Growth and inflation expectations need to be safeguarded

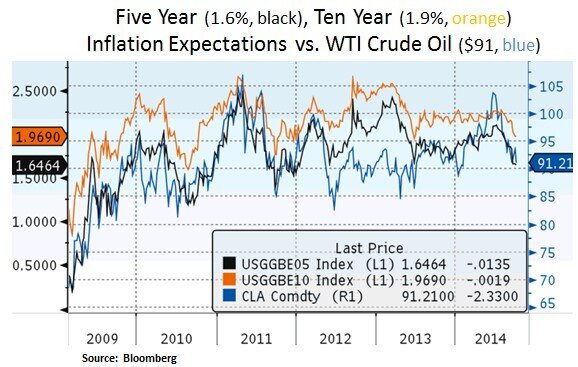

Financial market participants are assessing the outlook for asset prices in a backdrop that features uneven global growth and subdued inflation pressures. Investors are witnessing varying degrees of policy effectiveness and a divergence between the Fed and ECB policies. In particular, market expectations are increasing for more aggressive action by the ECB as the Eurozone’s inflation hit a five year low (0.3%) today and is undershooting the ECB’s 2% target level. As a result of these expectations, the EUR/USD has declined to a level last seen in Sept 2012 i.e. at $1.26. Moreover, softening demand out of China, rising oil supply out of Libya and a stronger USD have weighed on the broader commodity and energy complex e.g. WTI and Brent crude oil at $91 and $94 respectively. From our perspective, easing inflation expectations elongate the timeline for meaningful global monetary tightening. As long as long-term Treasury yields trade in a sideways range, we view income generating instruments as an appealing source of investment return. In U.S. equities, we continue to be selective with a focus on value, secular growth and large-cap opportunities.

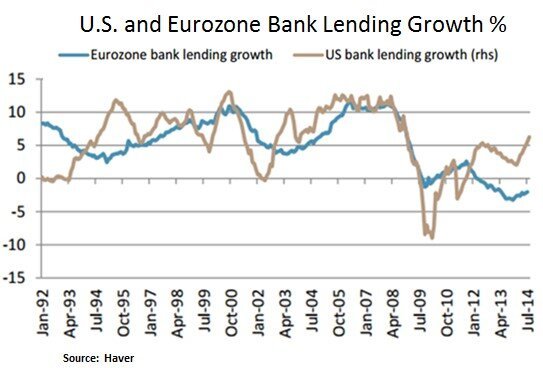

In our view, global growth and inflation expectations need to be safeguarded; especially in the Eurozone. To be sure, policy execution remains key in the ongoing effort to revive growth and stave off deflationary threats. Investment and productivity growth can be achieved as the European Banking sector completes its balance sheet repair and credit growth resumes at a higher pace. October may be an inflection point for European banks as the Asset Quality Review (AQR) results are announced by the ECB. Progress on credit transmission may finally unlock pent-up consumer and corporate demand, as the European labor market recovers. Such a development would be beneficial to U.S. multinationals e.g. in the industrials and technology sectors.

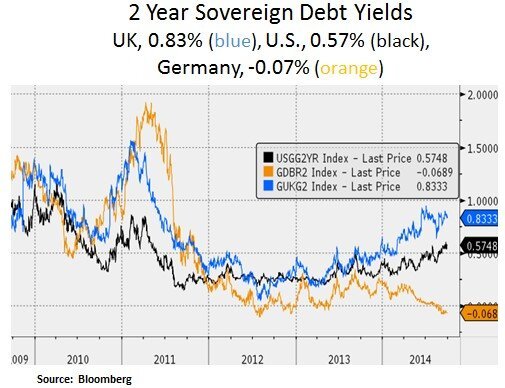

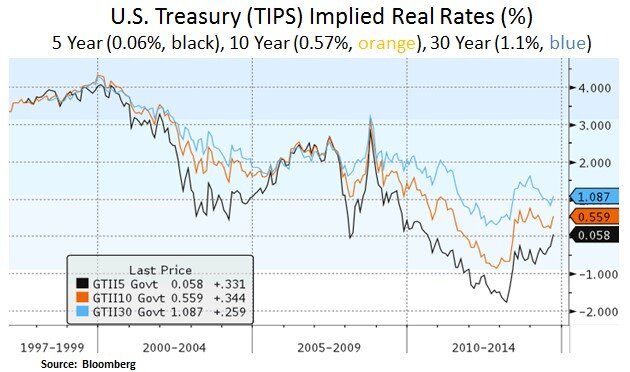

On the U.S. Treasury front, expectations for Fed policy normalization have created a yield divergence vs. European yields. Remarkably, the 2 Year Bund is now yielding -7 basis points vs. 57bps and 83bps for the U.S. and UK 2 year notes respectively. Arguably, such divergence is present at a time whereby the Fed and the BOE are ending their quantitative easing (QE) programs; and the ECB is on the precipice of embarking on a more aggressive unconventional path. Expectations for a relatively stronger U.S. growth outlook have led to a firming in TIPS implied real interest rates. In addition, from a fiscal perspective, we highlight the recent view from the IMF i.e. a looser U.S. fiscal backdrop in 2016-2018. From a capital expenditure point of view, the U.S. is likely to continue to attract foreign capital flows; especially as the U.S. continues to gain a leading global energy position. American crude oil production has now exceeded 8.5 million barrels per day – the highest level since July 1986, and within only 1.5 million barrels per day of the all-time record set back in November 1970. In terms of total oil and other liquid fuel production, the U.S. is likely to exceed Saudi Arabia in the coming months i.e. > 11.5 million barrels per day.

The U.S. economy has relatively higher growth prospects e.g. versus the Eurozone and the ECB & Fed policy paths are likely to continue on their divergent paths. We do not expect however an elevated inflation backdrop. Firstly, softening Chinese demand is likely to keep commodity and energy prices in check. Secondly, domestic U.S. demographic trends point to soft consumer spending trends. Lastly, global demographic trends suggest a muted inflation backdrop. Therefore, such as longer-term view on inflation, is likely to keep Central Banks accommodating for a longer timeframe. From our perspective, we seek investment opportunities in industries that offer above trend growth e.g. in the healthcare and technology sectors. In a low interest rate environment, we view income generating instruments as a key part of our long-term asset allocation.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.