Diminishing Asset Risk Premia

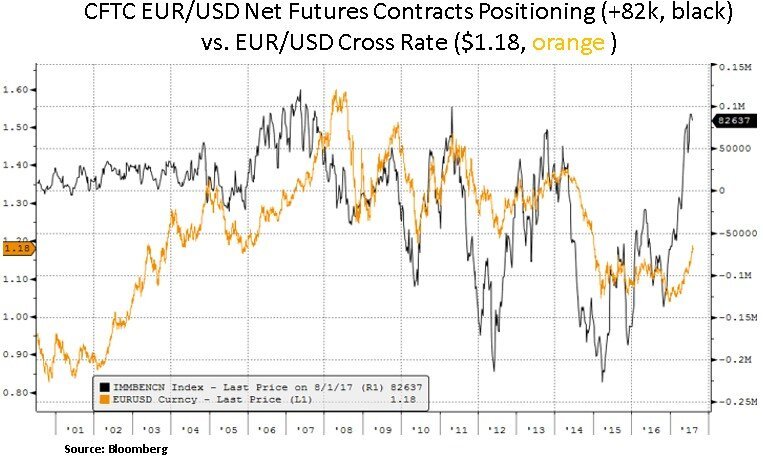

Financial markets are navigating a fundamental backdrop of steady global economic growth, recovering global corporate profitability and muted inflation expectations. The latter expectations have kept global government bond yields in check, despite Central Banks signaling a gradual withdrawal of excess liquidity. In the U.S. Treasury market, the 10 Year yield came off in the past month i.e. 2.26% (-0.12%). European 10 Year yields also saw notable moves e.g. Italian and Spanish yields declining by 0.34% and 0.29% to 1.99% and 1.41% respectively. On the U.S. equity front, year-to-date, equity indices have performed as follows: S&P 500 +11.9%, DOW JONES +13.3% and NASDAQ +18.7%; on a total return basis. Apart from a generally positive Q2 U.S. earnings season, the decline in the trade weighted U.S. dollar also contributed to relative resilience in U.S. and global equities. We note that speculative FX market positioning moved to the negative side on the U.S dollar; along with a mirroring bullish shift in positioning on the Euro. U.S. cross-asset volatility has also stayed subdued (i.e. equity, FX, interest rates). In global corporate bond markets, yield spreads vs. government bonds have stayed in a historically low range. From our point of view, the U.S. asset, credit and business cycles are at advanced stages and we continue to be cautious and opportunistic in our asset allocation and security selection.

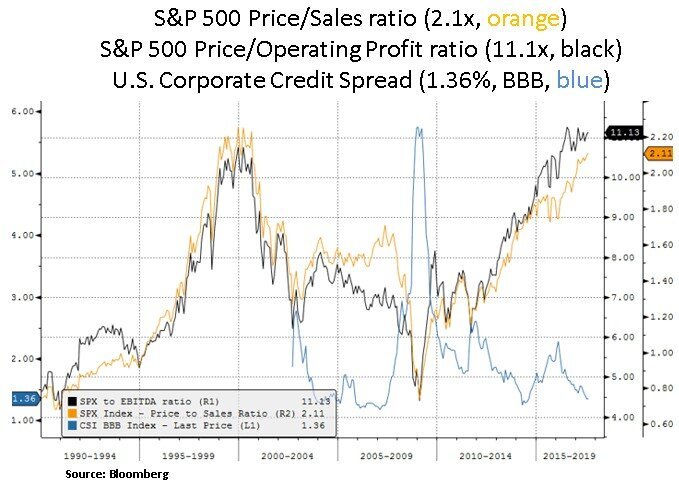

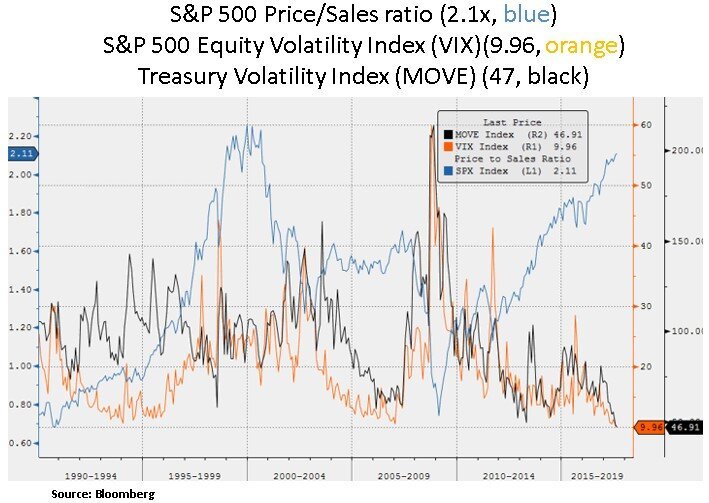

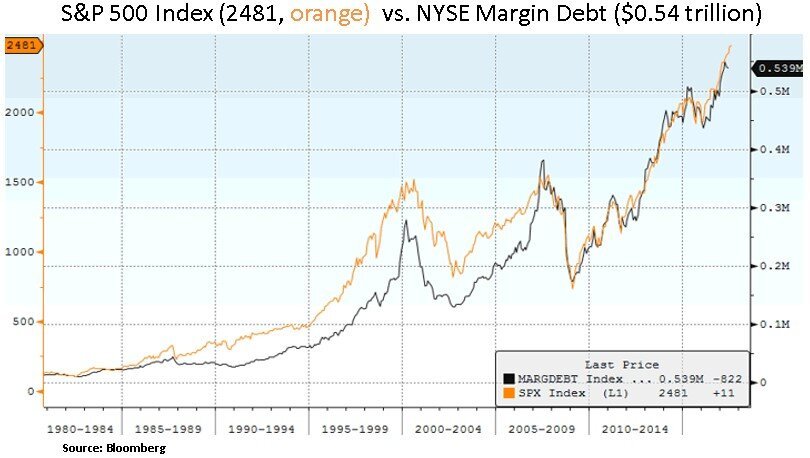

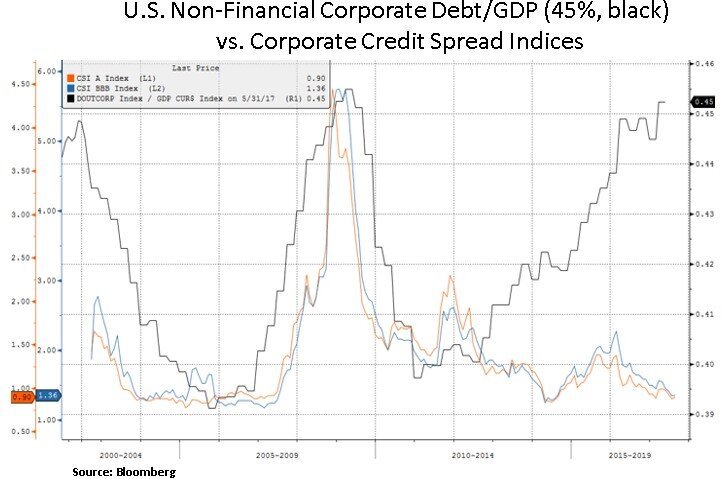

As we can see below, U.S. equity valuation metrics are at historically elevated levels. Tight corporate credit spreads and diminishing investor demand for portfolio hedging point to investor complacency. There are also signs of increasing embracing of leverage e.g. brokerage margin debt and rising non-financial corporate debt. Even though mega-cap corporate debt is not at alarming levels, the median corporate debt to profitability ratio is at historic highs. After 8 years of material global monetary accommodation, asset sensitivity to changes in monetary policy and interest rate hikes has increased. As such, investor over-reach for yield will likely be tested as Central Banks gradually remove excess liquidity and global labor markets finally become tight in the latter parts of their cycles.

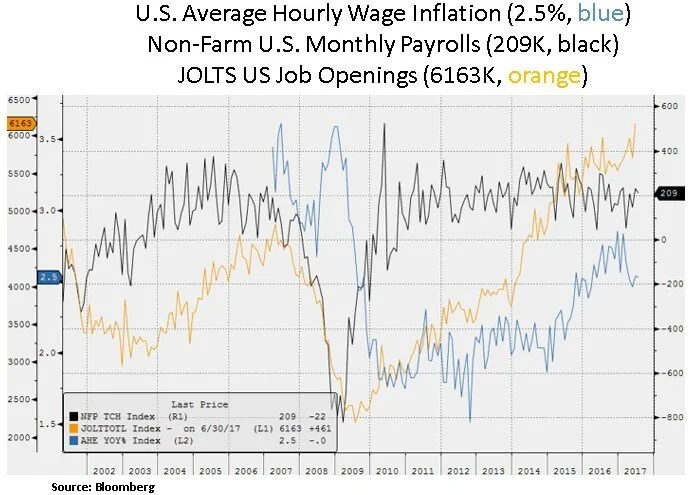

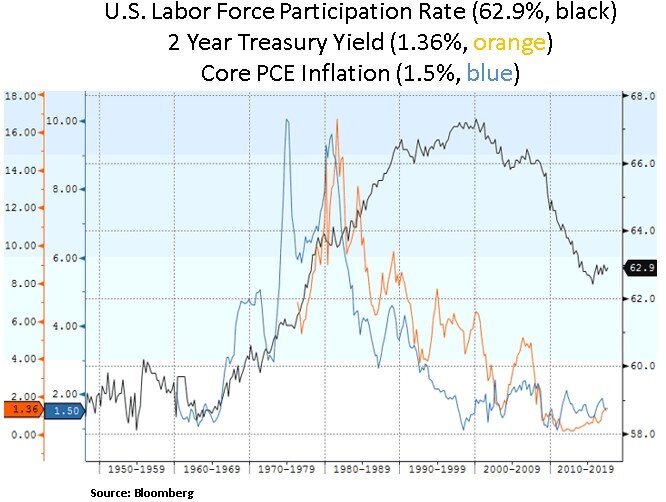

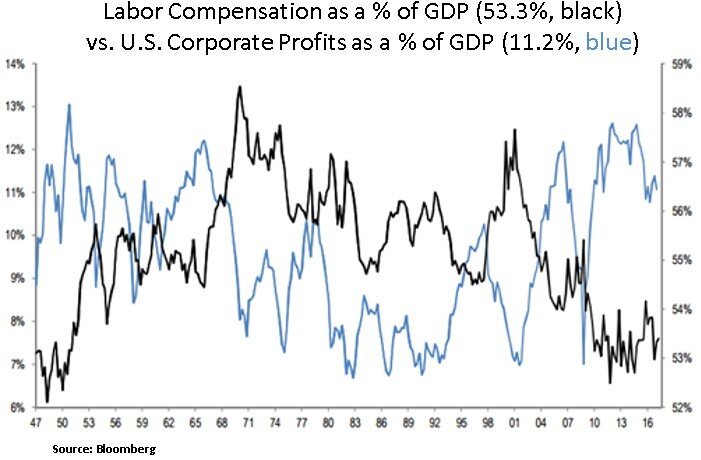

With respect to U.S. inflation dynamics, St. Louis Fed president James Bullard recently noted that he only sees small inflation impacts triggered by lower unemployment levels and he questioned whether inflation is reaching the Fed’s 2% target level. As such he noted that the current interest rate policy is appropriate. Indeed, core CPI inflation remains low and is not responding to labor market tightening in the manner central bank models would predict. From a U.S. equity perspective, corporate profits as a percentage of GDP hover near 70-year highs, and wages & salaries at 70-year lows. It is plausible that due to demographic changes (baby boomers retiring) job openings may remain elevated and insufficient supply of skilled labor may create pockets of inflation. On the other hand, due to insufficient retirement savings, baby boomers may continue working even on a part-time basis, thus constraining wage growth.

The decision on whether to continue working will affect the size of the overall labor force. In turn, the size of the labor force will impact the economy's growth potential and overall aggregate demand. We note that the rate of labor force growth is projected to decline further as 77 million baby boomers continue moving into older age and retirement. The oldest boomers hit 62 in 2008 and turned 70 in 2016. As large numbers of aging workers retire, there is a comparatively smaller cohort of younger workers to replenish the labor force. Even as overall labor force participation is projected to keep falling, the participation of older people is widely expected to resume climbing. From an investment point of view, given this demographic outlook, we would view any Central Bank induced (e.g. balance sheet reduction) increase in Treasury yields as a buying opportunity. We would also look for attractive yield opportunities in quasi-fixed income instruments (e.g. utility equities, preferred shares and MLPs). From an equity sector perspective, aging demographics are likely to benefit the healthcare sector and in a range-bound GDP world we will likely continue favoring secular growth themes (e.g. tech) and other internationally exposed U.S. corporations; with stronger earnings growth potential and pricing power.

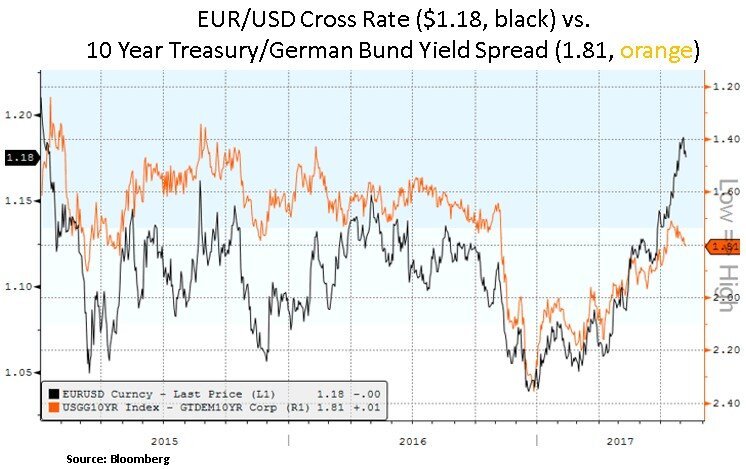

Lastly, we highlight below the recent market positioning shift in the EUR/USD. In the very near-term, a weaker dollar is likely to be beneficial for our internationally exposed equity holdings e.g. tech, healthcare and selective industrials and energy names. We suspect however that excessive Euro strength will likely trigger at least a verbal intervention in the ECB’s upcoming meeting (Sept 7th); which may keep Bund yields in check in the near-term. The Treasury/Bund long-term yield spread has been the key driver of EUR/USD for the past few years and it is plausible that given elevated positioning, the Euro is due for a near-term pull-back.

In conclusion, the current low cross-asset volatility levels and high asset price backdrop calls for increasing selectivity in asset allocation and security selection. Tight corporate credit spreads also indicate diminishing risk premia across global debt markets. Low asset volatility and tight credit spreads have also encouraged increases in investor and corporate leverage appetite. Increased interest rate sensitivity is likely to cause volatility mean-reversion episodes in asset prices; particularly as Central Banks seek to normalize their balance sheets towards year- end and into 2018. We look to be opportunistic across both the equity and fixed income spectrums.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.