Low productivity growth restrains the Fed

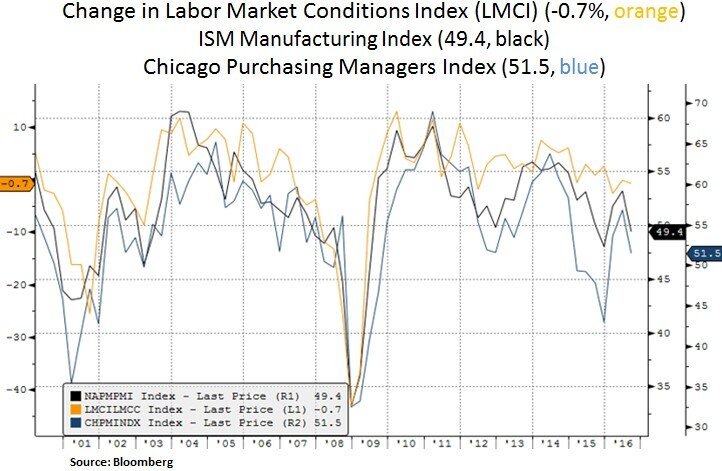

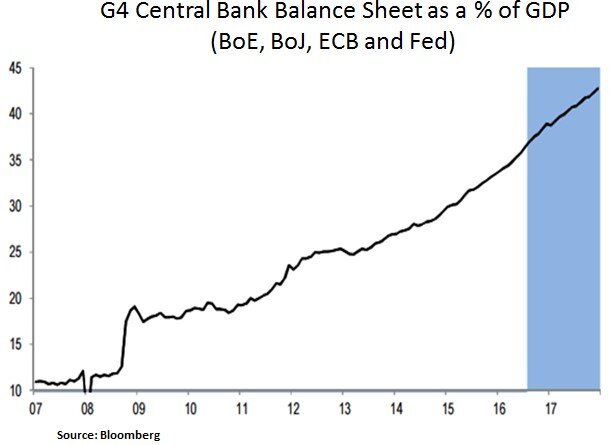

Investor attention has been dominated by recurring swings in expectations for further U.S. rate hikes. A soft Aug U.S. payroll report and lackluster manufacturing data have reinforced the market’s expectation for only one potential rate hike by year end. Moreover, growth uncertainty and global Central Bank asset purchase expectations are keeping the shape of the Treasury yield curve near its flattest level in 8 years. Corporate credit spreads (high yield and investment grade) remain low and inflation adjusted (TIPS implied) or real interest rates remain in check. The trade weighted USD index has also been in check. The market is also focusing on upcoming Sept Central Bank meetings (ECB on the 7th and Fed/Bank of Japan (BoJ) on Sept 21st) and the sustainability of asset purchases as we head into 2017. The market expects the global Central Bank balance sheet to expand as a % of GDP. In our view, the above liquidity and interest rate backdrop has been supportive of asset prices. The total return (year to date) for U.S. equities is as follows: S&P 500 +8.6%, DOW JONES +8.5% and NASDAQ 6.4%. We note that global cyclical equities have now caught up vs. earlier outperformance by defensive (rate sensitive) equities.

Profitability improvement has been a key driver of the 7-year-long equity rally. As the labor market recovery is now maturing, wage pressures are becoming a headwind for corporate profits; particularly for small and medium sized businesses. U.S. labor productivity is staying low, driving unit labor costs higher. In past cycles, productivity tended to decelerate in the latter stages. Output per hour increased only 1.25% percent per year on average from 2006 to 2015, compared with its long-run average of 2.5% from 1949 to 2005. This weakness can be attributed to meager investment spending after the Great Financial Crisis and more limited efficiency gains than before. If the low productivity backdrop remains a constraint for GDP growth and inflation expectations, one should expect long-term rate expectations to remain subdued. As capital spending to output recovers, we remain positioned in the technology and industrials sectors i.e. as capital expenditures focus more on productivity and technology.

One could argue that as the Fed started normalizing its policies very late in the current cycle, it raises the prospect that it either ends up behind the curve or that it is making a policy mistake. Moreover, if productivity fails to rebound, the Fed might be running out of room for maneuver. The critical question is whether the Fed can shield corporate profits. Further softness in profits could weigh on business investment. In our view, corporations seem to be attempting to arrest wage pressures by limiting hours worked (as seen in the Aug payroll report). In the long-term, it is likely that automation/artificial intelligence/machine learning could put a deflationary lid on unit labor costs, thus shielding corporate profits and removing the need for aggressive monetary tightening. Therefore, in a low rate backdrop we expect demand for income generating instruments to remain robust. We remain opportunistic as favorable risk-reward scenarios emerge in interest rate sensitive assets e.g. telecoms and utilities.

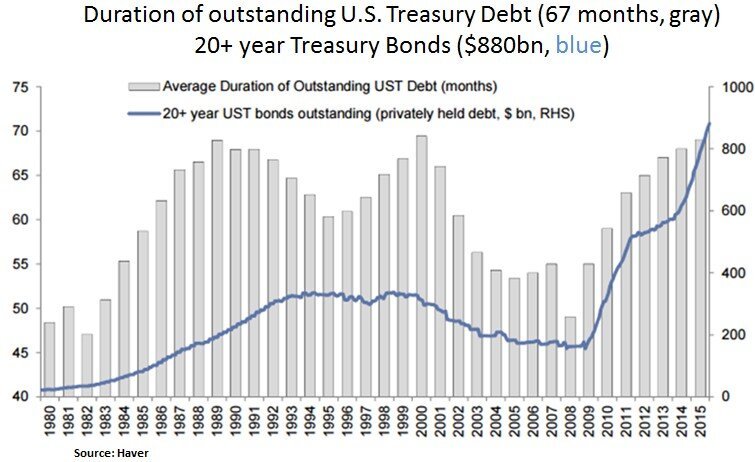

As discussed earlier, market expectations remain high for ongoing expansion of the global Central Bank balance sheet. For example, the ECB’s balance sheet last week surged +30% Y-Y to $3.7trillion and the BoJ’s balance sheet was up 30% Y-Y to $3.8 trillion. It is plausible that Central Banks shy away from further deposit rate cuts in their upcoming Sept meetings as they pressure the banking system. Instead, their focus should remain anchored on asset purchases. The Fed also hinted recently that when the next U.S. recession arrives the Fed could widen the range of assets eligible for purchases and it may need to expand its balance sheet by up to $4 trillion. In the long-run, we are concerned about the increasing interest rate sensitivity or longer duration risk enabled by Central Bank policies. In the medium-term however, other Central Bank asset purchases could keep a lid on U.S. real rates and probably keep the USD in a reasonably tight range i.e. as capital flows in Treasurys and other U.S. assets increase demand for USD. On the other hand, USD strength tempers the Fed’s hiking expectations as it compromises U.S. profitability and energy prices. Thus, we remain constructive on the U.S. energy sector as supply/demand rebalancing plays out.

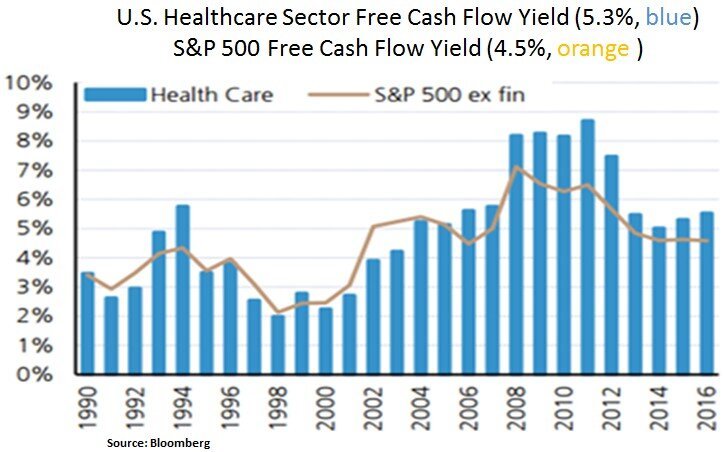

Lastly, we highlight our preference for the U.S. healthcare sector. Despite recent election related headline risk, the sector should continue to enjoy above market cash generation and sustainable long-term earnings growth. The latter is driven by aging global demographics and increasing global demand for healthcare from emerging market middle classes. As we can see below, the sector’s valuation vs. its earnings growth profile (PEG ratio) is currently at a favorable level relative to the U.S. equity market. We continue to favor large-cap healthcare equities with a capacity to grow their dividends.

In conclusion, investor focus is likely to be centered on Central Bank asset purchases and underlying fundamentals such as long-term GDP growth and inflation expectations. Structural or cyclical impediments such as productivity growth are also likely to remain in focus as they can further alter the market’s interest rate and corporate profit expectations. From our perspective, we continue to selectively allocate capital in sectors and themes that offer a healthy balance of income generation and total return potential.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.