Global disinflation tempers monetary tightening concerns

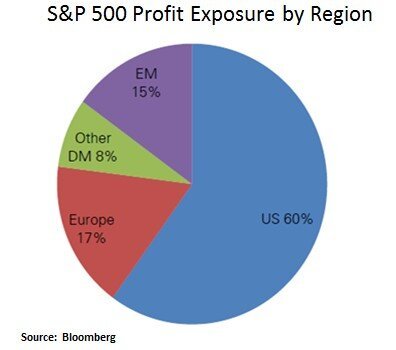

Market participants are reconciling a backdrop that features elevated financial asset prices and uneven global economic growth. The divergence between the U.S. and other major economies (e.g. Eurozone) has led to a strengthening in the U.S. dollar and a bias toward rising U.S. real yields. Moreover, a rising USD and a decelerating Chinese economy have led to weaker energy and commodity prices. The Federal Reserve is expected today to communicate its view with regard to the pace of its monetary policy normalization. In our view, the Fed finds itself in a delicate position as it juxtaposes U.S. financial conditions, broad inflation measures and progress in the labor market. With inflation expectations trickling down and an uncertain global growth picture, we presume that the Fed will take baby steps in gradually tightening its policies. As such, in a range bound Treasury yield environment, we seek to add quasi-fixed income instruments on meaningful back-ups in Treasury yields. In equities, we continue to focus on selective value opportunities.

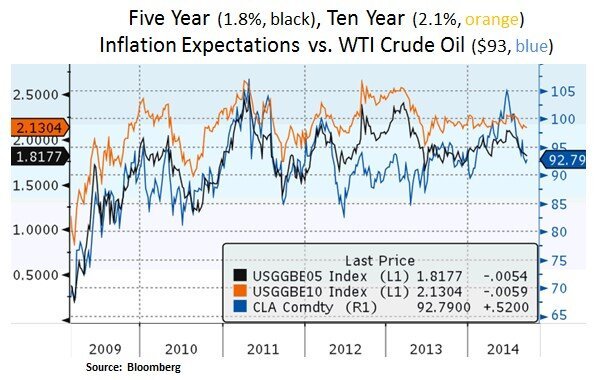

Inflation expectations have been moderating as a result of soft global growth and easing energy/commodity prices. Muted inflation reduces the pressure on global Central Banks to rein in their liquidity and credit easing programs. In addition, easing inflation bodes well for consumer spending; especially in Emerging Markets whereby industrial production is more energy intensive and consumers are more sensitive to food prices. From our perspective, the question is how the Fed will manage the USD’s strength at a time whereby major economies are at different stages in devaluing their currencies i.e. in order to re-assert competitiveness (e.g. Japan and most recently the Eurozone). Although we recognize that USD strength can be a future headwind to U.S. economic performance, it can also attract foreign capital flows into U.S. based assets.

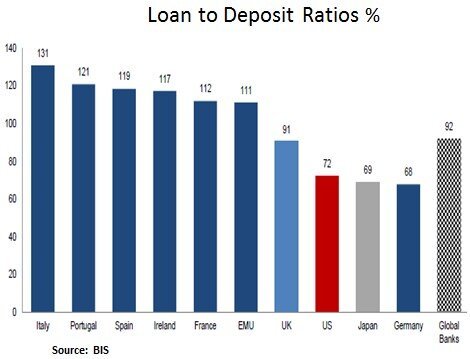

From the ECB’s point of view, deflationary risks still present themselves in the Eurozone. The U.S. banking system is in a better position to extend credit. As we can see below, the road to debt deleveraging is still long for Southern European banking systems. Thus, the Euro is still at risk of further devaluation vs. the USD. To be fair, the health of our trading partners matters more than FX frictions. However, we are cognizant of the USD sensitivity within our equity portfolio e.g. for large-cap international equities. Due to their capital intensiveness and commodity leverage, the energy and materials sectors are more sensitive to USD fluctuations.

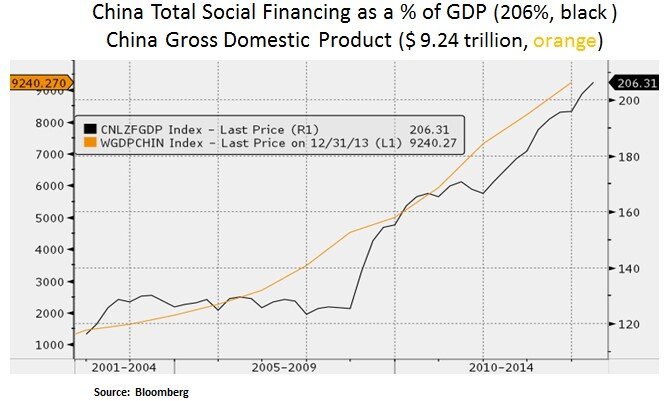

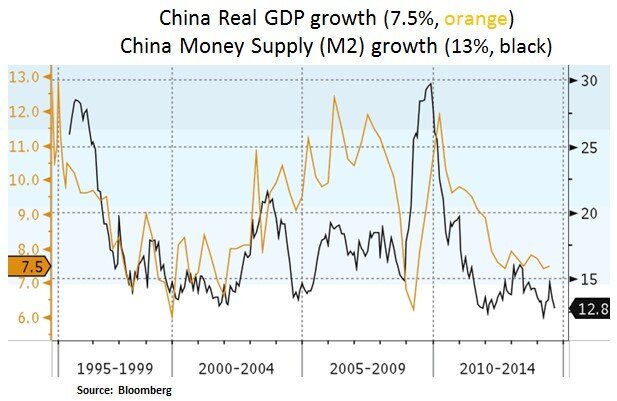

Lastly, as discussed in past articles, we are currently observing a transition within the Chinese economy; from investment to consumer driven economic growth. After rampant credit expansion since 2009, we are now observing a slowdown in credit creation and hence slower underlying growth trends. In our view, China will use fiscal and monetary tools in order to cushion the aforementioned transition; along with a series of structural reforms. As the PBOC aims to internationalize its currency, it may leave currency devaluation as a policy of last resort. From our perspective, we prefer secular growth exposure to China via healthcare and technology multinationals. In the industrials sector, we remain cautious with regard to mining machinery names. We prefer aerospace and power generation exposure.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.