Deflationary headwinds ease pressure for Fed tightening

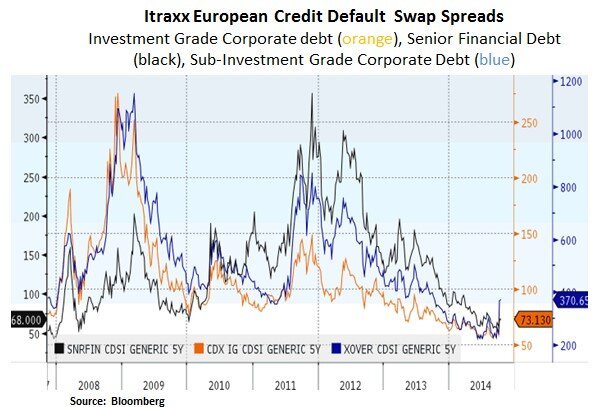

Financial markets are currently re-pricing softer growth and muted inflation expectations. In the energy complex, crude oil prices (WTI $81, Brent $84) are now reflecting a well-supplied market and a reluctance by Saudi Arabia to cut production levels. In addition, investor positioning has most likely weighed on the recent declines in oil prices. Softer German economic data and concerns about the Ebola outbreak have also weighed on investor sentiment. In our view, market participants are also witnessing a weaker than expected policy response e.g. by the ECB and Chinese authorities. This is occurring at a time whereby the Fed is ending its Quantitative Easing program by the end of October and is attempting to normalize its policies. The S&P 500 declined intraday (15th Oct) by 9.8% from its recent Sept 18th high. Prior to the recent pick-up in market volatility, we reduced the risk profile of our portfolios by adding interest rate sensitive securities (e.g. mortgage REITS, preferred shares) and by selling energy sensitive equities. Moreover, after the recent dislocation in the energy sector, we increased our exposure to pipeline and midstream energy infrastructure MLPs.

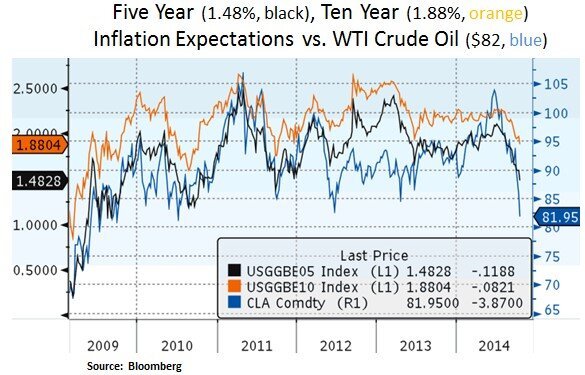

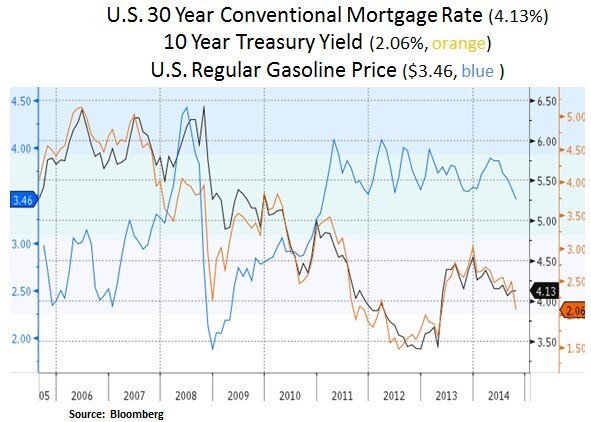

As we can see below, inflation expectations have declined, partly due to weaker oil prices and partly due to USD strength. In the Treasury market, yields have eased in the past month with the 5,10,30 year yields at 1.36%,2.14%,2.92% respectively (with the 10 Year Yield hitting 1.86% intraday, 15th Oct). Deflationary headwinds are easing some of the pressure on the Fed to tighten its policies in a material manner; especially as long-term inflation expectations are undershooting the Fed’s ~2% inflation target. Across the pond, the European sovereign debt market is continuing to price a very subdued growth and inflation backdrop. The German 10 Year Bund is now yielding 0.76%.

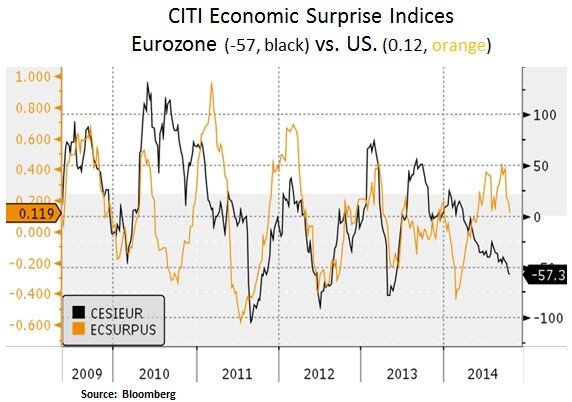

In our view, the European recovery is likely to continue to garner investor attention. As Germany’s economy faces increased recession concerns, the pressure will likely increase domestically for a stronger policy response. Moreover, as we discussed in our last article, the European banking sector holds the key for healthier credit expansion and an unleashing of consumer and corporate pent-up demand. Therefore, despite recent concerns about policy execution, we believe there is light at the end of the tunnel. Clearly, this is contingent on a more concerted Eurozone/ECB policy effort.

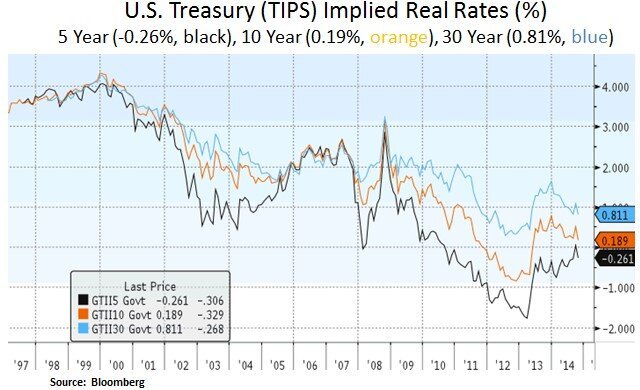

On a more positive note, current financial conditions are not tight. As we can see below, inflation adjusted or real interest rates remain in check. Lower Treasury yields are likely to lead to lower mortgage costs. In addition, lower gasoline prices are likely to increase consumer purchasing power. Demand for labor remains firm as indicated by the recent jump in job openings from 4.6 to 4.8 million. The Fed is likely to continue to monitor growth and inflation expectations. In a consumer driven economy, the Fed is also likely to continue assessing consumer confidence indicators. We highlight below one leading indicator for consumer spending. Future expectations seem to be ticking lower than current expectations. Therefore, as some deflation/growth uncertainty is surfacing in financial markets, we believe the Fed will take baby steps in normalizing its monetary policy. Thus, in a lower for longer interest rate environment, we expect rate sensitive and income generating securities to be prime beneficiaries.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.