Increasing Late Cycle Signals

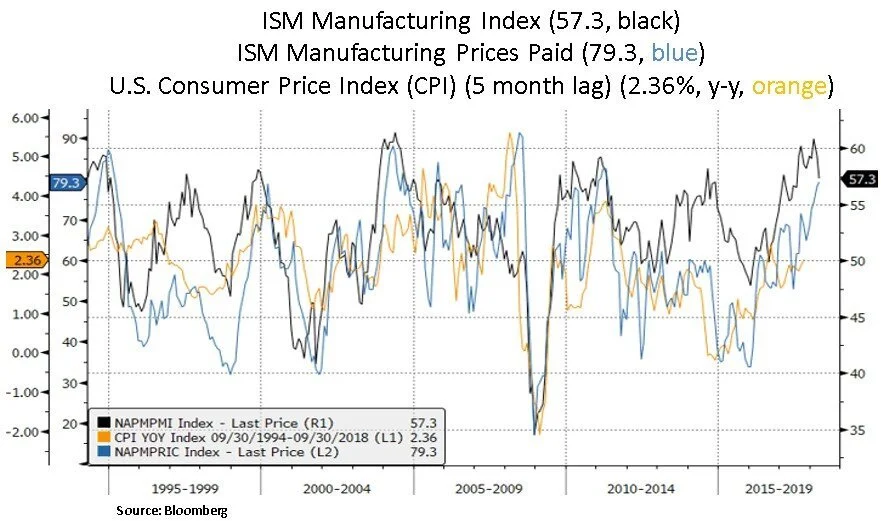

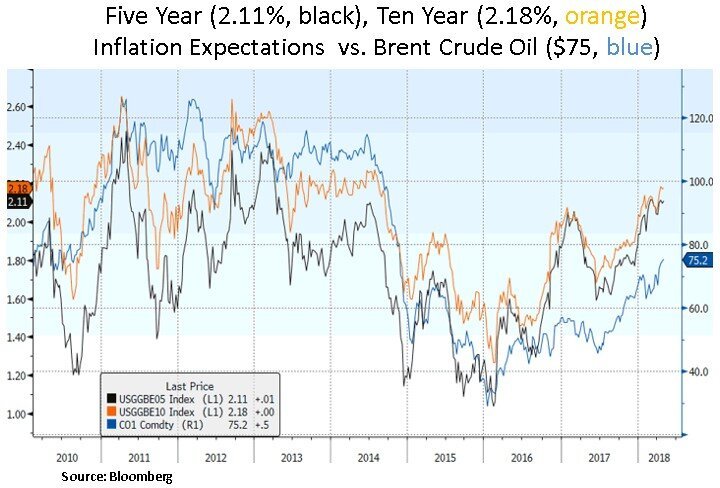

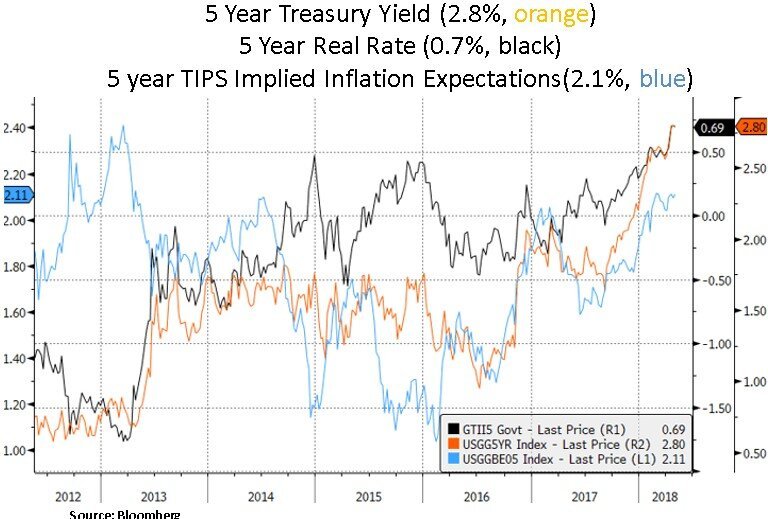

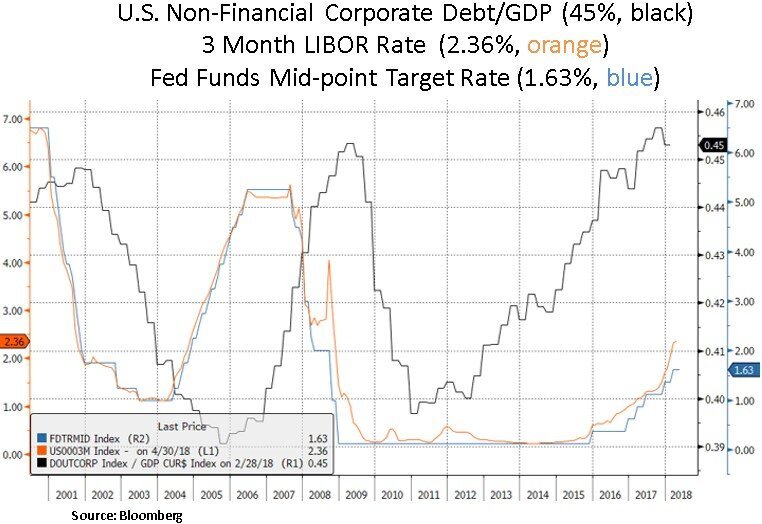

The U.S. economic expansion is now the second longest on record. At 107 months the current expansion just surpassed the 1960s expansion and may beat the 1990s expansion if it extends past July of next year. Recent regional Fed surveys and company earnings reports by industrial companies have pointed to increasing cost inflation (e.g. energy, metal pricing). Moreover, recent manufacturing surveys have pointed to slower growth readings and faster inflation. According the latest ISM manufacturing report, prices paid have accelerated to near prior cycle highs. On a more positive note, capital expenditure intentions have reaccelerated vs. Q4 of 2017, on the back of the recent U.S. tax reform. Despite rising Treasury yields in the past month (e.g. 0.25% increase in the 2 Year Treasury Yield to 2.50%) and tightening financial conditions, the high yield bond market has been relatively resilient. For the latter, part of it reflects the high share of energy credits in the high yield investment arena and there has also been a fair retrenchment in new supply of high yield bonds. With firming inflation expectations and a tight labor market, the Fed is likely to stay on course with its tightening program. From our perspective, we continue to remain selective with a focus on high free cash flow yields in equities and income generating securities.

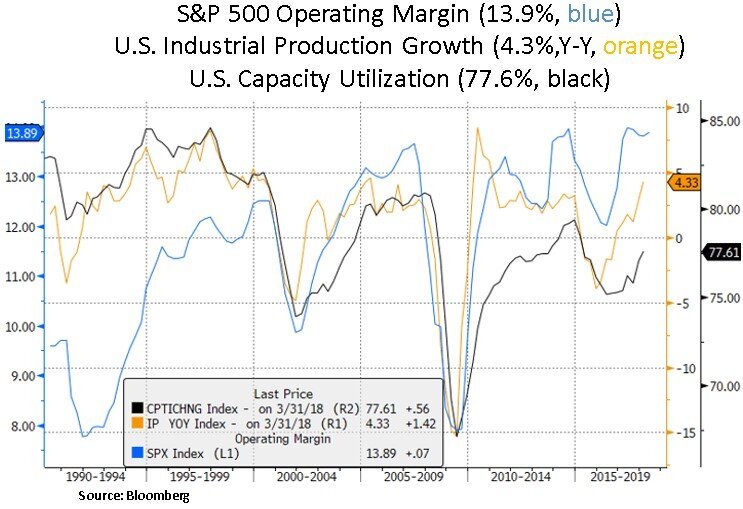

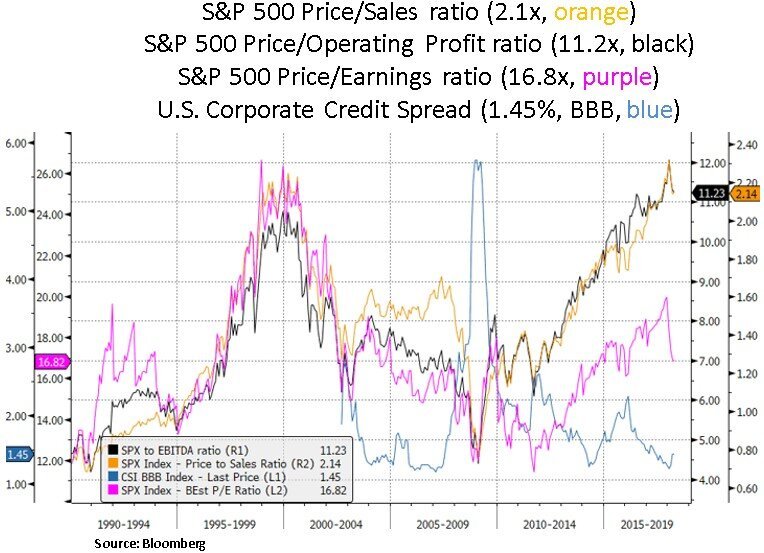

Rising cyclical inflation, increasing borrowing costs and a bottoming out of the consumer savings rate are features of a late-cycle business setting. From an equity perspective, we are careful to avoid securities that are expensive and whose cycle high operating profit margins may come under pressure from cost-push inflation. We also prefer sectors that are less labor intensive and less impacted from cost inflation, such as Technology and Healthcare.

On the bond side, the Treasury yield curve has remained flattish and long-term Treasury positioning remains quite bearish as reflected in a record high speculative short in U.S. 10 Year positions. The Treasury futures speculative net short positions recently rose to 462k contracts. In contrast, speculative S&P 500 equity positioning has recently rebounded, and equity volatility positioning has recently declined from historically elevated levels. Regarding Treasury positioning, this could be a contrarian positive. Any credit driven deceleration in the economic cycle, will likely shave off some of the long-term inflation expectations, which are largely priced in by the Treasury market. Extrapolating cyclical inflation pressures over a much long-term horizon is likely imprudent. From an investment perspective, interest sensitive securities are likely to outperform as the business cycle eventually runs its course.

Another interesting data point is that the spread between the 10 Year Treasury bond yield and the 10 Year Bund (German) yield is now at its widest since April 1989. In a global sovereign bond market whereby the 10 Year Bund and 10 Year Japanese bond yield 0.56% and 0.03% respectively, one would expect reasonable demand for a global carry trade i.e. to take advantage of historically wide yields spreads between Treasuries and these key sovereign bonds. Such a carry trade is likely a near-term positive for the USD; whose sentiment has been sagging after the recent fiscal/tax reform fueled concerns for bulging U.S. budget deficits and debt sustainability. Thus, bearishness on the U.S. Treasury market seems too one-sided at this juncture.

Lastly, we highlight below recent data points on key global money supply indicators. Declining global liquidity is likely to cause further volatility episodes; especially as the U.S. corporate credit cycle matures. However, even though the current U.S. corporate credit cycle is cyclically extended, we note that sizable corporate refinancing needs will likely become an issue in the 2020-2022-time frame, as a fair amount of investment grade and high yield debt matures and will need to be rolled over.

In conclusion, we continue to assess the prospects for the current profit and credit cycles. From an asset allocation perspective, we remain selective in both the equity and fixed income spectrums. We continue to favor areas that offer more sustainable growth dynamics, such as the technology and healthcare sectors. Our cyclical call on the energy sector recovery and our avoidance of expensive consumer staples stocks have also been beneficial to our portfolios.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.