Central Bank Pivot to Synchronized Tightening

Financial markets are currently repricing to a certain degree the hawkish shift in policy rhetoric from major Central Banks, chiefly the European Central Bank. As such, major sovereign bond yields increased in the past month e.g. the U.S. 10 Year Treasury to 2.38% from 2.17% and the German 10 Year Bund to 0.57% from 0.27%. In the context of muted inflation expectations, real borrowing costs also rose. The latter move weighed on interest rate sensitive U.S. equity sectors such as utilities and consumer staples. We are currently underweighted in these sectors. Incrementally, Central Bank rhetoric is becoming more vocal regarding the importance of both CPI and asset price inflation; in relation to their monetary policy normalization path. The rising concern for financial markets is that the Federal Reserve has tightened monetary policy twice in 2017 even though US economic data has not accelerated and core inflation remains below its 2% target. Moreover, the Fed has now seemingly verbally committed itself to commencing balance sheet reduction later in 2017. From the Fed’s perspective, financial conditions remain loose, asset valuations are on the high side and certain sectors of the U.S. credit market are overstretched (e.g. auto loans). As we look ahead into 2018, the main potential headwind for global risk assets is a coordinated withdrawal of excess Central Bank liquidity. A pick-up in cross-asset volatility will likely offer us better entry points to allocate capital.

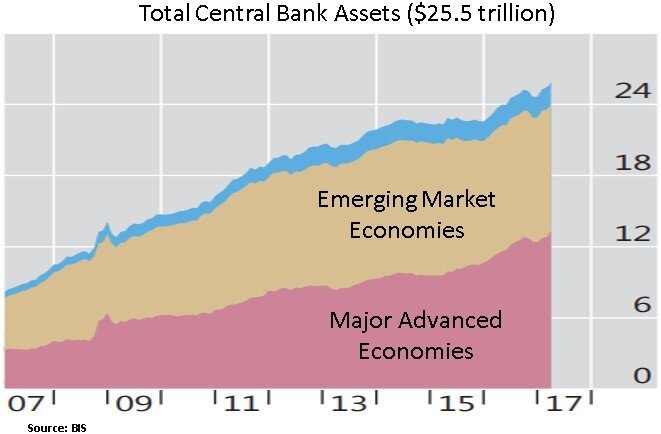

As recently published by the Bank of International Settlements (BIS), the stock of negative yielding government bonds is still sizable; this is the outcome of Central Bank asset purchase programs known as ‘quantitative easing’. As we are in historically unchartered monetary waters, the question is how smooth the balance sheet normalization will be and what will be the repercussions to the global asset, credit and business cycles. We suspect the monetary normalization path will be uneven with episodes of Central Bank hesitancy in implementing their current plans.

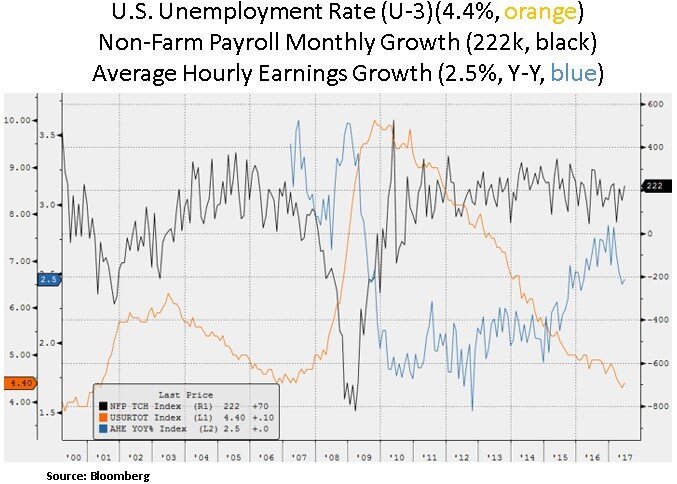

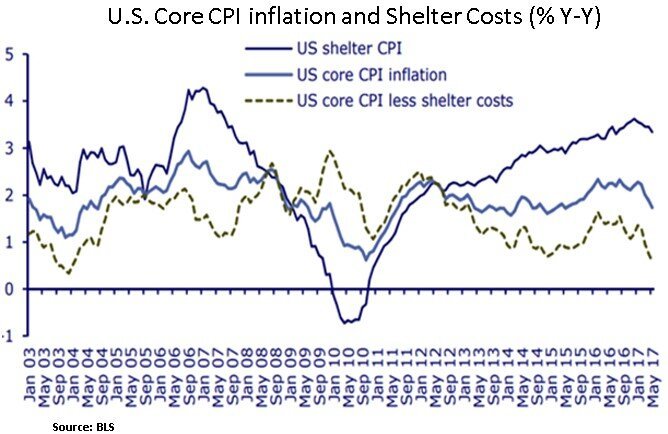

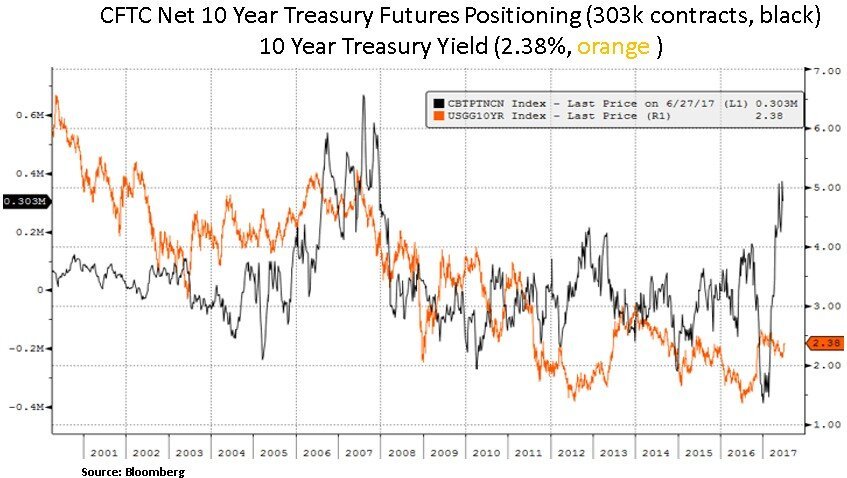

The most immediate binding constraint for the Fed’s pace of policy normalization is consumer inflation. Recent U.S. inflation readings have lagged market expectations. Despite a cyclically tight U.S. labor market, wage growth remains in check and fuel prices remain subdued. Moreover, other core inflation metrics are showing signs of deceleration e.g. new vehicles and apparel. Shelter inflation appears to be the main pillar of support for core U.S. inflation (34% weight in the CPI index). Yet, it may be cyclically topping out. Subdued inflation expectations have likely contributed to the recent sharp reversal in Treasury futures positioning i.e. from bearish to bullish. Yet, the recent Central Bank hawkish signals are challenging this speculative long positioning in long-term U.S. Treasuries. Even though lagging indicators such as inflation trends should be considered, the market and the Fed are likely to pay close attention to the pace of the global credit cycle and Central Banks may likely adjust their forward guidance if financial conditions (which include asset price growth) or labor markets face unforeseen disruption.

Apart from loose financial condition indicators, the growing Central Bank hawkish rhetoric may have increased on the back of the recent decline in the U.S. dollar; which is still the global economy’s main funding currency. As we highlight below, speculative USD market long positioning has been reduced. On the other side of the major cross currency USD trades, the ECB’s recent shift in policy language has contributed to increasing long positioning in the EUR/USD. From a U.S. corporate earnings perspective, a falling trade weighted USD bodes well for U.S. large-cap multinationals; particularly for the technology and healthcare sectors that have high international exposure. We continue to favor secular growth stories within these sectors. From a balance sheet perspective, these sectors may also benefit from an eventual offshore cash repatriation deal, once U.S. tax reform and fiscal plans fall into place.

Lastly, we highlight below the recently published chart by the Bank of International Settlements regarding global debt levels as a % of GDP and the advanced stage in the long-run financial cycle. Even though global Central Banks would like to arrest financial excesses and increase dry powder for the next cyclical downturn, they may adjust their normalization language down the road if the credit/asset cycles or CEO/household confidence levels wane.

In conclusion, given historically high asset valuation levels and suppressed volatility metrics, we continue to be highly selective. We retain our preference for income generating financial instruments and large-cap equity opportunities in industry leaders that have more defensible earnings profiles and strong balance sheets. A potential withdrawal of excess global liquidity may give rise to cross-asset volatility episodes that may give us the opportunity to be more aggressive in our capital allocation.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.