Soft growth will likely keep the Fed on hold

Investors continue to witness a backdrop that features resilient asset prices, subpar U.S. GDP growth (1.2% in Q2 2016) and subdued real interest rates. As the current Q2 2016 earnings reporting season nears its end, U.S. corporations have reported EPS and revenue numbers 5% and 0.5% above consensus estimates. Our core sector favorites such as technology and healthcare have exceeded market expectations. Year-to-date, U.S. equities have performed as follows: S&P 500 6.7%, NASDAQ 3.3% and DOW Jones 6.7% on a total return basis. We also note that the 10 Year Treasury yield is currently 1.52% vs. 2.27% on Jan 1st. On the corporate bond side, credit spreads remain in check. However, on the bank commercial and industrial loan side we highlight that banking lending standards have been relatively tighter. On the Fed front, the 1% U.S. GDP growth in the first half of 2016 along with low capacity utilization and weak oil prices are likely to keep the Fed on the hold in the medium term. Thus, income generating strategies and corporations that are able to grow their dividend will likely stay in demand. Even though there is a consensus view forming for major global fiscal stimulus, there is likely a question mark about the size and impact of such a proposed plan. Thus, any rise in sovereign yields will likely open up buying opportunities in interest sensitive instruments.

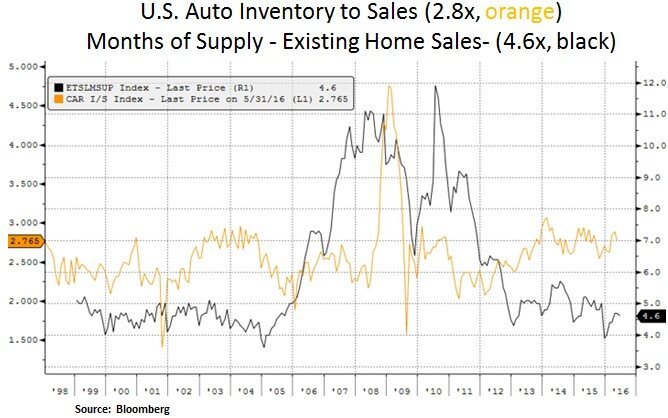

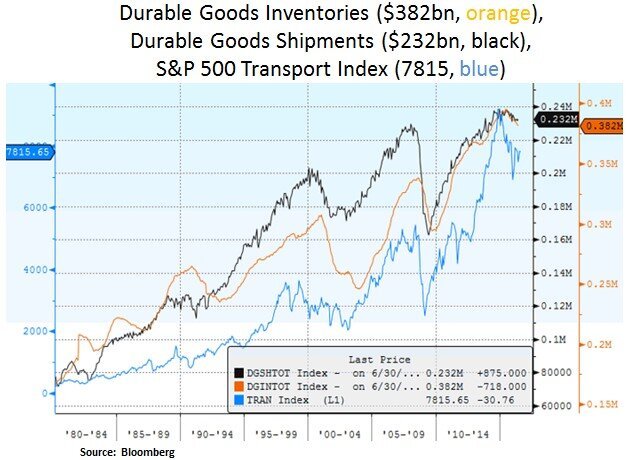

As we can see below, nominal and real U.S. GDP growth remains soft at 2.4% and 1.2% respectively. Soft business investment and a paring back of inventory held back GDP in Q2 2016. On the bright side, consumer spending remained a pillar of support. We see some inventory risk in the U.S. auto sector but we are more sanguine about the housing sector whereby the supply/demand balance is tighter. As the labor market expansion is at an advanced stage, the pace of large ticket purchases is likely heading towards the later part of the cycle. We are more constructive on technology enterprise spending (e.g. cloud computing) as corporations will likely strive to improve the currently subdued productivity trends (rising unit labor costs) and thus aim to protect profit margins.

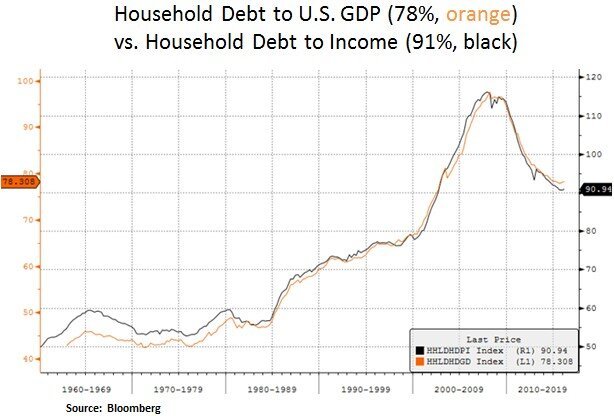

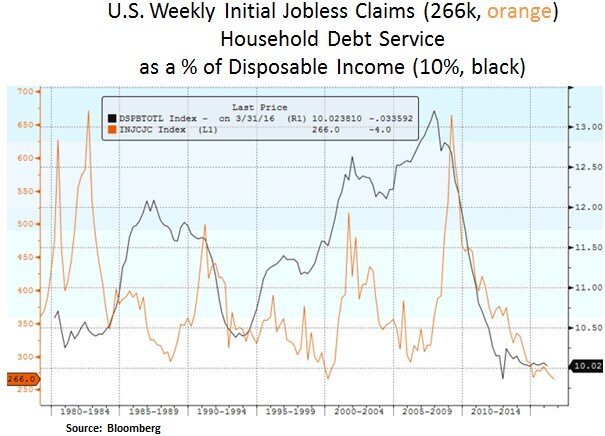

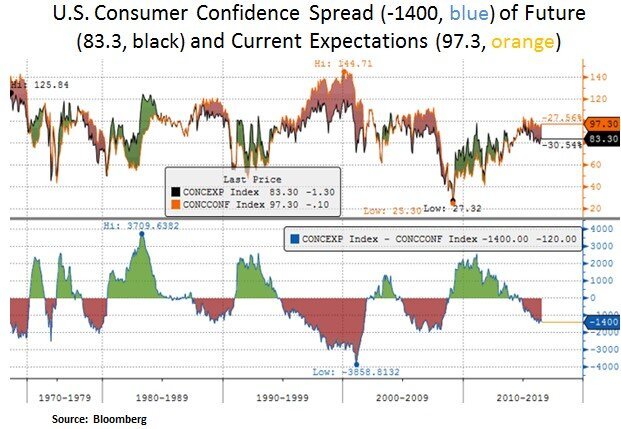

The U.S. consumer will likely stay a source of support. Household balance sheets have been getting repaired. Low mortgage rates and low gasoline prices are likely to remain supportive. On a cyclical basis, we are somewhat concerned that initial jobless claims and future confidence expectations may indicate the best days of this consumer spending cycle are behind us. Yet, on a secular basis, there is a case for low unemployment rates due to demographics i.e. due to skill shortages as baby boomers retire. In Japan for example, the unemployment rate is at 3.1%. We favor secular consumer spending stories such as e-commerce, internet data and connectivity themes. Moreover, as the global population ages and global incomes rise, we favor strong secular growth themes within the healthcare sector. As of late, we took advantage of favorable entry points in the biotech sector whereby valuations were at a sizable discount; despite the sector’s attractive growth profile.

Lastly, the Fed’s monetary policy is likely at a crossroads. Despite years of extraordinary accommodation, the U.S. economy is still lacking escape velocity. In our view, the global economy cannot seem to handle a strong U.S. dollar or higher U.S. funding rates. The weakness in the oil patch in particular has been a big global growth overhang as ~50% of global capital expenditures are linked to energy and utility sector spending. Therefore, the Fed will likely monitor how the USD interacts with energy/commodity prices and end-user demand from emerging markets. In a perfect world, the Fed would have liked to normalize its policy and wind down its balance sheet (the latter grew more than 5 times in the past 6 years). The long-term concern for the Fed (and investors) is that an overly easy policy may lead to financial instability. As we can see below, the ratio of asset prices to income is at the high end. To a certain degree, the Fed has been successful in generating inflation e.g. recovery in housing and financial instrument prices. Hence, given today’s asset valuations, we continue to be selective with a bias towards defensible cash flow profiles and sustainable investment themes with company specific catalysts.

In conclusion, we expect the Fed to proceed cautiously as U.S. growth is still in the low gear. A rise in sovereign yields on the back of global fiscal stimulus expectations will likely create buying opportunities in interest rate sensitive instruments. We seek to be nimble, particularly if U.S. election uncertainty leads to higher volatility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.