Policy Execution Needed for Sustainable U.S. Growth

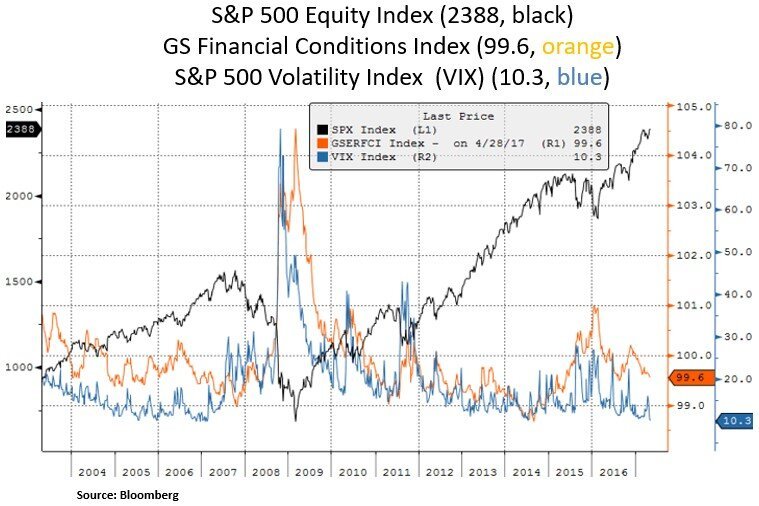

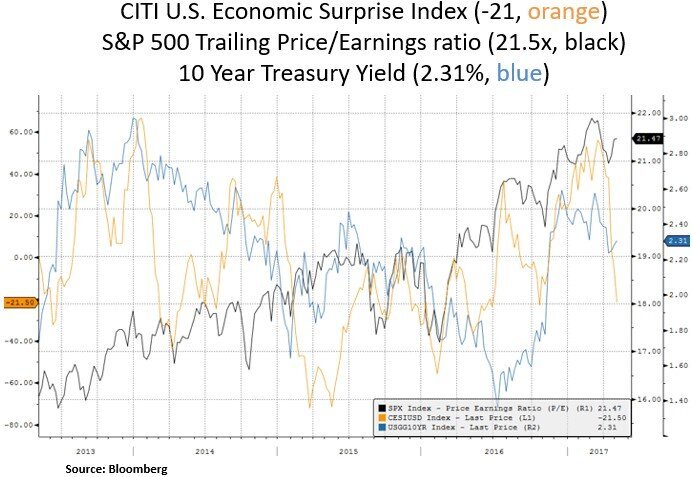

Financial markets have witnessed in the past month further resilience in U.S. equities with a notable decline in equity volatility and correlation. Year-to-date, U.S. equities have performed as follows: S&P 500 +7.3%, DOW JONES +6.7% and NASDAQ +13.4%. Fundamentally, positive quarterly U.S. corporate earnings and revenue surprises have been supporting investor sentiment. Mega-cap technology equities have been leading the equity market rally, with the technology sector’s total return at 16% year to date. Moreover, demand for equity portfolio hedging has been subdued; especially after the first round of the French election which put Macron in the lead vs. anti-Euro candidate Le Pen. In the Treasury market, a yield decline in the belly of the yield curve (5 year & 10 Year) has added to the easier financial conditions backdrop. In our view, fiscal policy execution is an essential component for equity performance as the market is expecting material tax reform, off-shore cash repatriation, fiscal stimulus and an ongoing pro-growth agenda. Fiscal accommodation matters at a time where the Federal Reserve is still poised (68% probability) to raise interest rates in June, despite a weaker Q1 GDP growth at 0.7%. From our portfolio perspective, we remain highly selective and opportunistic in U.S. equities with a preference for sustainable growth exposures and strong balance sheets.

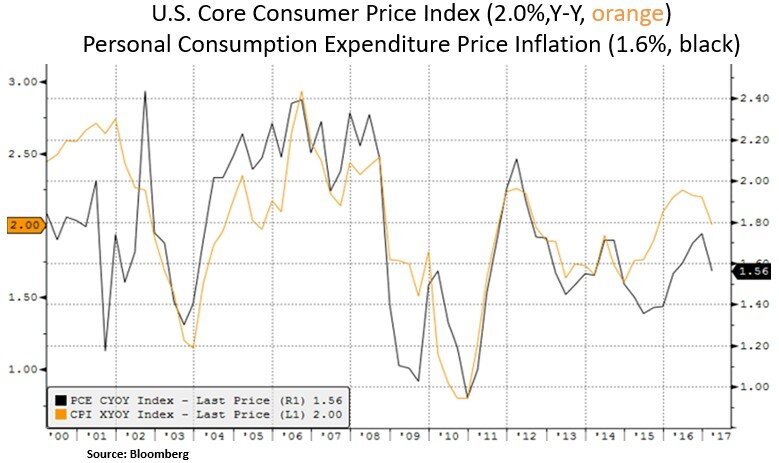

As we can see below, the Fed may be tempted to highlight the recent soft patch in Q1 GDP growth and core price inflation. Yet, consumer and CEO confidence measures remain high, with expectations for back-end loaded 2017 growth. As other Central Banks are still adding to global liquidity, the Fed will likely still stay the course in their near-term tightening path. Thus, we look forward to better entry points in interest sensitive assets e.g. utilities.

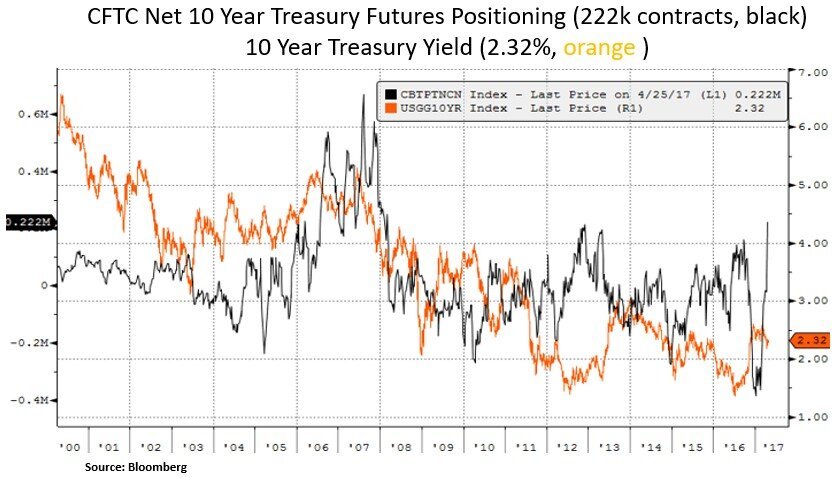

With U.S. household net worth at record highs and easier financial conditions, the window is still open for the Fed to tighten and further communicate a passive reduction in its balance sheet i.e. reduce the pace of re-investment of principal payments. The Fed would also like to increase its monetary dry powder if the global reflation backdrop and U.S. domestic growth expectations fall short. With historically high equity valuations and depressed volatility measures, one would expect some mean reversion in volatility as the market is still pricing in a pro-growth backdrop and material fiscal policy accommodation. We also note below the material swing in 10 Year Treasury positioning; which likely fueled a good part of the 10 Year Treasury rally from the 2.62% yield level down to the 2.18% level. Along with this bullish positioning, a rebound in U.S. GDP in Q2 and the rest of the year may put some upward pressure on long-term yields.

Lastly, we highlight below that the prospect of wider budget deficits (to fund material tax cuts) may also put some upward pressure on Treasury yields. The current Trump tax plan could raise the national debt by an extra $6 trillion over the next decade. On a further note, if the full $1 trillion infrastructure program is not implemented in its entirety, we would look for better entry points in cyclically sensitive sectors e.g. industrials and materials.

In conclusion, fiscal policy is still a key pillar for reflationary expectations, especially at a time where the Fed is poised to further normalize its monetary path. We would allocate further capital in both the equity and fixed income spectrums as both fiscal and monetary actions may be catalysts for a pick-up in asset price volatility.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.