Is the Federal Reserve falling behind the curve?

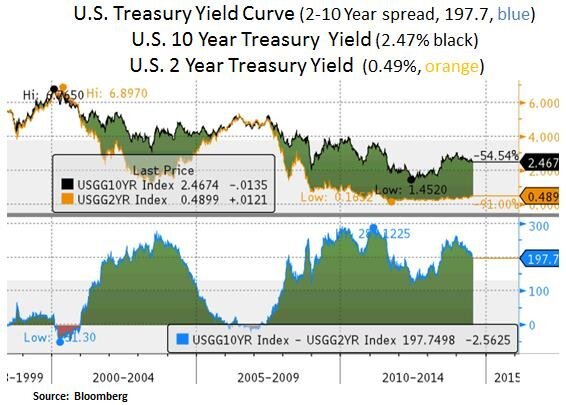

Investors are currently reconciling a backdrop that features resilient financial asset prices and a fair amount of geopolitical headline risk (Ukraine, Israel and Iraq). Large-cap U.S. equities in particular (S&P 500, +7.4% YTD) are outperforming their European peers (Euro Stoxx 50, +2.5% YTD) and riskier U.S. equity segments such as the Russell 2000 (-0.4% YTD). On the Treasury front, the U.S. Treasury yield curve has been flattening as of late. The back-end of the Treasury curve has eased in the past month with the 10 and 30 Year yields at 2.49% (-0.14%) and 3.28% (-0.16%) respectively. Across the pond, European sovereign debt yields remain subdued, with the German bund (10 Year) setting a recent low at 1.14%. Looking ahead and into 2015, market participants are debating whether the Federal Reserve has fallen behind the curve with regard to normalizing its monetary policy; especially as interest rates have been held at the zero for nearly 6 years. In our view, the Federal Reserve is in the process of normalizing its ultra-easy policies by ending its current quantitative easing (QE) program by October. Gradual interest hikes should be expected in 2015-16 and we see risk at the front-end of the Treasury curve. The back-end of the curve however can trade in a range; driven by long-term growth, inflation expectations and a decreased supply of long-term debt issued by the Treasury i.e. as fiscal deficits have been reigned in. Lastly, we highlight structural and global factors (e.g. low global population growth and global debt deleveraging) that may keep global inflation and real rate expectations in check. Therefore, the Fed will likely raise interest rates to a degree (~2%, +/- 0.5%) but perhaps not to ‘old normal’ levels (~4-5%).

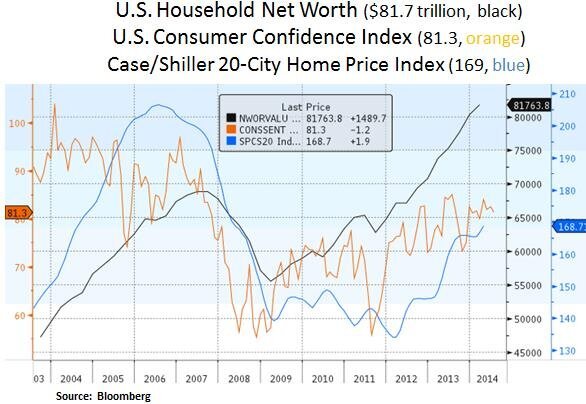

As we can see above, asset price recovery and traditional inflation measures suggest that at this point in the economic recovery it is getting difficult to argue for a zero interest rate level. U.S. household and non-profit organizations net worth is well above 2007 levels – a time whereby the effective Fed Funds rate was at 5.3%. The housing market has experienced a moderate recovery and households are at an advanced stage in their balance sheet repair. Moreover, with regard to the Fed’s preferred inflation metric (core PCE inflation), at 1.49% the Fed is closing in to its inflation target of ~2%.

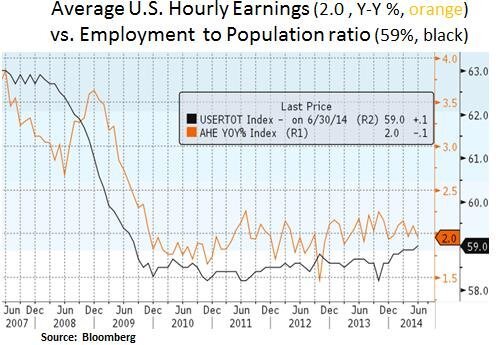

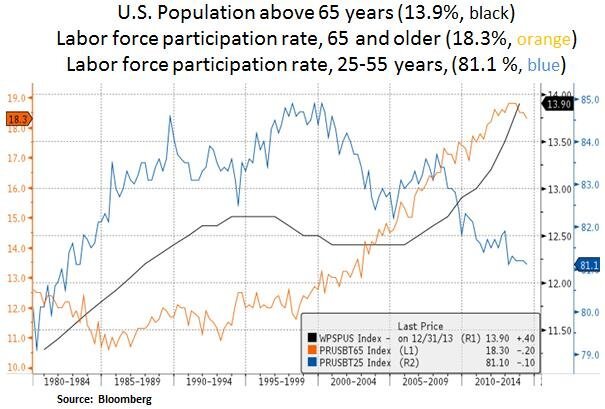

On the labor front, data suggest that on a cyclical basis the labor market is at an advanced stage in its recovery process. To be sure, the complexion of the labor recovery has been far from perfect. Full-time employment is still below its 2007 high. In addition, a shift from full-time to part-time employment has taken place i.e. an increase of ~3 million part-time jobs since 2008. This shift has dampened wage inflation. In terms of demographic trends, older workers have increased their labor participation rate. However, as a skilled Baby Boomer generation starts retiring, we are noticing a jump in the unfilled number of available jobs i.e. 4.6 million job openings as per the JOLTS report below. Due to these structural factors, keeping interest rates at zero may not be as effective at this point. Therefore, a measured and gradual normalization of the Fed’s interest rate policy is warranted; especially as inflation is still in check.

Lastly, we highlight some of the ‘new normal’ realities that have been affecting the underlying economic growth rate. For example, population growth has been slowing. This is linked to lower fertility and immigration rates. Moreover, the financial crisis and a lower labor participation rate have contributed to a lower homeownership rate. Other factors, such as Obamacare and a lower corporate investment rate have also contributed to a moderate pace of growth that has hovered in the 2-2.5% area in the past 3 years. Therefore, even though we expect the Fed to begin normalizing its interest rate policy in 2015-16, we do not expect substantial tightening measures that would undermine the broader pace of GDP growth.

In conclusion, we expect the Federal Reserve to continue in its current attempt to normalize its monetary policy. The extent and pace of the Fed’s tightening effort may not be as severe however, due to structural factors such as challenged demographics and global debt deleveraging (i.e. deflationary impact). From our investment perspective, we are currently selective across the fixed income and equity spectrum. We patiently seek financial instruments that offer favorable risk-reward and total return profiles. We remain opportunistic with regard to interest rate sensitive securities such as Utilities, REITS, MLPs and preferred shares. In equities, we lean on large-cap equities with healthy balance sheets, visible earnings/dividend growth and catalysts for price appreciation.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.