U.S. Labor Market Reaching New Milestones

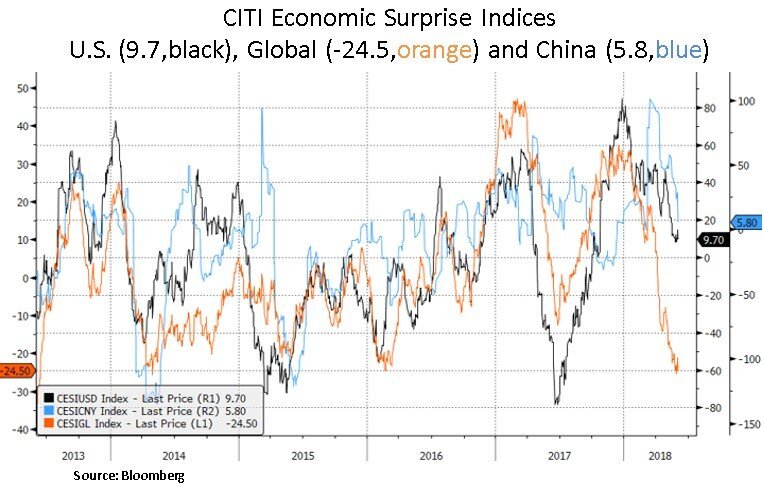

In the past month financial markets have witnessed a backdrop whereby U.S. economic data have outpaced global peer metrics. As such, the front-end (3-12-month maturities) of the Treasury yield curve saw yields rise while the entire curve has continued to flatten. The 2-10-year yield spread hit a cycle low at 0.43%. On the European sovereign bond yield front, Italian yields diverged notably on the back of fiscal and political concerns. For example, the 10 Year Italian bond yield rose 0.98% in the past month to 2.76% and the German Bund yield declined by 0.18% to 0.36%. U.S. equities rose for the month (+3.3%), with notable outperformance by the technology sector (+6.1%). We have maintained an overweight position in the technology sector with exposure to key secular growth themes such as cloud computing, artificial intelligence and other enterprise software and hardware.

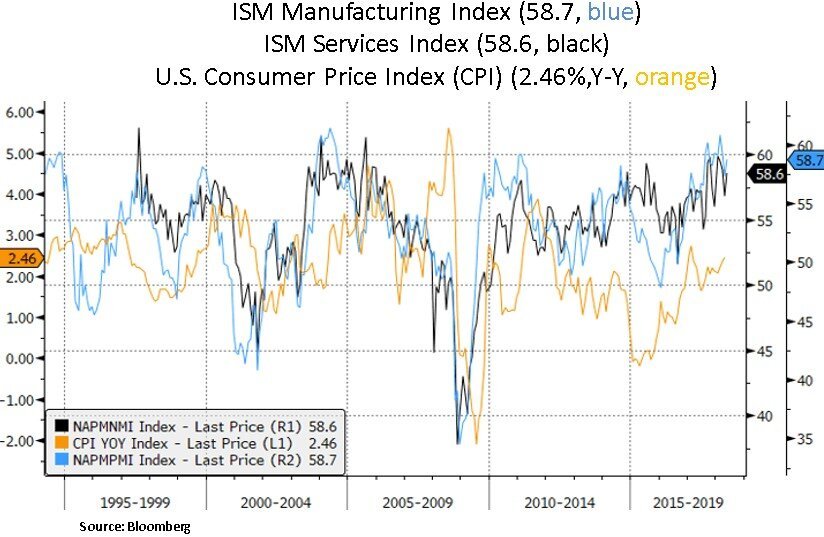

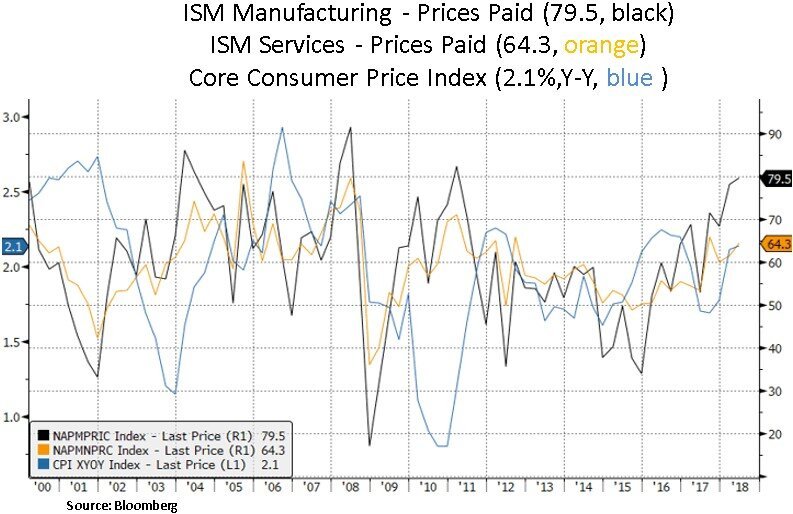

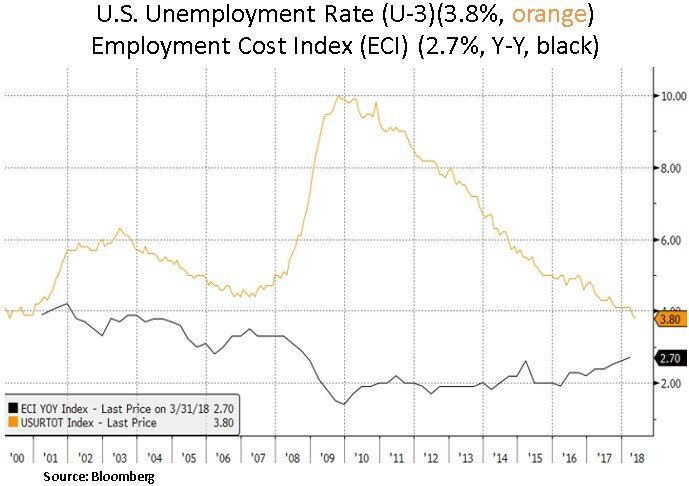

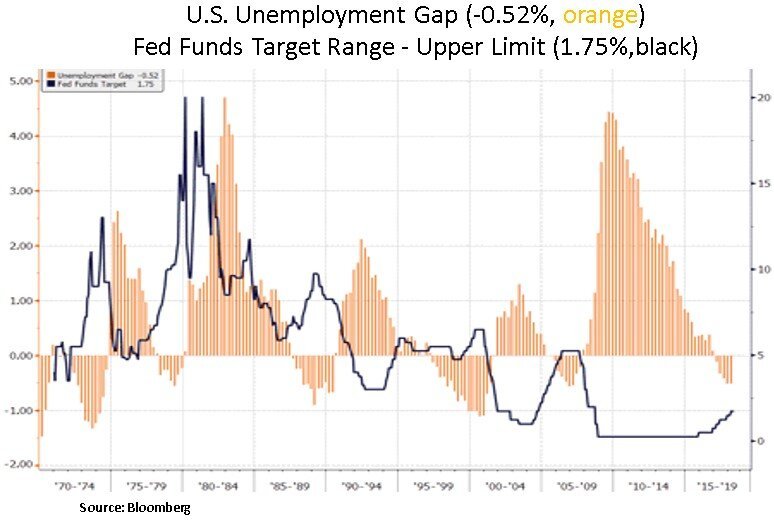

As of late, U.S. manufacturing, services, labor and inflation data had positive surprises. The U.S. unemployment rate hit a multi-decade low at 3.8% (below what the Fed considers ‘full employment’ i.e. ~4.5%) and several labor market metrics hit new milestones; indicating a cyclically tightening labor market. The latter likely keeps the Fed on course its monetary normalization path, as wage and other cost pressures build. Thus far in 2018, U.S. businesses and consumers are enjoying tax-fueled fiscal stimulus. Most likely, 2019 becomes the year whereby tightening financial conditions and capacity constraints start impacting the pace of GDP growth and the credit cycle. We note that brisk consumer spending is outpacing income growth; leading to a cycle low for the consumer savings rate.

A robust labor market is good news for the latter part of the U.S. economic cycle, but it may not be very good news for the long-term corporate profit cycle as borrowing costs gradually rise and labor compensation becomes a headwind for corporate margins. To be sure, not all U.S. equity sectors are impacted in the same manner. For example, the technology sector sports strong balance sheets and it is not as labor intensive as industries like leisure/hospitality/restaurants. Moreover, the technology and healthcare sectors generally have better pricing power and global growth prospects.

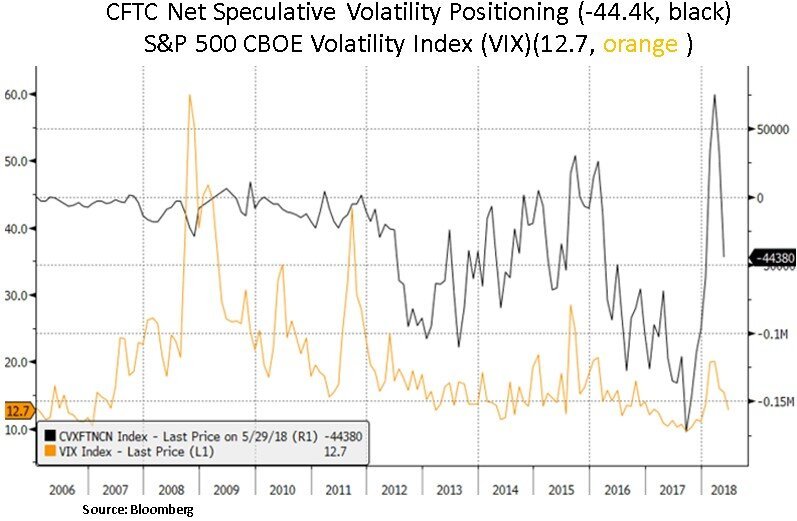

As the labor market cycle matures, one should expect labor shortages and skills mismatches to become a hurdle for corporate expansion plans and unit labor costs. As we can see below, the recent job openings number has hit a record high at 6.7m which far exceeds the total pool of unemployed persons (6.1 million). If demand exceeds supply, wage pressures will continue to build, and monetary policy will continue to tighten as the Fed will not want to fall behind the curve. Apart from classic interest rate hikes, the Fed also plans to reduce the size of its balance sheet; gearing to an annualized pace of $600bn liquidity withdrawals by Q4 of this year. Moreover, Global Central Bank balance sheets will likely start contracting collectively in 2019. As such, apart from exogenous factors such as trade skirmishes, we expect a less accommodative liquidity backdrop to cause episodes in asset price volatility; particularly as the positive cash repatriation cycle and thrust in share repurchases run their course in 2018.

Lastly, we highlight below that despite the burst in Italian bond yields, the overall European equity benchmark did not experience a material drawdown. The main casualty of the sovereign bond yield volatility was the European banking sector. For example, the EUFN (European Bank ETF) declined by 7% in the past month. On the U.S. equity front, we note that equity volatility has continued to subside, and speculative volatility positioning has declined as well.

In conclusion, the U.S. economy is hitting further cyclical milestones with ongoing traction in manufacturing and services. Cost pressures are building however, and the labor market is showing signs of overheating. Even though recent Fed minutes have pointed to a higher medium-term tolerance for inflation, labor capacity constraints are starting to be more evident. As such, we expect a less accommodative monetary and liquidity setting to trigger asset price volatility episodes; as the corporate profit cycle faces more margin headwinds in 2019 and beyond. Therefore, we remain opportunistic in our capital allocation and security selection; with a bias towards industry leaders and dividend growers.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.