Should Central Banks target a higher inflation rate?

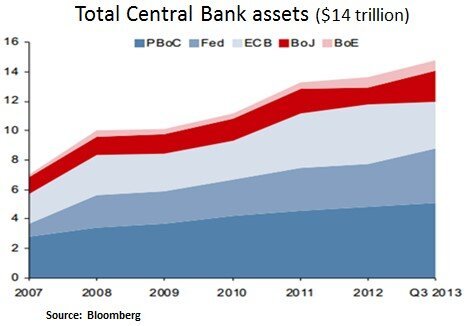

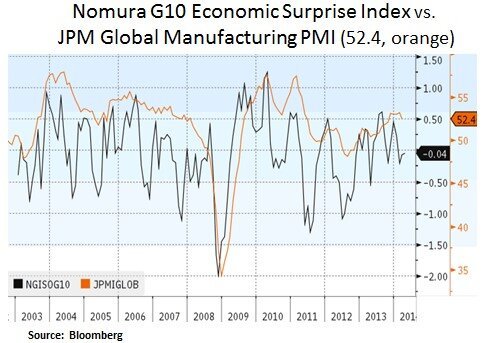

Financial markets are currently observing a divergence in inflation between financial assets and goods & services. Unlike various financial and real assets such as U.S. equities and U.S. housing, broad measures of global inflation (e.g. consumer, producer, commodity inflation) have continued to decline since the end of 2011. This has incurred at a time of record liquidity injections from the largest global Central banks. An inflation rate of ~1.8-2% is typically targeted by Central Banks in order to avoid a deflationary environment. The latter could raise real rates for debtors and undermine private sector spending. In our view, there are three global factors to consider. Firstly, the global crisis and weak recovery created large unemployment and output gaps in advanced economies. Secondly, after booming in 2010-11, emerging market economies have cooled off and are now growing at below-trend rates. Thirdly, commodity prices have similarly cooled off as EM/China demand declined. Long-term inflation expectations (as implied by the TIPS market) appear stable (~1.9-2.2%, 5 and 10 year). However, there may be some Central Bank complacency in the medium-term. From an investment perspective, disinflationary concerns may keep interest rate hike prospects in check. In such a scenario, income generating and interest rate sensitive assets are likely to stay in demand.

As we can see below, disinflationary concerns have been more evident in Europe. With a headline inflation rate of just 0.5%, the sovereign debt markets have been pricing in a very subdued growth and inflation environment. In addition, the Eurozone’s debt markets have been the beneficiary of elevated foreign capital flows in anticipation of ECB action. At its recent meeting, the ECB indicated that its member central banks are prepared to engage in further easing measures. In a bank loan based financial system, the main challenge for the ECB is how to design a quantitative easing program which purchases private bank loan assets. ECB action would be supportive to U.S. multinational corporations with exposure to Europe e.g. tech and industrials.

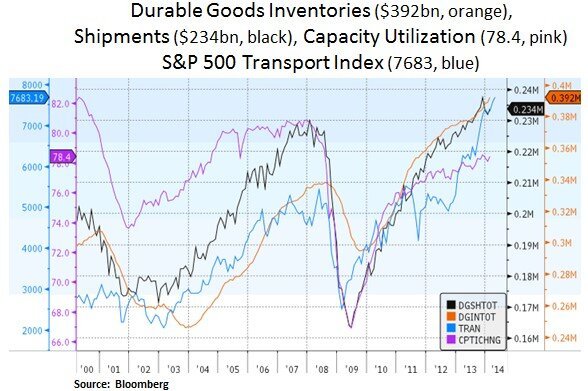

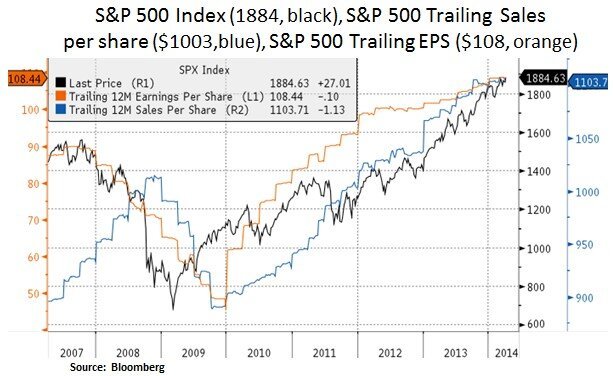

In terms of U.S. inflation, if we consider capacity utilization, the U.S. economy is not operating at peak potential. As such, corporations are unlikely to face capacity constraints any time soon. In fact, for industrials companies, if capacity constraints are reached that would be a sweet spot for capital goods demand. U.S. equity Return on Equity (ROE) and profit margins have benefited in the current profit cycle from lower effective taxes, lower interest rates and subdued labor costs. As financial conditions are still not sufficiently tight, we suspect the profit cycle is not over yet. We are seeing however signs that the current market cycle is beginning to mature. For instance, we are seeing elevated IPO activity and a broad over-reach for yield in credit markets e.g. covenant lite leveraged loans and other high yield debt instruments. In our view, we need to see M&A activity pick up meaningfully before we observe a peak in the current business cycle.

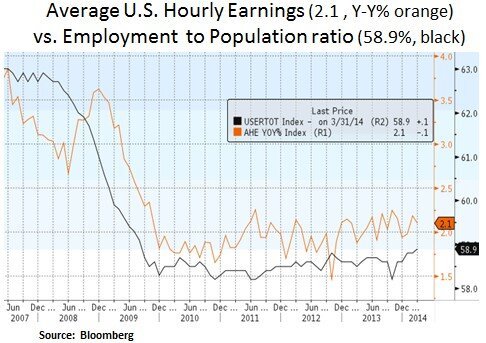

With regard to U.S. labor cost inflation, we expect a slow and gradual pick-up in labor costs. The bulk of U.S. job creation is currently in low paying industries such as education & health, leisure & hospitality and retail. The U.S. jobs recovery has progressed at a steady but slow pace, with the most recent non-farm payroll number for March growing at 192k. Wage growth appears to be in check at 2.1% Y-Y growth. The latest Fed Beige Book highlighted labor shortages in health care, technology, transportation services, engineering and construction. Labor shortages may only affect specific industries due to a skills mismatch. As we can see below, most graduates seem to prefer social sciences (first 4 columns) over engineering/computer sciences/mathematics. From a policy perspective, immigration reform could help relieve some of the labor shortages. Therefore, our broad view on labor cost inflation remains balanced.

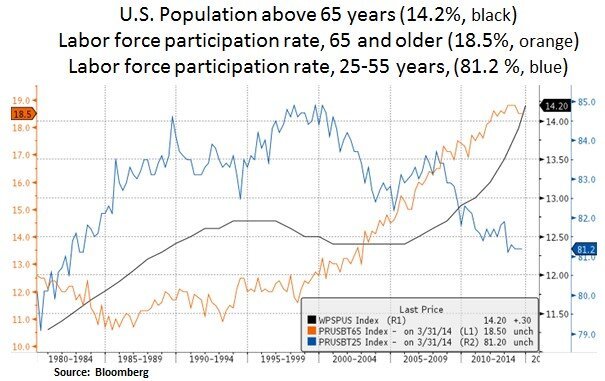

In our view, there are some structural and policy points to consider. The Baby Boomer generation (born 1946-1964) turned 65 years old three years ago. As this generation gradually retires, consumer spending will likely face some headwinds. Interestingly, the age cohort 65 and older has increased its labor force participation. In contrast, the age cohort 25-55 has experienced a drop-off in labor force participation. Thus, one could argue that older workers are keeping labor costs in check by not allowing more young people to enter the labor force. Tame inflation may help the Federal Reserve’s pace of monetary policy normalization by keeping faster than expected interest rate hike expectations in check.

In conclusion, global inflation is still an area that should garner investor attention. Recent consensus expectations have placed pressure on the front-end of the Treasury curve e.g. the 2 year and 5 year note yields increased by 8 and 17 basis points respectively to 0.41% and 1.71% in the past month. In the context of an uncertain global inflation backdrop, we would view a meaningful yield increase as a buying opportunity for interest rate sensitive securities. From a Central Bank policy perspective, ECB action in particular would be beneficial for a healthier growth and inflation backdrop; especially as the European banking system is currently repairing its balance sheet ahead of the ECB’s Asset Quality Review (AQR) in October.

Christos Charalambous CFA

Senior Strategist

christos.charalambous@edgewealth.com

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product made reference to directly or indirectly in this newsletter (article), will be profitable, equal any corresponding indicated historical performance level(s, or be suitable for your portfolio. Due to various factors, including changing market conditions, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this newsletter (article) serves as the receipt of, or as a substitute for, personalized investment advice from Edge Wealth Management, LLC. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. A copy of our current written disclosure statement discussing our advisory services and fees is available for review upon request.