Global GDP growth and risk sentiment diverge

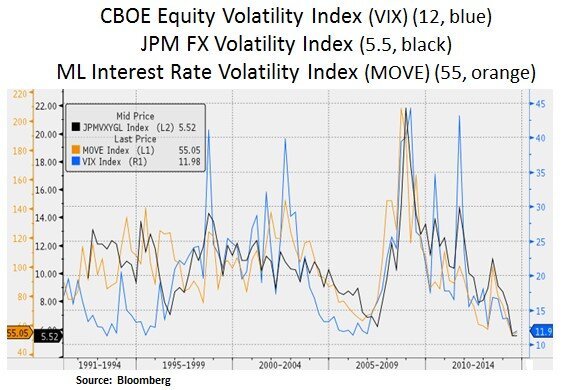

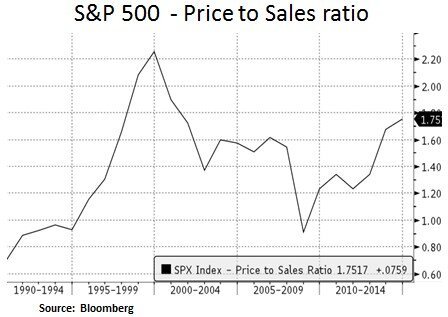

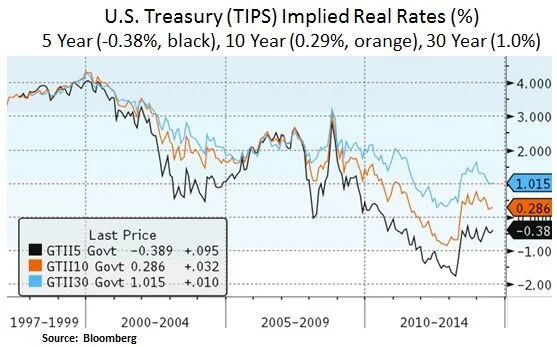

Investors are witnessing an environment that features low global GDP growth (~2.5%) and resilient financial asset performance. As we look across most asset classes, various volatility measures remain subdued. On the corporate front, CEO confidence and M&A activity remain firm. With regard to balance sheet health, the U.S. corporate and household sectors are at an advanced stage in their balance sheet repair since the 2009 crisis. On the asset side, U.S. equities in particular have benefited from record earnings, significant stock buyback activity and low real interest rates. In our view, despite unprecedented central bank easing measures, global growth remains unbalanced and simply not high enough in order to secure future public liabilities. Therefore, we need to see further policy measures (especially fiscal) that will promote higher growth rates. From an investment perspective, with elevated asset prices and subdued asset volatility, we remain selectively positioned in securities that offer visible cash flow, income generation and favorable risk-reward profiles.

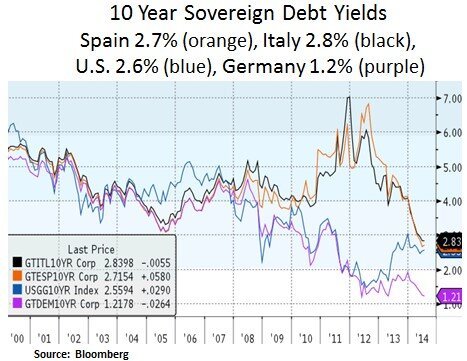

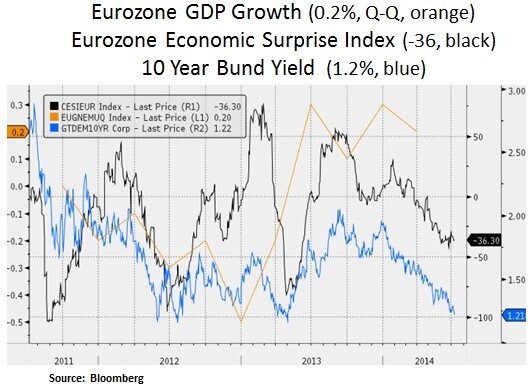

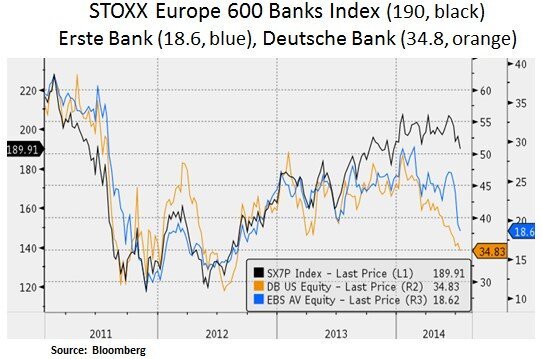

European sovereign debt yields continue to diverge from the 10 Year Treasury yield. European growth is underperforming the U.S. and European banks have recently experienced volatility as they face higher capital requirements and rising non-performing loans (e.g. Erste Bank). On the global front, recent macro readings point to muted global labor supply and productivity growth. We expect U.S. GDP growth to rebound in the second half of 2014, supported by seasonal factors and labor growth.

On the U.S. equity side, we remain selectively positioned in sectors and equities that offer quality earnings, robust balance sheets and still favorable risk-reward profiles. As intra-stock correlation remains low, we focus on stock picking opportunities. The broader market risk-reward profile however, does not strike us as particularly favorable at this point in time. From a historical perspective, volatility tends to mean-revert. Thus, we remain opportunistic in deploying capital; especially in sectors such as healthcare and technology that offer secular growth dynamics.

On a more positive note however, we do not see imminent risks to the current business and credit cycles. The corporate sector in particular has done a good job in refinancing and pushing out debt maturities. A low inflation backdrop is also likely to keep interest rates in check. As wage inflation still lacks momentum, we are hopeful that the Federal Reserve will normalize its policy in a timely fashion; thus limiting further distortions in financial markets. As discussed in our previous article, we still see risk in the front-end of the Treasury curve as the Fed gradually exits its ultra-easy posture.

In conclusion, we currently see some divergence between underlying economic growth and risk sentiment. We continue to allocate capital in fixed income and equity instruments that offer favorable total return opportunities and visible cash flow.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.