Value, Income and Secular Growth focus

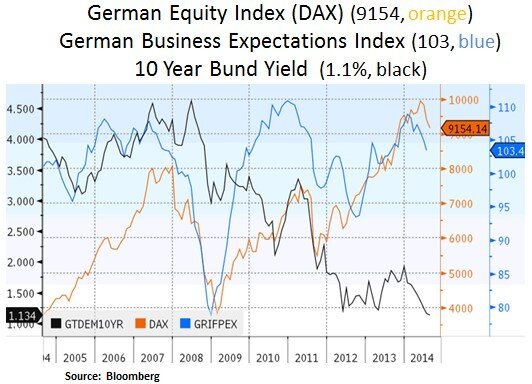

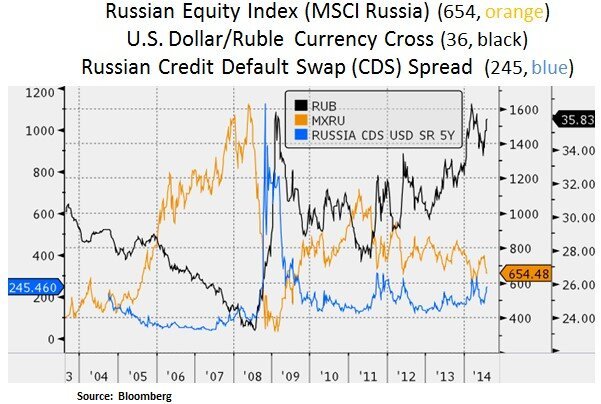

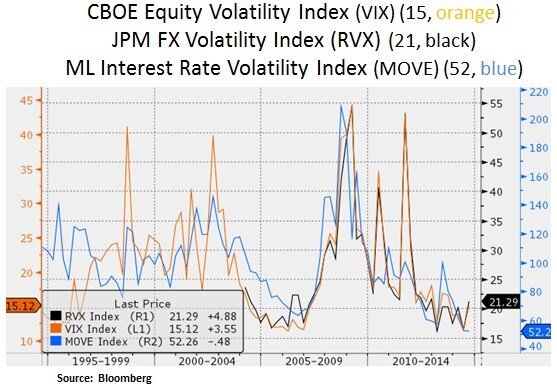

Risk aversion and asset price volatility increased in July, with notable pull-backs in small-cap U.S. equities (-6%, Russell 2000), high yield bonds (-3%, HYG ETF); and large-cap equity indices such as the S&P 500 (-3%) and the German DAX (-4%). In Europe, equities were impacted by the prospect of stricter economic sanctions on Russia. Moreover, European bank sentiment was dented by the 4.4 billion Euro rescue of Portugal’s second largest listed bank (Banco Espirito Santo). In the U.S. Treasury market, pressure on the front of the curve eased as July’s job gains and wage inflation came in below expectations. From our perspective, we have been avoiding riskier and fully valued asset classes such as small-cap equities and corporate debt instruments. Within large-cap equities our focus remains on secular growth themes e.g. in healthcare (new pharma pipelines) and technology (enterprise software, PC replacement cycle, healthcare I.T. services). In addition, in industrials we have a preference for late-cycle themes such as commercial aerospace and energy equipment. We continue to avoid expensive and highly cyclical sectors such as consumer discretionary. Lastly, as interest rate and inflation expectations fluctuate, we remain opportunistic in adjusting our high dividend yield exposure e.g. in utilities, telecoms and quasi-fixed income instruments. Prior to the recent pick-up in volatility, we selectively reduced exposure in securities that were fully valued. As such, our cash levels have increased in the short-term.

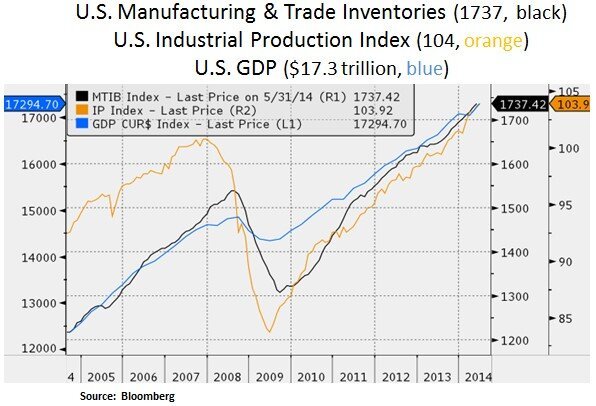

On the U.S. economic front, GDP growth rebounded in the second quarter (Q2, +4%) after a -2.1% start for the year. Inventory accumulation has contributed 1.6% to the rebound and underlying end-demand has bounced back to the 2-2.5% level. At this point of the cyclical recovery we are cautious on highly cyclical names e.g. transport, auto and retail names. We note that manufacturing and trade inventories remain at historically high levels. High inventories may weigh on corporate profitability down the road if end-demand does not pick up meaningfully. Therefore, at this juncture we prefer late-cycle exposure in sectors whereby earnings are counter-cyclical and tied to long product cycles.

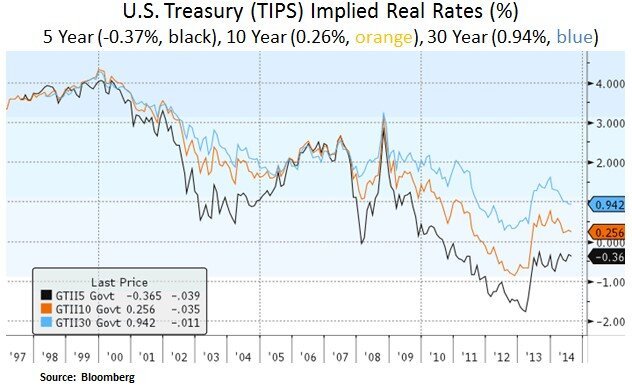

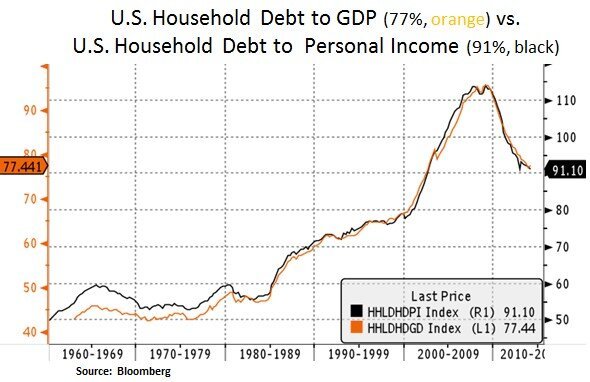

Lastly, on a more positive note, financial conditions are still supportive. As we can see below the overall interest rate backdrop is still not tight enough to impede the current business cycle. Real interest rate and inflation expectations are still in check. This backdrop buys the Federal Reserve some time in order to normalize its ultra-easy policy. On the labor front, we note that full-time employment has continued to increase and this is supportive for the ongoing housing market recovery; as household balance sheets progress with their repair.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.