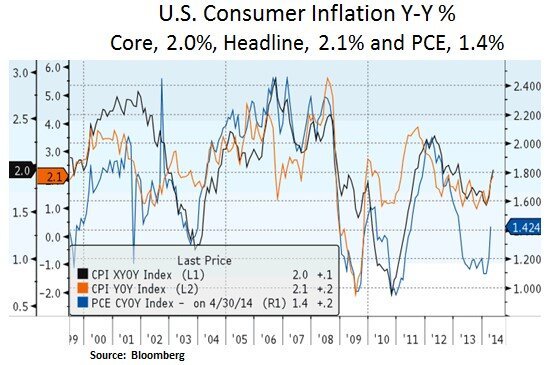

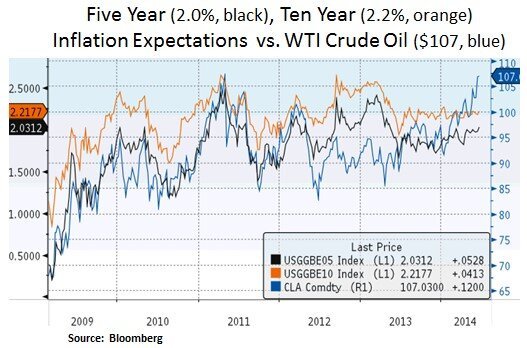

We expect the Fed to continue on its asset purchase tapering path, by reducing its MBS and Treasury purchases to $35bn per month ($20bn for Treasuries and $15bn for agency MBS). One of the debates in the bond market is whether the Fed will reduce its long-term Fed funds interest rate guidance (currently at 4%) in the coming meetings; to a level which would be more in line with e.g. 10 year sovereign debt yield levels (~2.5-3%) and long-term GDP growth expectations. Another debate is whether the Fed is falling behind the curve with regard to dealing with future inflation expectations; especially if the banking system starts extending more credit. Recent banking data suggest that loan growth is accelerating e.g. in commercial and auto loans. In the housing market, as we can see below, rising rent inflation may prod more households to assume mortgage credit.

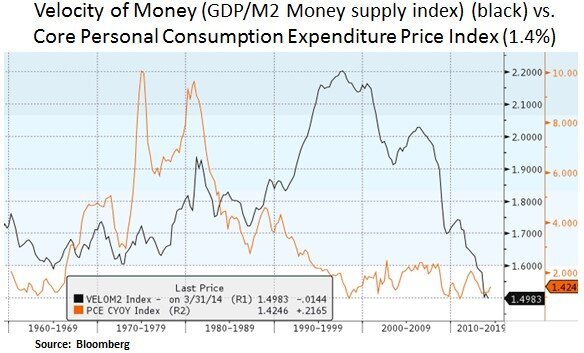

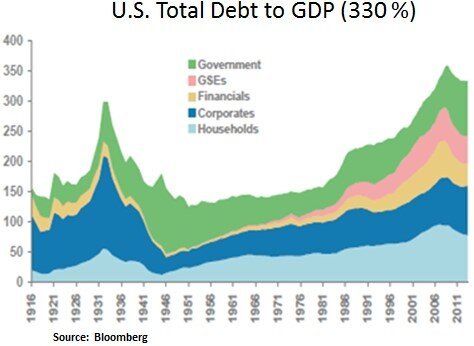

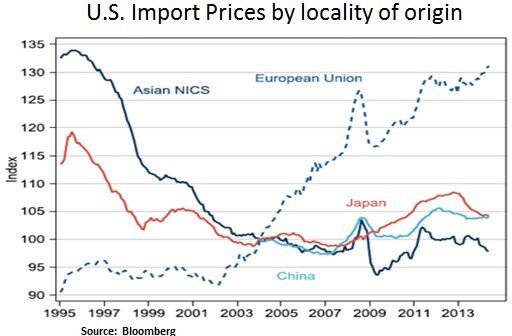

On the U.S. inflation front, the Fed’s preferred metric (core Personal Consumption Expenditures (PCE)) is indeed not far from the Fed’s ~2% target. In our view, a slow global growth backdrop and over-capacity in manufacturing may keep U.S. inflation in check via lower import prices. Secondly, with regard to total debt in the U.S. financial system, the U.S. still carries a heavy debt load. Over time, we still expect debt deleveraging to be a headwind for growth and inflation. Thus, we may not see the velocity of money nor inflation getting out of hand. Therefore, the Fed may still have time on its side as it attempts to wind down its quantitative easing program and gradually normalize its monetary policy.

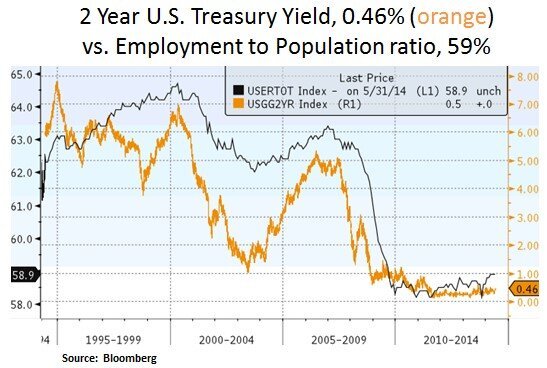

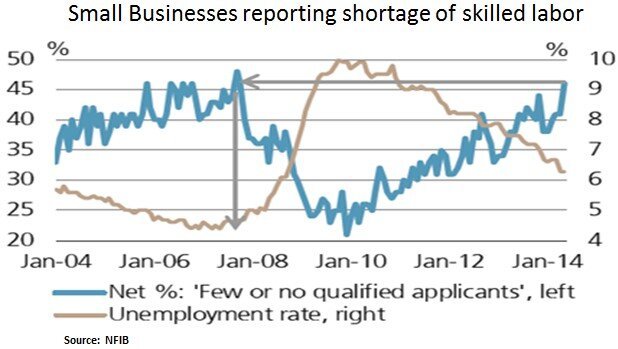

Lastly, with regard to the labor market, our view remains balanced. On the one hand, the employment to population ratio indicates slack and the average duration of unemployment is still elevated (35 weeks vs. 15 week historical average). On the other hand, it is true that the supply of skilled labor is increasingly becoming an issue for employers. Thus, we expect labor costs to cyclically increase but not to levels that would force the Fed to tighten its policies sooner than later.

In conclusion, given the low historical levels for Treasury yields, we would not be surprised to see a pick-up in interest rate volatility, especially at the front end of the Treasury curve which is more sensitive to the Fed’s interest rate policy. At the back end of the curve, a shortage of long duration instruments and muted long-term growth/inflation expectations will likely keep the long-term yields in check. From our perspective, our non-agency MBS exposure offers a good balance between yield and duration. At the corporate debt level, we do not favor investment grade or high yield debt instruments due to valuation concerns. In quasi-fixed income instruments (e.g. REITS, preferred shares, MLPs), we are managing our exposure to interest rate sensitive instruments as risk-reward profiles change. Lastly, in common equities, we remain selective, with a preference for value opportunities in large-caps and in sectors with favorable supply/demand dynamics e.g. healthcare, technology and energy.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.